2025 Q4 Earnings Preview

By: Michael Reinking | Sr. Market Strategist/Head of MAC Desk, NYSE

January 14, 2026

Key takeaways

- 2025 Q4 S&P 500 EPS expected to be up 8.3% YoY, the 10th consecutive quarterly increase

- Revenues estimated to be up 7.7%, the 21st consecutive quarterly increase

- Second consecutive quarter of positive revisions driven by tech and financials

- Key topics - Demand dynamics, inventories, pricing and AI capex efficiency/monetization

- Q3 Shareholder returns bounce back modestly, but coming under fire

What will investors be listening for on Conference Calls?

Broad Economy

- As policy uncertainty has subsided has there been a pickup in activity?

- Did the government shutdown slowdown that acceleration?

Inflation/Margins

- Are the previously announced mitigation efforts tracking as expected?

- Did the government shutdown slowdown that acceleration?

Inventory/Logistics

- Where do inventory levels stand after the pull forward of demand earlier in the year?

- Have tariffs or other recent geopolitical events changed how the company manages inventories?

- Has the shift in immigration policy impacted your access to labor?

- What is the plan for headcount? Is the implementation of AI having an impact on this decision?

Capital Allocation

- Do recent tax changes shift how you think about capital investment versus shareholder return programs?

Financials

- What is the state of the consumer?

- Are there signs of credit deterioration in private credit or subprime?

AI

- Are you able to meet the demand for AI related products?

- What percentage of your capex/IT budget is being spent on AI related initiatives? How is this being financed?

- When do you expect to see a return on this investment?

- Can you provide examples of how the AI implementation has improved efficiency or productivity?

