Data Insights

NYSE Group Handles Record Message Volume

March 10, 2021

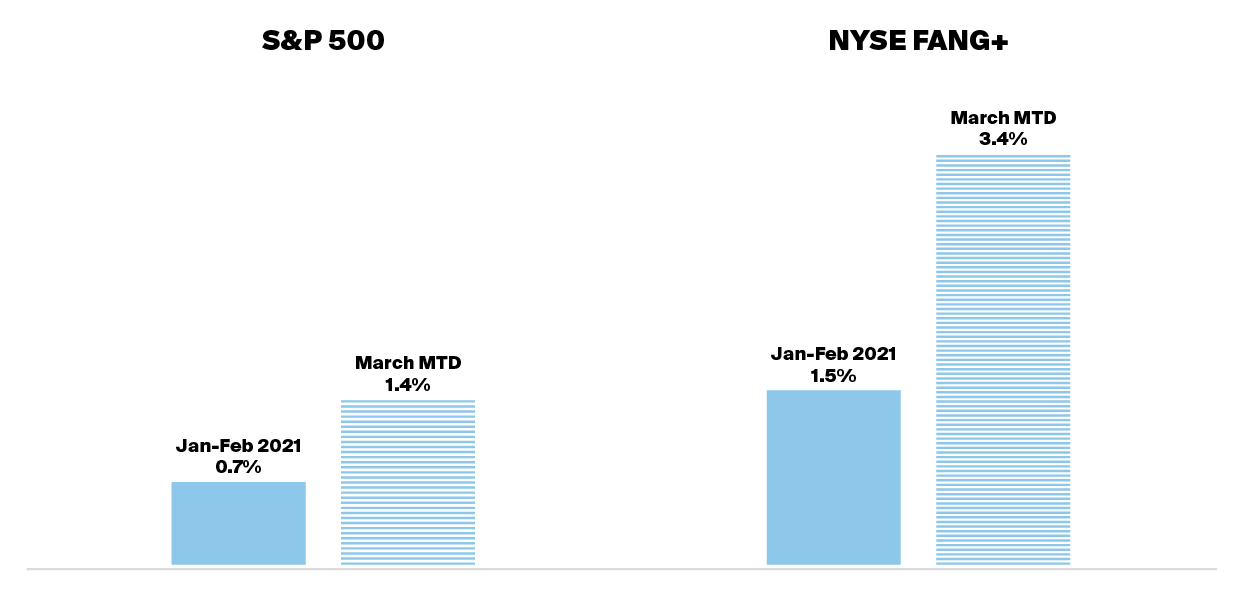

Volatility has roared back into the market in March. In contrast to the bleak outlook and dramatic price declines in March 2020, this month has shown decidedly two-way markets with a heavy influence from widely held tech stocks. So far this month, the S&P has on average moved about twice as much per day as it had in January and February. The tech influence is reflected in price moves in the NYSE FANG+ Index, which has shown even more price movement than the broader index.

