Innovation and trust go hand-in-hand at the NYSE

The New York Stock Exchange leads with seven of the 10 largest IPOs in 2025, paves way for digital currency public market debuts

Learn moreCapital markets happen here

The NYSE is capitalism at its best, the belief that free and fair markets offer every individual the chance to benefit from success.

We set the standard with our unparalleled trading platform, enabling entrepreneurs, innovators, and investors to raise the capital they need to change the world. We want to share our vision for good governance, transparency, and trust with our listed community, furthering the responsible development of global business. You work too hard to list anywhere else.

Learn more

Today’s Stock Market

March 9, 2026 at 2:30 p.m. EST

Military strikes over the weekend increased concerns over the duration of the Iranian conflict and the status of oil infrastructure and global transit. After breaking above $90 on Friday, ICE Brent traded up ~$120 last night before prices began to pull back. President Trump is expected to hold a press conference at 5:30pm today to provide an update on Iran.

S&P futures were down ~2% at the lows overnight. Things improved throughout the morning and equities cut that by more than half at the Open. but weakened right after again. However, buyers stepped in and brought the S&P back to about where we opened.

Tech is leading and the only sector solidly higher. The NYSE Semis index is up 1% while the IGV software ETF is down 1% as it pulls back from its 8% gain last week. Oracle reports tomorrow night in that is a highly anticipated earnings update for the AI ecosystem, and market overall. And before Oracle, HPE reports tonight in another significant update- especially AI server demand and memory/storage prices.

In commodities, outside of energy, metals have turned higher except for gold. Silver is back around its HOD ~$85, right around its 50d ma after trading down to ~$80 earlier. The ag complex has slipped into negative territory. Interestingly crypto has held up reasonably well. Bitcoin is hovering ~$68k while Ethereum is still holding $2k.

| Description | Last | Change (%) |

|---|

| Description | Last | Change (%) |

|---|

| Description | Last | Change (%) |

|---|

| Description | Last | Change (%) |

|---|

| Description | Last | Change (%) |

|---|

Market data delayed minimum of 15 minutes

![What's next [fade-up]](https://www.ice.com/publicdocs/images/NYSE-homepage-pattern-02.svg)

What’s next?

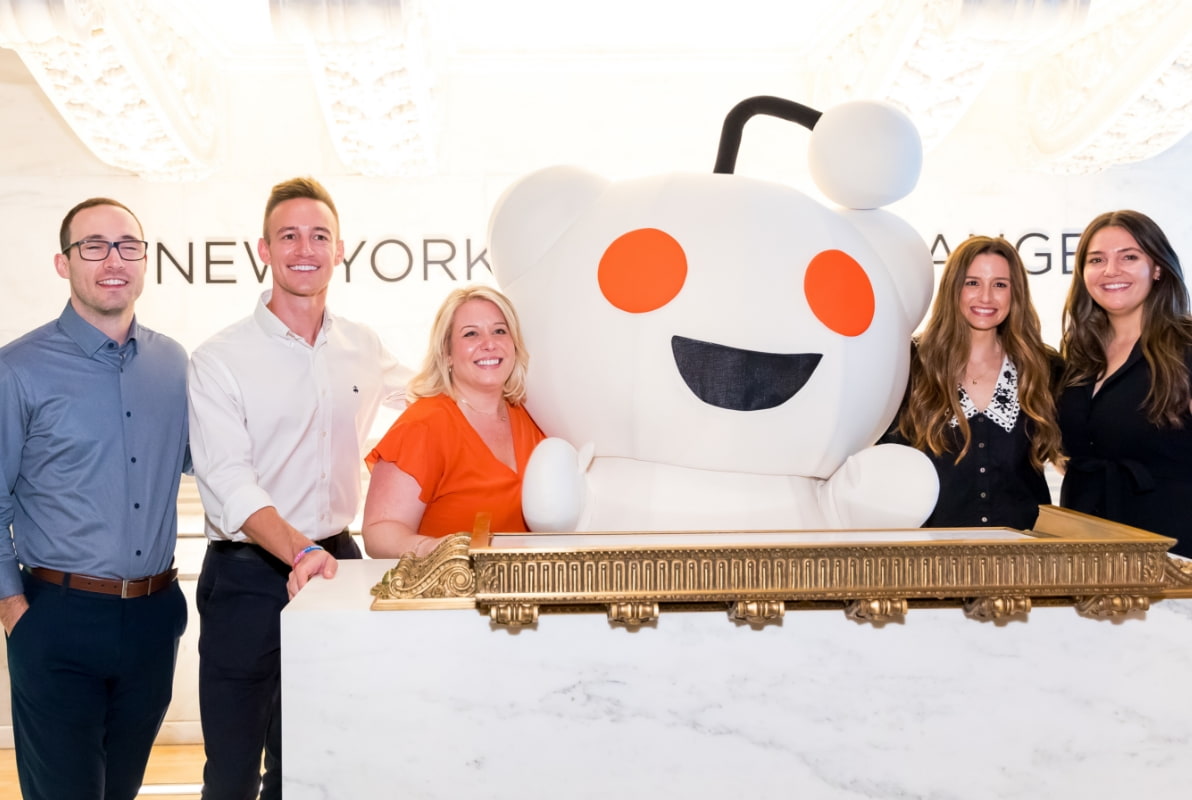

The NYSE looks forward to welcoming more leading companies from around the world in 2026, growing our one-of-a-kind community and setting the pace for innovation on a global scale. We’re endlessly inspired by the people behind these companies, check out their stories below and let’s make something happen together.

Going public

What does it take to go public? Ryan Hinkle draws on twenty years of investing at Insight Partners, one of the most prolific global software investors, and shares his advice for SaaS startups preparing to go public.

Making their mark

Entrepreneurs come to the NYSE to realize their ideas and change the world. We teamed up with 3M’s Post-it® Brand to encourage future leaders visiting our building to take a step toward making their goals and dreams happen. Watch as interns from Life Science Cares’ Project Onramp make their mark.

The Cure(ious)™

We asked some of the most curious minds in life sciences and healthcare to share thoughts on their careers, the future of health and more. Each participant drew questions and shared their insights, knowledge and some personal fun facts that left us inspired about the future of health and wellness.