Setting the Stage - A quick lookback at 2025 and Q4

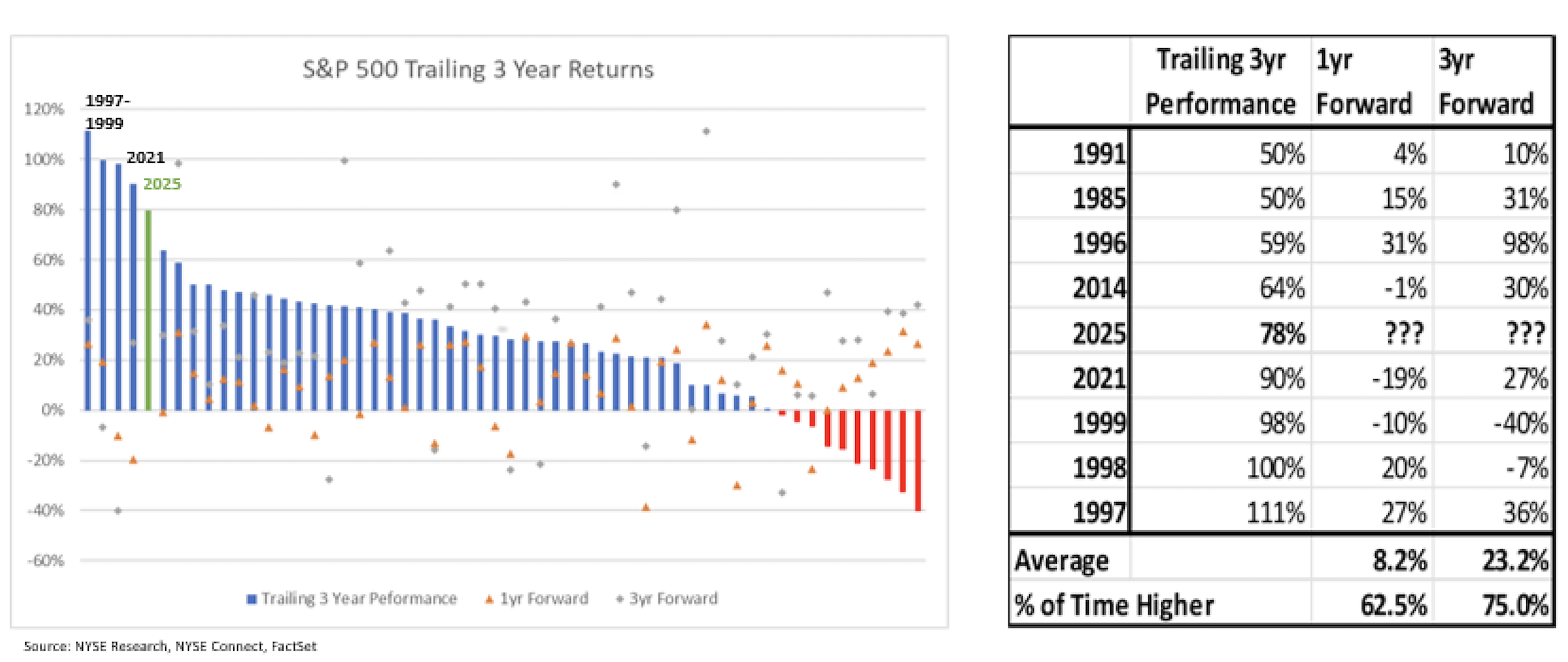

Major US indices ended 2025 near all-time highs with the S&P 500 booking its third consecutive year of >15% gains. The index was up nearly 80% over that time frame putting it in rarified air. There have only been 4 years since 1970 where the cumulative 3-year performance has exceeded that mark,1997-1999 and 2021.

S&P 500 Trailing 3 Year Returns

After the policy induced volatility at the end of Q1, equity markets snapped back rallying through the fall. The S&P 500 peaked right around Halloween, about a month after the government shutdown started, before essentially moving sideways through the remainder of the year. Relative to much of the rest of the year it was a reasonably quiet quarter, partially due to the lack of economic data during the government shutdown.

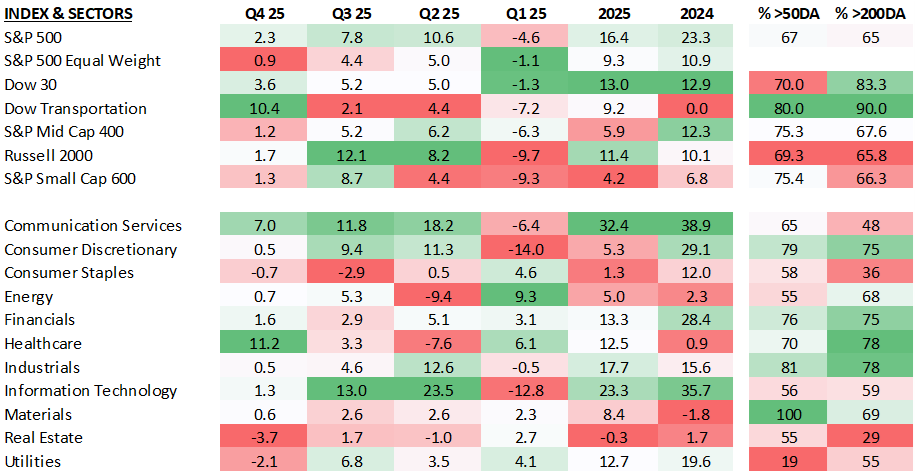

Concerns about the level of AI capex spending emerged amidst increasing circular partnership/financing announcements and as companies started to tap debt markets. However, as the tech complex came under some pressure there was a rotation. Small and midcap indices began to outperform as the Federal Reserve resumed its rate cutting cycle after remaining on the sidelines for about a year. Healthcare, which had underperformed throughout most of 2025, also snapped back as drug pricing deals were not as draconian as feared and amidst a pickup in M&A activity. The AI capex debate will rage on in 2026, but the other major question is whether the broadening of the rally will continue. Earnings will be central to that answer.

Inside the Numbers - Data compliments of FactSet Earnings Insight as of January 9, 2026

Q3 Review

- Q3 S&P 500 earnings +13.6% YoY vs. 8% estimate

- 83% of companies beat analyst estimates

- Q3 Revenue +8.4% (vs. 4.3% est.), strongest since Q3 2022

2025 Q4 EPS Est. +8.3% YoY

- Sectors with largest YoY growth

- Info Tech (25.9%), Materials (9%), Financials (6.4%)

- Sectors with YoY declines

- Consumer Discretionary (-3.5%), Energy (-1.7%) and Industrials (-0.5%)

Number and percentage of companies issuing positive guidance above historical averages (47% vs. 5/10yr avg. of 42%/40%)

Q4 Revenues Est. 7.7% YoY

- Largest increases: Info Tech (18%), Comm. Services (10.2%), Healthcare (9.1%) and Financials (8%)

