Data Insights

Market rules are making more liquidity inaccessible

to institutional investors

January 11, 2021

One of the most notable effects of 2020 in the equity markets has been the growth in retail trading and its related challenges to institutional trading and liquidity. Market volume has grown dramatically, but not necessarily to the benefit of institutional trades. NYSE has long advocated for steps to improve displayed liquidity and increase broad market participation1. To further advance this advocacy in 2021, in our new research paper, "The Impact of Tick Constrained Securities on the U.S. Equity Market", we discuss how a regulatory shortcoming in U.S. market structure has limited the benefit from higher market volumes and increased “inaccessible liquidity.”

Displayed liquidity is critical to the success of the US equity markets. Under today’s set of market rules and procedures, however, trading away from transparent exchanges is at an all-time high. Each of the top 25 days, going back to 2012 were in 2020, with the top 15 all occurring since November 23, 2020. For the first time ever, on December 23, total off exchange share topped 50%, touching 50.4% of total volume. This increase in trading away from exchanges has substantially increased inaccessible liquidity as a share of the market. More precisely, retail traders are a much larger part of the market this year, contributing to overall market volume growth; however, the majority of this activity is executed on a bilateral basis between brokers and market makers — most other market participants are unable to directly interact with the largest-growing source of market liquidity.

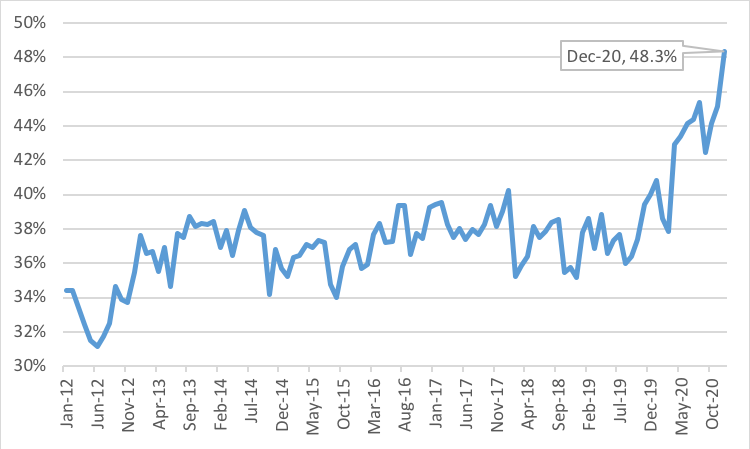

Retail order flow has been processed in this manner for years, but the impact has become more meaningful in the tumult of 2020. Most retail brokers dropped their commissions to zero, and interest in day trading spiked as people remained at home due to the Covid-19 pandemic, leading retail to be as much as 25% of total market volume.2 This resulted in more and more volume trading away from exchanges by virtue of wholesaler internalization. Chart 1 below shows total market share for off-exchange trading, which reach 48.3% for the month of December, nearly 3% higher than the prior record set in August 2020.

Share of Dark Pool & Bilateral Intraday Volume

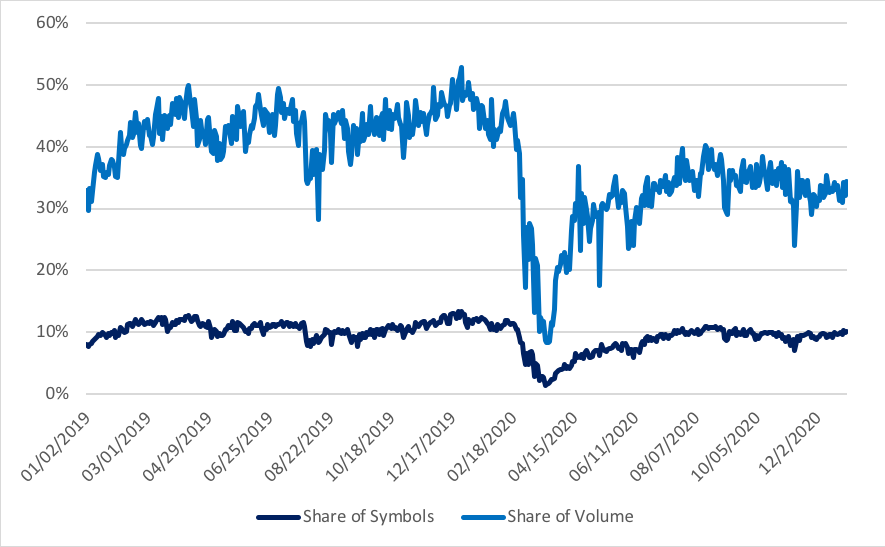

Our research paper highlights challenges due to inaccessible liquidity. We focus on the specific issue of inaccessible liquidity in “Tick-Constrained” Securities, which we define as securities above $1.00 that are regularly quoted with a consolidated spread at or very close to the minimum tick size of $0.01. We find that Tick Constrained Securities, which exhibit large queues of trading interest, make it difficult for liquidity providers to achieve a fill. We also introduce a Tick-Constrained Score, which is a daily measure that combines spread and consolidated quoted size compared to short-term volume. Despite wider spreads in 2020 due to higher volatility, we still find more than 30% of market volume to be constrained by an artificially wide tick size.

The attached paper covers these issues in greater depth. We welcome feedback and suggestions for further research on this important topic.

Symbol and Volume Share Constrianed

1Two recent examples of this advocacy involve the Securities Information Processors (SIPs). In July 2020, NYSE affiliate SIAC launched an upgraded SIP for Tape A and B securities, employing the market-leading NYSE Pillar technology and resulting in a 75% reduction in round-trip quote and trade processing time. NYSE also proposed a modernization of the information content available from SIPs, including the addition of depth-of-book data, odd lots and auction data.

2 https://markets.businessinsider.com/news/stocks/retail-investors-quarter-of-stock-market-coronavirus-volatility-trading-citadel-2020-7-1029382035

NYSE Research Insights

Find all of NYSE Research's articles on market quality, market structure, auctions, and options.