May 11, 2020

The NYSE Arca Options Trading Floor partially reopened on May 4, after its temporary closure on March 23. As a follow up to our recent Q1 2020 Options Review, we wanted to share a few initial observations around market dynamics with open outcry execution once again available. Open outcry is an important mechanism for executing institutional-sized, complex transactions, which benefit from the human judgment that floors provide. As anticipated, there has been a resurgence in volume associated with these types of transactions and the return of certain market participants to the Trading Floor after reopening.

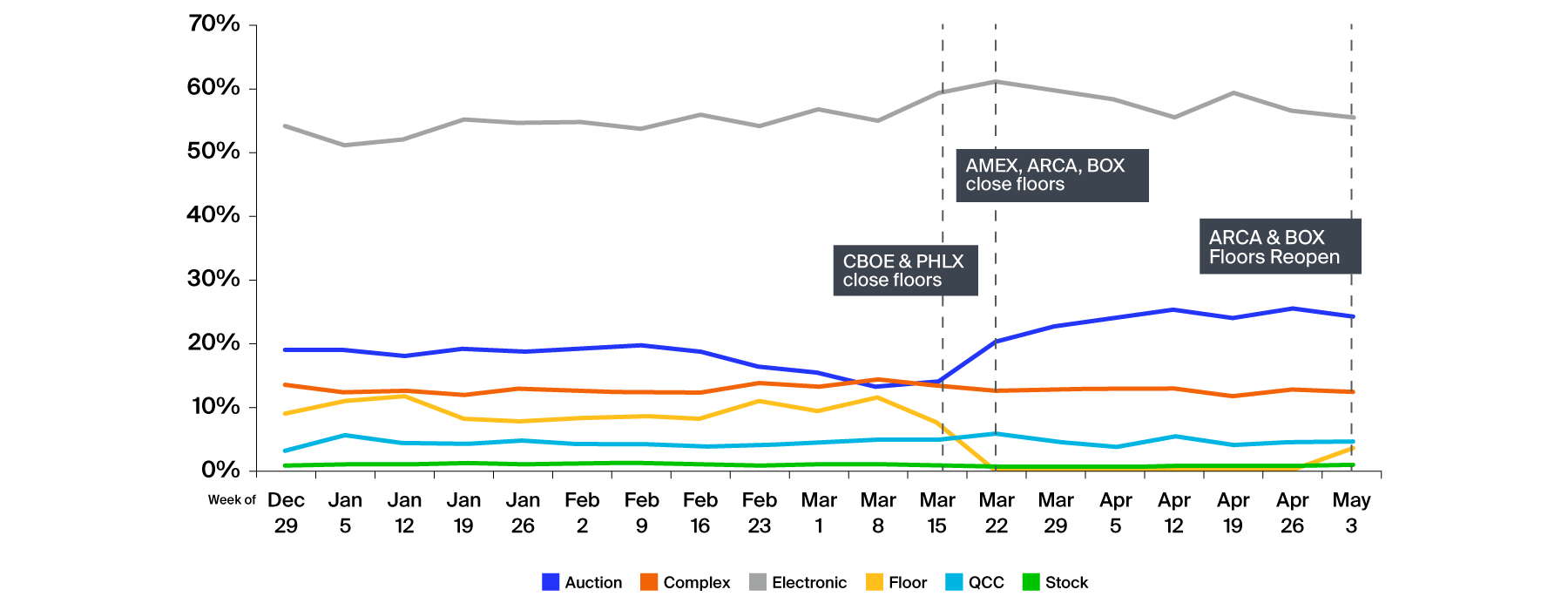

In response to the closures in March, we saw a material increase in the use of electronic auctions for affecting paired trades. In the week since the reopening of the Arca Options Trading Floor, electronic, auction and electronic complex trade shares collectively decreased from the prior week at levels consistent with the gains in open outcry trading. Auction activity in trades above 5,000 contracts experienced a stronger decline, as that volume started returning to trading floors.