- Energy (-2.2%) the only decline

Q4 Net Profit Margin Est. 12.8% down from 13.1% last quarter

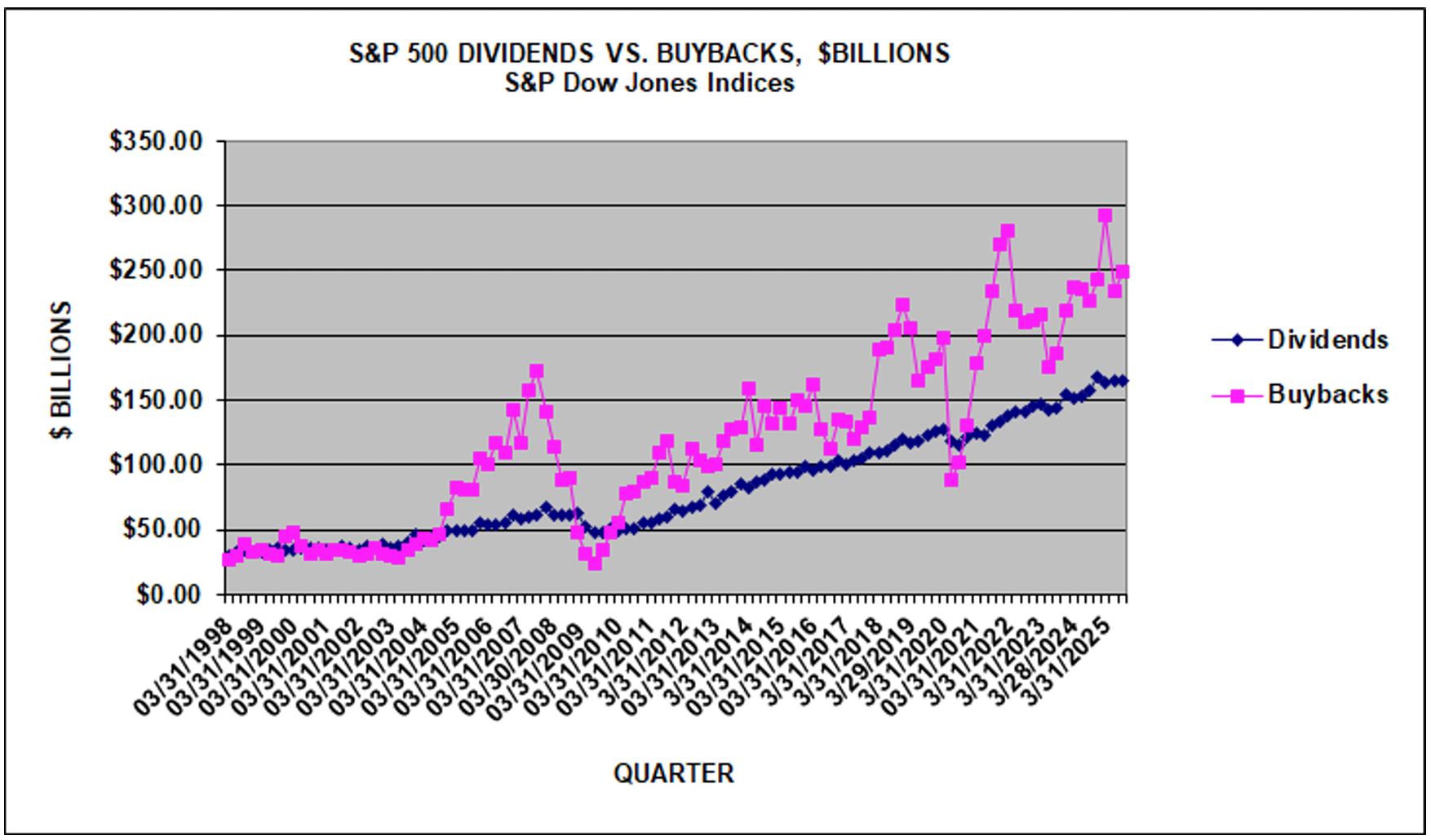

Capital return programs - Data compliments of S&P Global

- Q3 programs up 4.3% QoQ to $399.7B

- Q3 buybacks up 6.2% QoQ to $249B, bouncing back after Q2 declines

12-month buybacks surpassed $1T

Number of firms carrying out buybacks of at least $5ml down to 333 from 338

Activity remains top heavy with largest 20 companies executing 49.5% of buybacks down from 51.3% in the prior quarter

- Q3 S&P 500 dividends increased 1.8% QoQ to $168.1B

The Big Picture

The Q3 earnings season was once again solid driven by strength in tech and financials. Amidst the economic uncertainty management teams continued to point to a resilient economy. It was the fourth consecutive quarter of double-digit earnings growth, up 13.6%. This exceeded estimates by over 5% with >80% of companies beating estimates. Cost cutting and mitigation measures put in place throughout the year paid dividends, but revenues also came in well ahead of estimates, up 8.4% YoY, the strongest quarterly growth rate since Q3 of 2022.

