Data Insights

Investments in consolidated tape infrastructure yield

ultra-low latency for investors

July 13, 2020

The NYSE completed the migration of its five equities markets to the best-in-class Pillar technology platform in late 2019. Then, shortly thereafter, in the early days of the Covid-19 pandemic, Pillar faced its greatest test. Despite historic levels of market volatility, Pillar technology was fast, reliable, and consistent, maintaining low latency and deterministic performance.

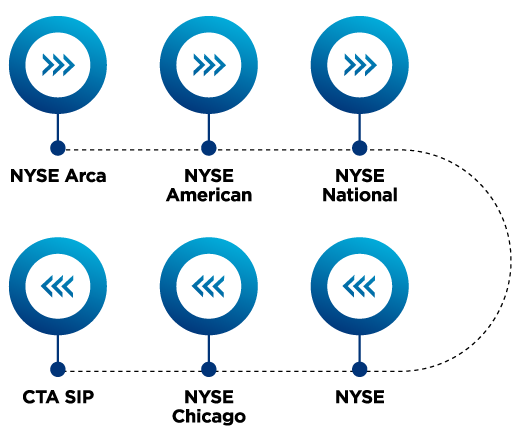

This morning, NYSE’s affiliate SIAC upgraded the Consolidated Tape Association’s (CTA) equity trade and quote data feeds to the same Pillar technology. SIAC is the Securities Information Processor (SIP) for CTA and the Options Price Reporting Authority (OPRA).

Pillar now brings superior speed and resiliency to SIAC’s processing of the CTA consolidated trade and quote data feeds for equity securities listed on NYSE (Tape A) and Cboe, NYSE Arca, and NYSE American (Tape B). For example, we expect Pillar to reduce CTA quote consolidation processing time by more than two-thirds.

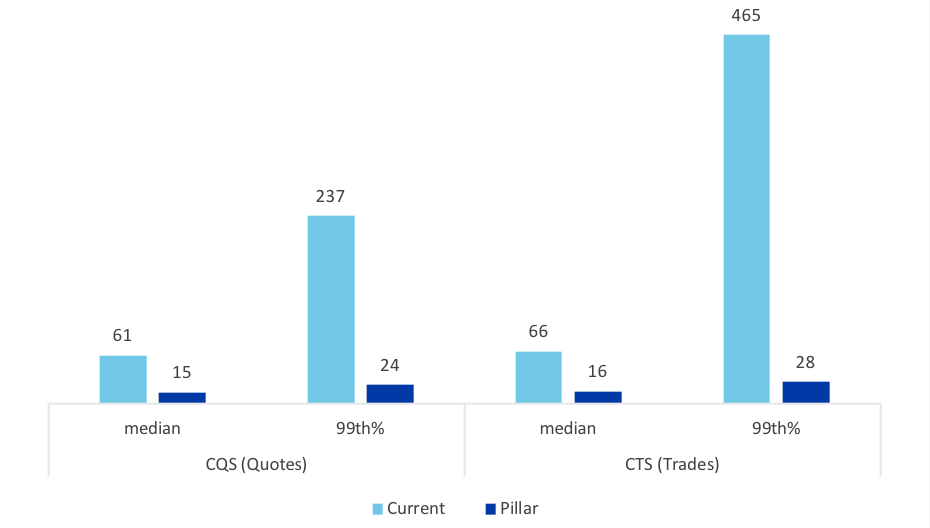

Latency improvements expected with Pillar Technology

Latency shown in microseconds; 'Current' based on May 2020 metrics at CTAPlan.com, 'Pillar' observed in production 'shadow' environment on July 9, 2020

Some of the many improvements the upgrade to Pillar will bring CTA SIP subscribers include:

- Faster Speed: The SIP’s median round-trip message processing for quotes is reduced by 75%.

- Improved Determinism: Latency is highly consistent, even during times of peak message traffic.

- Upgraded Capacity: Increased overall system capacity, capable of handling message traffic well beyond the recent record volumes of 2020.

- Enhanced Resiliency: Built with resiliency in mind, the SIP now runs with a local backup and a disaster recovery site tertiary backup, both of which process messages in parallel with the primary (hot-hot).

- Simplified Scalability: As capacity requirements grow, Pillar supports additional processing capacity without impacting exchange participants or data recipients.

Source: Various trader notes

SIAC’s Pillar launch for the CTA SIP is a major milestone, underscoring the commitment to continuous innovation to improve the customer experience, and follows SIAC’s June 2020 launch of the enhanced SIP network and improved message latency for CTA and OPRA data recipients. These significant SIP systems improvements have been delivered without any new cost to the industry.

The upgrade also marks the latest step in Pillar migration, with SIAC’s processing of the OPRA data feed planned to move to Pillar in the first half of 2021. Looking ahead, NYSE’s two options exchanges, NYSE American Options and NYSE Arca Options, will upgrade to Pillar as well.

Further information can be found at www.ctaplan.com.

NYSE Research Insights

Find all of NYSE Research's articles on market quality, market structure, auctions, and options.