Average Absolute Daily Price Change

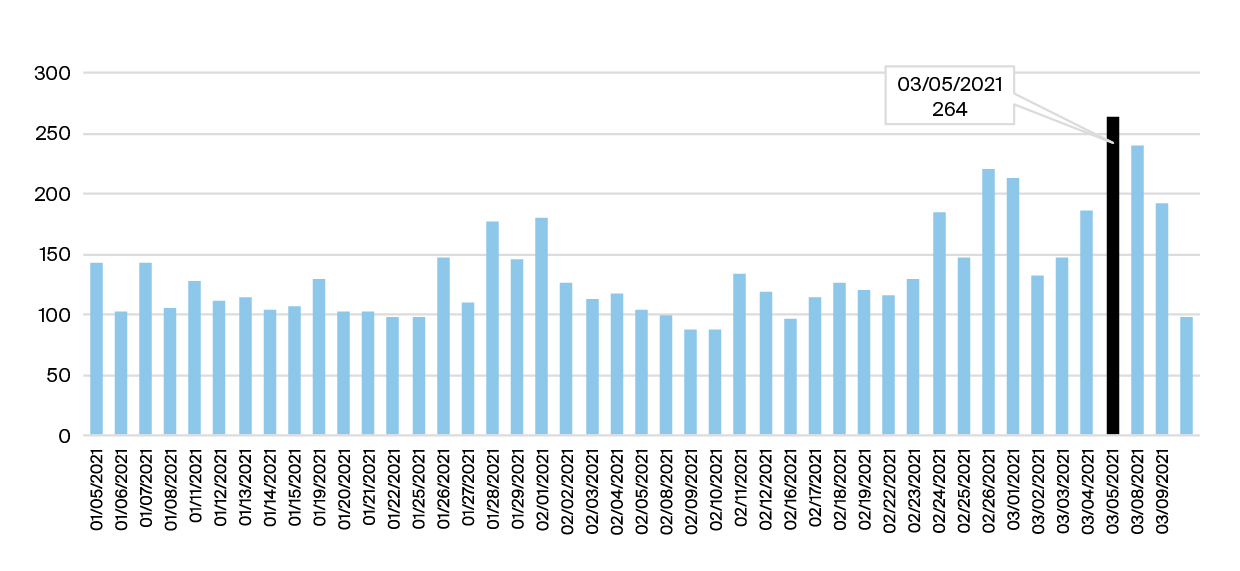

As market activity and volatility has increased, NYSE Group is handling record levels of message traffic on its systems. Growth peaked on March 4th, when NYSE Group systems handled a record 356 billion messages in a single day. Message traffic on NYSE Exchanges was roughly 2.6 times average Q4 2020 levels and did not cause any change to client throughput or latency experiences.

NYSE Exchange Messaging Traffic

(Q4 2020 average=100)

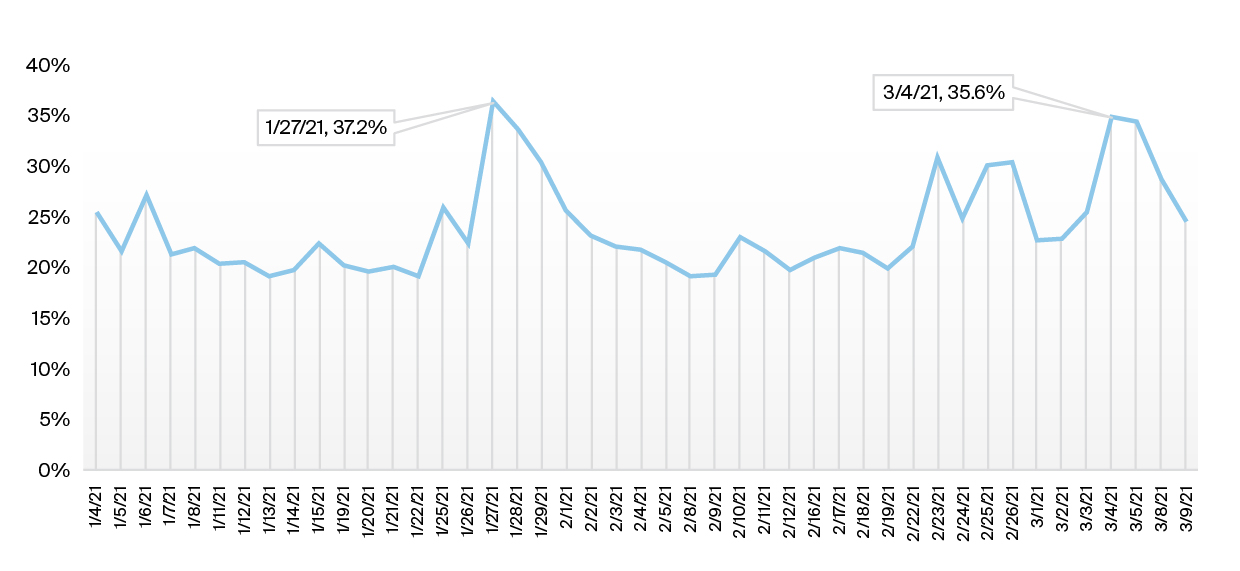

Other Effects: Quote Volatility & Options Market Activity

Along with daily price action and record messaging levels, increased volatility is manifesting itself in other notable ways:

- NYSE Quote Volatility rose sharply last week, reaching levels not seen since the market disruption in January

- Options market volume continues to reset its standards to higher levels:

- March 4th and 5th were the 3rd and 4th most-active days in market history

- The top 10 most active market volume days of all time have occurred in Q1 2021

S&P 500 Average Quote Volatility

Outlook

This month has seen dramatic moves across markets, from rates to mega cap tech to retail favored stocks. With ongoing uncertainty around virus mutation, vaccine rollout, and broader governmental fiscal and monetary response, volatility could very well continue going forward. These macroeconomic factors, along with the upcoming quarterly options expiration and index rebalances, are likely to cause heavy trading volume and messaging traffic over the balance of the month.

NYSE Research Insights

Find all of NYSE Research's articles on market quality, market structure, auctions, and options.