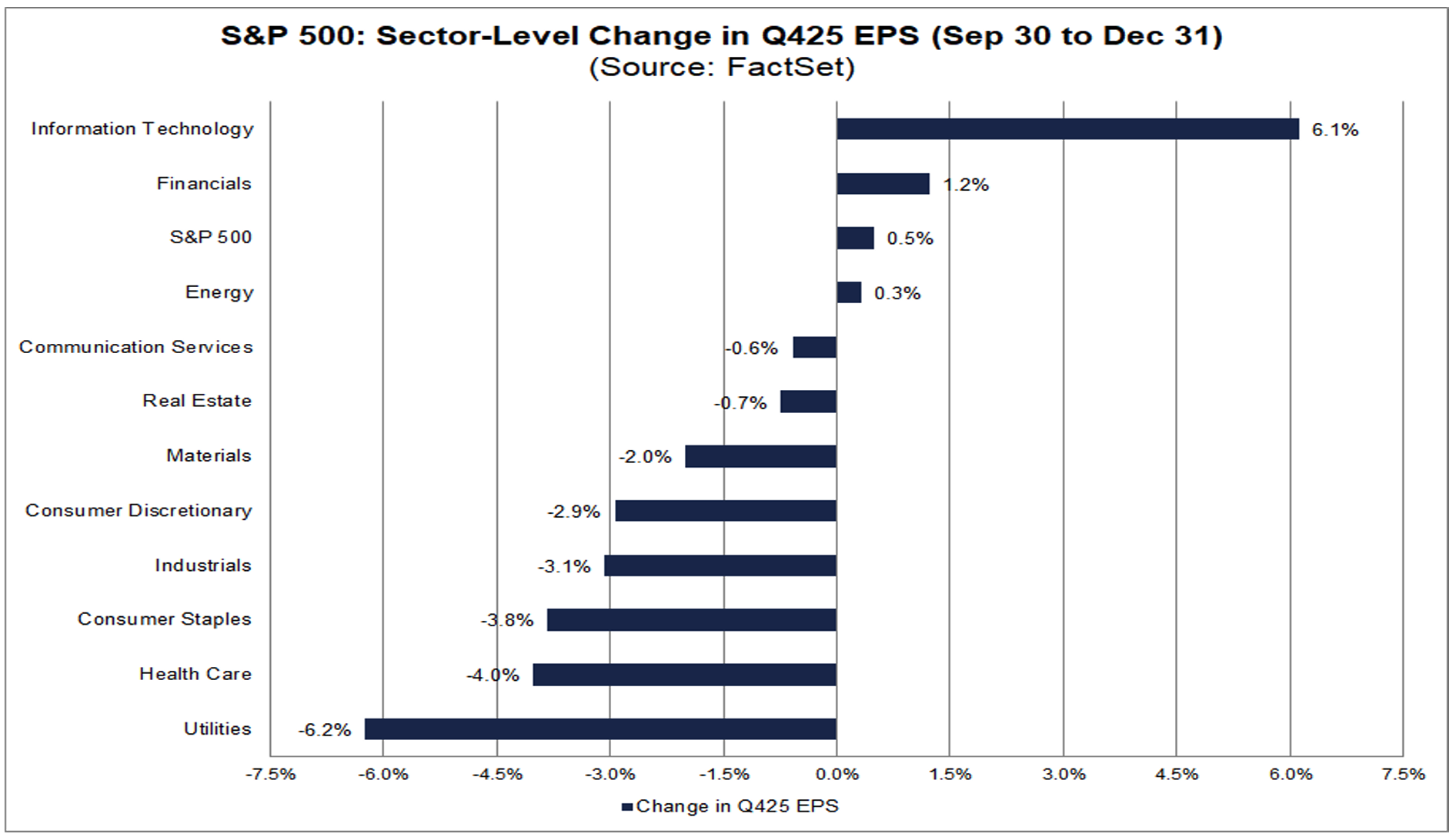

As we head into Q4 all indications point to continued strong demand within technology. Q4 earnings growth for the sector is projected to be up ~25% YoY. Tech companies account for ~75% of all of the positive pre-announcements during the quarter, which is the primary driver for the positive earnings revisions in the S&P 500. Earnings estimates increased 0.5% since the end of Q3, the second consecutive quarter of positive revisions, which compares to a ~3% decline on average over the last 10 years. This was not only AI-driven demand as we’ve also heard from analog chip makers and memory companies suggesting an improvement in other business lines as well.

