Closing Auction: Immediate market impact, price drift and transaction cost of trading

Part 2

Transaction cost analysis

A standard Transaction Cost Analysis (TCA) usually defines trading cost as a function of the slippage against a conventional benchmark, reflecting the impact of volatility, spread, participation rate, order size and daily volume among other factors. In this analysis, we review multiple TCA extensions tailored to the unique trading profile of the final minutes of trading on the NYSE leading into the NYSE Closing Auction. Specifically, we:

- Estimate the potential dollar-cost or dollar-savings of orders intended for the NYSE Closing Auction, and

- Examine how the relationship between the order side and auction imbalance side impacts these metrics.

Definitions

Auction orders are orders eligible for execution in the NYSE Closing Auction and are included in the imbalance calculation. These include Market-on-Close and Limit-on-Close orders, Closing Imbalance Offset orders and D-Orders.

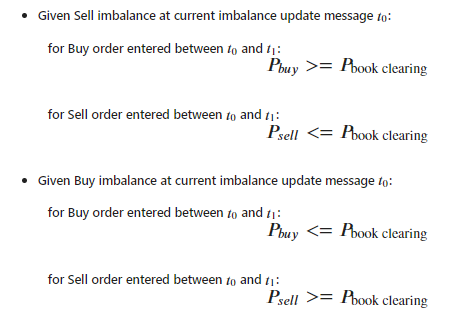

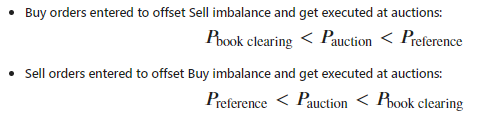

The marketability of an auction order is determined by the limit price of that order compared to the continuous book clearing price and imbalance side of the most recent imbalance update message.

Offsetting orders are marketable auction orders entered on the opposite side of an imbalance to offset it, while joining orders are marketable auction orders entered on the same side of an imbalance.

Auction order executed volume offsetting vs joining the imbalances

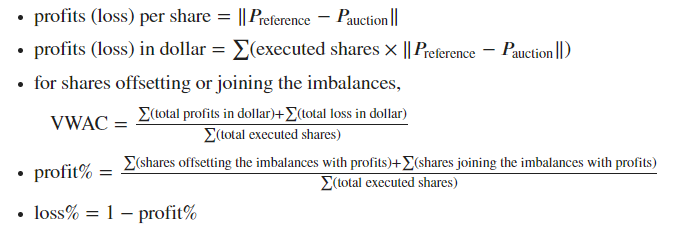

VWAC is the Volume Weighted Average Cost in dollars of an auction order at each minute and is considered separately for offsetting and joining order flow. VWAC is similar to the more commonly used Volume Weighted Average Price (VWAP), but emphasizes the net cost benchmarked to the market rather than simply the stock price itself. Positive VWAC values reflect a gain, while negative VWAC values reflect a loss. Our measure of an order’s profitability discussed below considers the order’s execution price at the NYSE Closing Auction relative to the reference price at the time of order entry. For example, when a buy order is entered and eventually executes in the NYSE Closing Auction at a price lower than the order entry reference price, this price difference is considered a proxy for the cost saved by executing at the NYSE Closing Auction.

Statistics

Offsetting auction orders have a VWAC range of +$0.0075 to +$0.014 for corporate stocks in the S&P 400, S&P 500 and S&P 600. The VWAC tends to be slightly higher for stocks in the S&P 500, peaking at $0.03 at around 3:58pm, but lower for ones in the S&P 600, with the first 3 minutes of the imbalance period having a negative dollar cost.

In contrast, joining auction orders for the entirety of the S&P 1500 universe have a negative VWAC (i.e., a loss), and the average cost per minute ranges from -$0.03 to +$0.01, with some gain observed in the first 3 minutes of the imbalance period for S&P 600 names. We calculated the average order size relative to each stock’s CADV to track how the net cost per minute changes as order size changes. Although stocks within the S&P 500 had smaller average order size compared to the other two groups, offsetting orders continued to show higher VWAC (gain).

The divergence in VWAC between imbalance-offsetting and imbalance-joining orders highlights the increasing benefits in offsetting posted imbalances when trading into the close, with benefits observed for both larger and relatively smaller order sizes.

$VWAC and %Order Size for S&P400, S&P500, S&P600

Profitable auction order offsetting vs joining the imbalances in %

Summary

- Closing auction orders as large as 2.5% of CADV for Russell 1000 stocks result in an immediate price move of around 0.3X the daily average spread, and the stocks not in the Russell 1000 have a less immediate price move, suggesting the market takes more time to digest and react to information in auctions of less-active stocks.

- Across all stocks, impact is likely to increase when order entry gets very close to the end of trading.

- During the imbalance period between 15:57 - 16:00, auction orders could be sized up to approximately 0.47%, 0.86% and 1.18% of CADV before triggering the large and persistent market impact.

Part 2:

- Imbalance-offsetting auction orders have a VWAC range of +$0.0075 to +$0.014 for corporate stocks in the S&P 1500, while imbalance-joining auction orders are more likely to have negative VWACs.

- The divergence in VWAC between imbalance-offsetting and imbalance-joining auction orders highlights the increasing benefits of offsetting posted imbalances when trading into the close.

- Imbalance-offsetting auction orders show a higher probability of being executed at a better price and attaining some degree of cost savings than imbalance-joining orders.

NYSE Research Insights

Find all of NYSE Research's articles on market quality, market structure, auctions, and options.