Data Insights

Opening and Trading Direct Listings

October 6, 2020

On Wednesday September 30th the New York Stock Exchange broke new ground by holding two concurrent NYSE Direct Listings — in Asana, Inc. and Palantir Technologies Inc. — along with 4 traditional IPOs, all on one day. The NYSE Trading Floor facilitated price discovery and liquidity for these trading events smoothly and with a high degree of transparency. Asana (NYSE: ASAN) and Palantir (NYSE: PLTR) highlighted NYSE’s ability to consolidate disperse trading interest in a single trade; PLTR’s opening auction was the largest auction ever for an IPO or new listing on NYSE.

Direct Listings

Direct Listings allow a company to become publicly-listed without the traditional IPO process. In a Direct Listing, a company’s stock begins trading with an opening auction run by a Designated Market Maker (DMM) on the NYSE Floor, with the opening price set by the natural supply and demand submitted into the marketplace. The Exchange, in consultation with the company’s financial advisor, sets an initial reference price; as orders are submitted to the Exchange and buy and sell interest accumulates, the DMM provides indicative price ranges throughout the price discovery process.

Price Discovery Process:

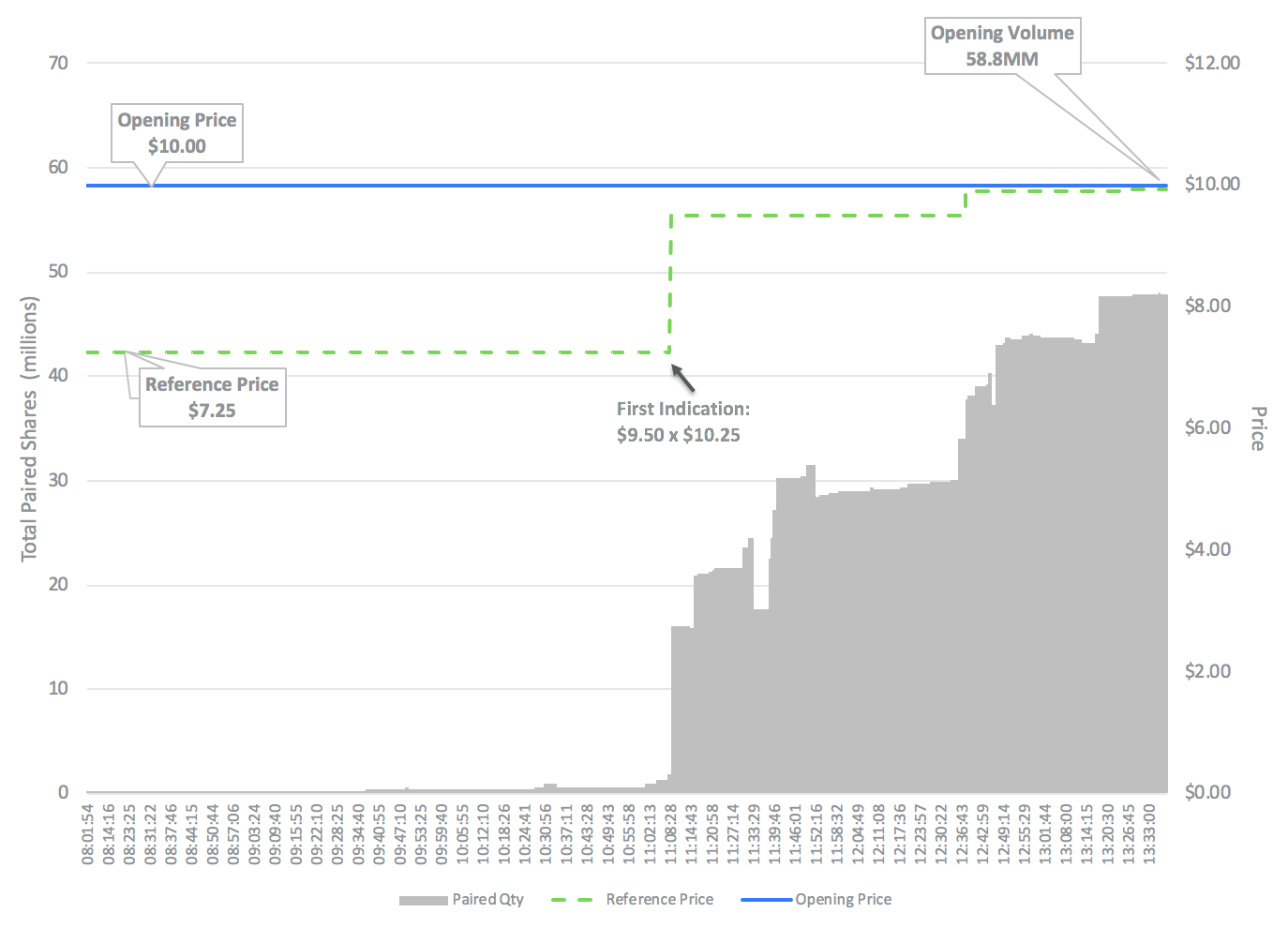

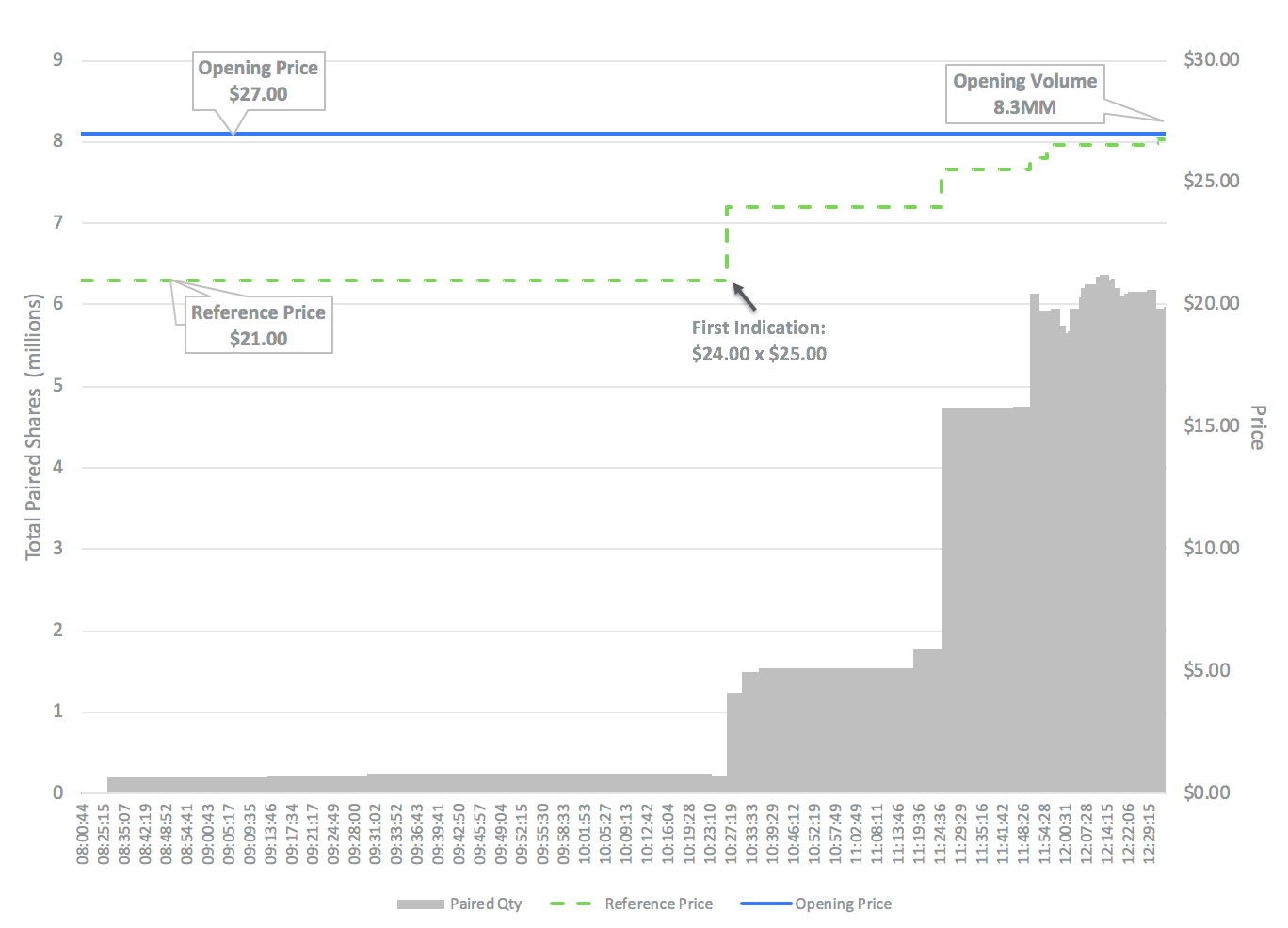

- Similar to the two previous Direct Listings, Spotify Technology S.A. in 2018 and Slack Technologies Inc. in 2019, NYSE received a significant number of orders in both ASAN and PLTR.