The revisions were mixed when looking across other sectors. It’s unclear how much of an impact the government shutdown had on the overall economy, particularly consumer spending. That being said, the corporate commentary at investor conferences during the quarter remained cautiously optimistic.

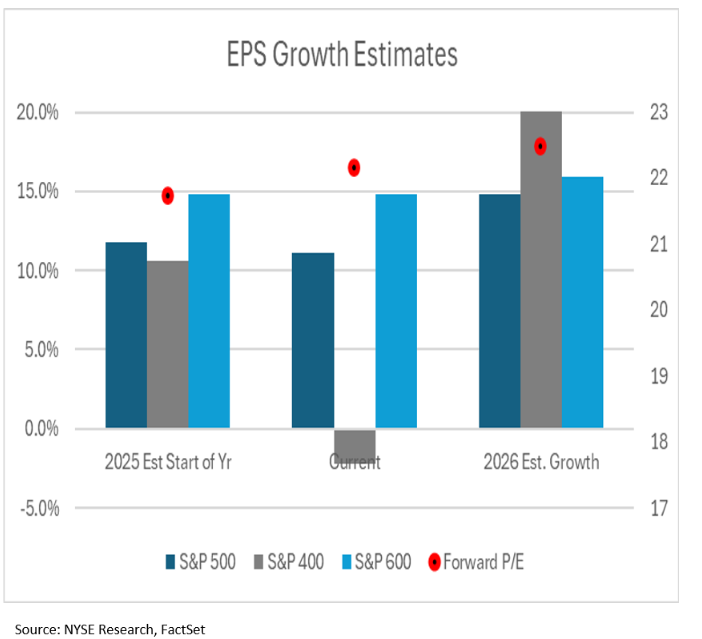

Speaking of optimism, there is quite a bit heading into 2026 with street estimates for earnings growth projected to be up in the mid-teens across the S&P 400, 500 and 600. Within the S&P 500 earnings across every sector are expected to be up at least 5%. This optimism is being driven by hopes that economic growth is set to accelerate driven by a combination of factors. First, the lagged effects of prior rate cuts and expectations of easier monetary policy going forward. Secondly, the positive fiscal impulse from the One Big Beautiful Bill and other initiatives put forth by the administration. Lastly, the efficiency measures put in place over the last couple of years adds to the operating leverage at the company level. This doesn’t even account for the potential benefits of AI adoption.

Bringing the conversation back to this quarter - outside of tech, financials and pockets of industrials, most of that growth is still on the come. Which brings us to what we think will be the most important aspects of this quarter: guidance, commentary on the environment and price action. Earlier we discussed the rotation happening within markets down the capitalization scale and into more cyclical areas of the market. The cyclical turn has not happened yet and there are still some headwinds in place. Investors will be listening closely to management commentary pointing to green shoots.

For Tech, there is very little question about strong demand, but investors will be looking for changes in the competitive landscape, supply chain choke points, levels of capex and how that will be financed. Examples of investments that are starting to benefit the bottom line are growing in importance.

With the continued increase in capex spending across industries we will be watching to see if this starts to eat into shareholder return programs. In Q3, buybacks bounced back modestly after falling in the prior quarter. This has become a rallying cry for the administration which has called for a reallocation of capital away from shareholder returns in multiple industries including energy and defense. If I had to guess housing will be next.

From a market perspective price action might be the most important aspect of this quarter particularly as it relates to the rotation and there are some very early signs there may be some runway. Given the very high bar for technology we’ve seen some of the recent pre-announcements met with a sell-the-new response. On the flipside, particularly in cyclical sectors there have been a couple of instances where companies have cut guidance/missed estimates and after some initial weakness the stocks have rallied back, suggesting that investors are taking advantage of this volatility to put cash to work.

Since 2020 one constant has been the resilience of US corporate earnings. Management teams have had a steady hand navigating through quickly evolving and often treacherous operating environments. There is no reason to believe that dynamic is about to change and there is some hope that the operating environment is about to improve, which helps to explain some of the valuation premium. However, the other lesson learned over the last year is to expect the unexpected.

Michael Reinking

Sr. Market Strategist/Head of MAC Desk, NYSE