Industry Trade Type Mix

| Jan 1 - Mar 22 | Mar 22 - May 3 | May 4 - May 8 | |

| Auction | 17.14% | 23.64% | 24.14% |

| Complex | 12.99% | 12.61% | 12.16% |

| Electronic | 54.87% | 58.13% | 55.07% |

| Floor | 9.53% | 0.22% | 3.46% |

| QCC | 4.41% | 4.67% | 4.33% |

| Stock | 1.05% | 0.73% | 0.82% |

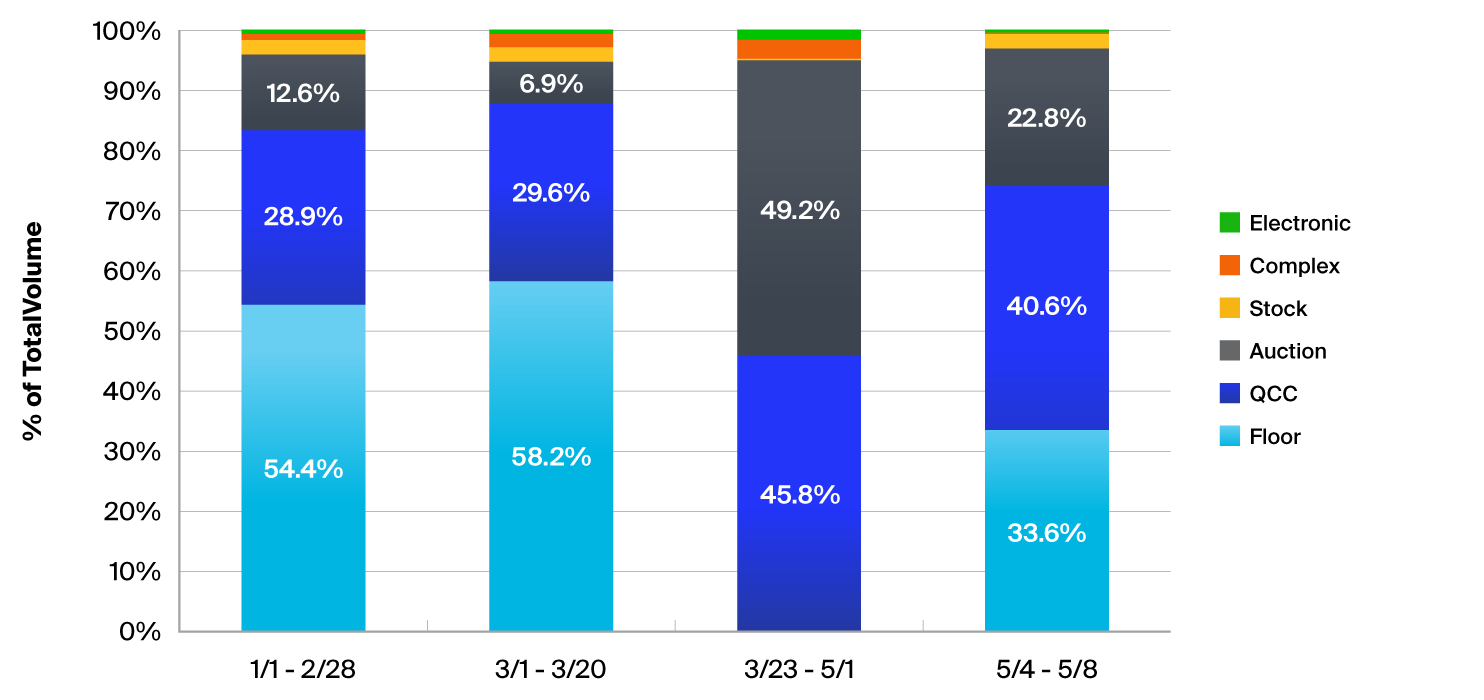

Product Types

Open outcry trading is well-suited for the execution of complex multi-leg options trades, as illustrated by the statistics below:

- Year-to-date, multi-leg options trades accounted for 81% of Arca Floor trade volume, while single-leg trades accounted for 19%.

- Multi-leg trades generally have higher volumes, but we also saw a high frequency of these trades with multi-leg at 68% and single-leg at 32% of Floor trades on Arca for the year.