- As with other popular debuts, price discovery was a deliberate process that took hours to complete and resulted in massive auction sizes.

- Auction imbalance information was published via NYSE’s proprietary data feeds beginning at 8:00 AM and continuing until the auction execution.

- In both of these auctions, the first indication from the DMM raised the reference price, leading to an increase in the published paired quantity and further order entry activity in response to the new information.

PLTR Direct Listing Opening Auction

ASAN Direct Listing Opening Auction

Direct Listings as a Liquidity Event

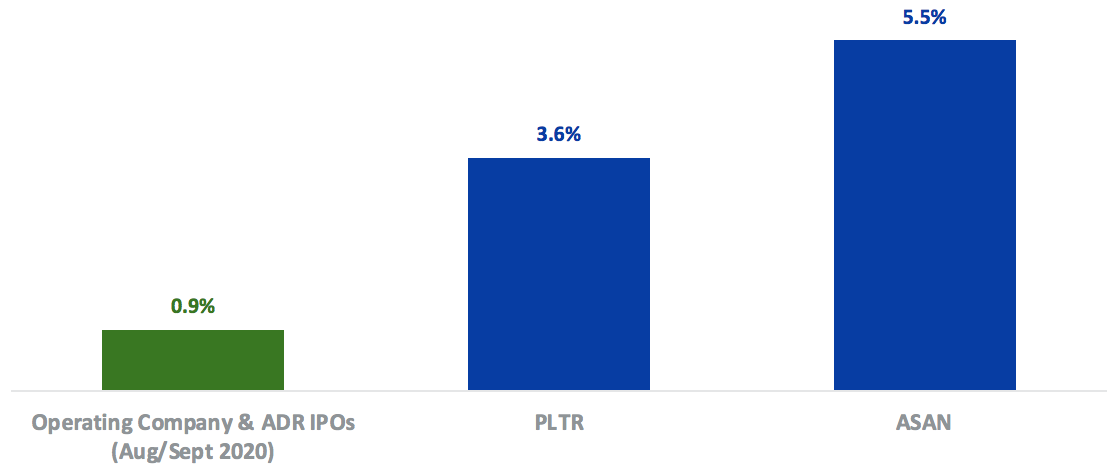

- Direct Listings are significant liquidity events for existing shareholders, and as such the opening auction reflects a much larger share of a company’s initial market capitalization than a traditional IPO.

Opening Auction Notional Value Share

of Opening Market Capitalization

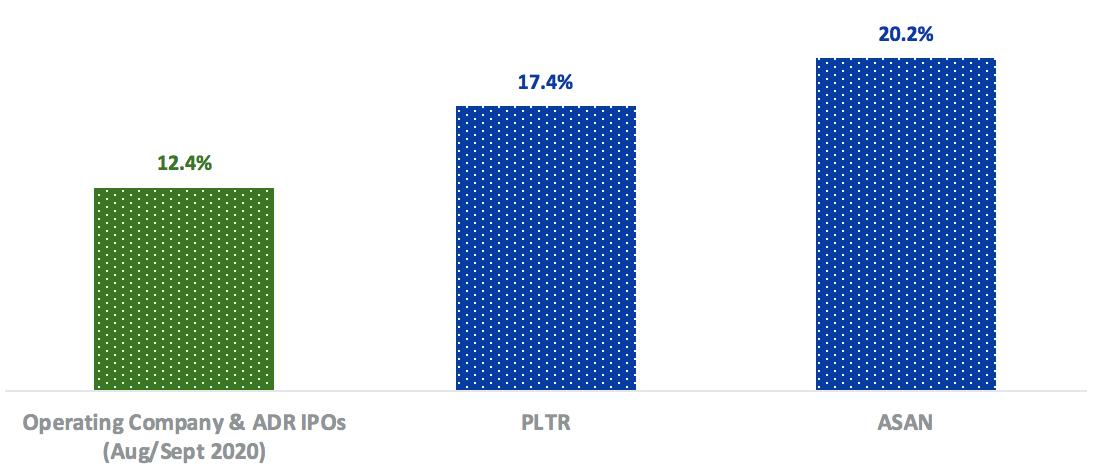

- Direct Listings’ auction size also concentrates the liquidity seeking a trade on Day 1.

Opening Auction Share

of Day 1 Trading Volume

Size and Stability

- Opening auctions of this size are meaningful price markers for subsequent trading.

- Direct Listings, unlike IPOs, do not have stabilization agents, and there is no prior indication of how many buyers and sellers will converge on the first day of trading.

- Despite the inherent uncertainty around the start of trading, the Day 1 trading volatility for ASAN and PLTR was similar to traditional IPOs

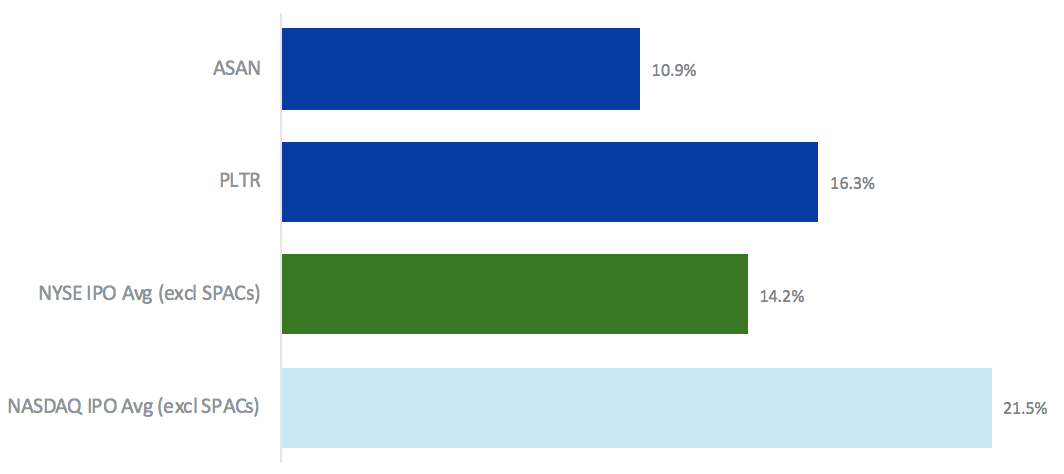

- NYSE’s Quote Volatility measure, which reflects the frequency and severity of intra-day price changes, shows relatively stable trading for a new issue

Quote Volatility on 1st Trading Day

Quote volatility is measured as the standard deviation of secondly returrns, aggregated daily here. The NYSE IPO Avg (excl SPACs) and NASDAQ IPO Avg (excl SPACs) are simple averages across all non-SPAC IPOs in August and September 2020. Similar results are found using medians or Winsorized means across non-SPAC IPOs.

A New Execution Tool for Capital Markets

- NYSE has now conducted four Direct Listings, including two on the same day, all of which were major trading events

- In each case, the NYSE market model allowed for a deliberate price discovery process culminating in a large percentage of the listing company’s market value trading in the opening auction

- This centralization of liquidity helps initiate relatively stable price discovery throughout the first trading day, despite the lack of a stabilizing bid as in a standard IPO

- NYSE will build on this success by offering companies the ability to raise capital as part of a Direct Listing (pending SEC approval)

NYSE Research Insights

Find all of NYSE Research's articles on market quality, market structure, auctions, and options.