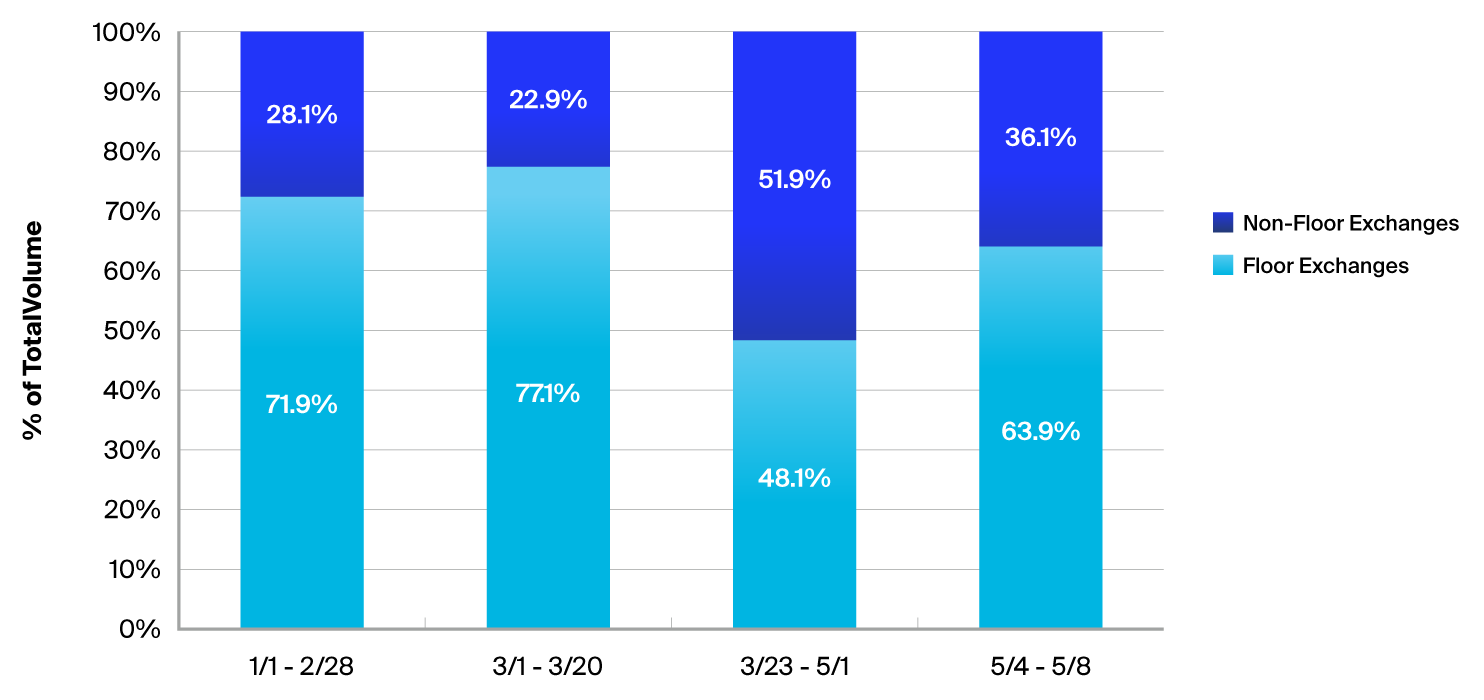

- In the industry, week-to-date Floor Trade share recovered about 36% of its share prior to the temporary closures.

Preference for Open Outcry

- Early data shows trades above 5,000 contracts, which accounted for 9.9% of industry volume prior to the Floor closure, have started returning to trading floors following the reopening of the NYSE Arca's Trading Floor. As noted above, during the Trading Floor closure, this volume had moved to electronic auctions and, to a lesser extent, QCC mechanisms.

- A similar pattern is noticeable in firm trades, which can be representative of institutional investors. These trades have also started returning to trading floors.

- We will continue to monitor how this trend progresses.

Industry Trade Type Share

Industry Firm Volume Share

NYSE Research Insights

Find all of NYSE Research's articles on market quality, market structure, auctions, and options.