May 26, 2020

The NYSE Trading Floor partially re-opened today, May 26, 2020, after a temporary two-month closure. This marks an important milestone because operating with the Trading Floor provides investors the highest level of market quality.

Floor brokerages are now eligible to return to the Floor, with reduced headcount and restrictions in place to enforce social distancing and other safety protocols. Designated Market Makers (DMMs) continue to operate remotely as they have since March 23rd. D Orders are available, but Opening and Closing Auctions continue to operate electronically (as explained in this FAQ).

As expected, traders and investors welcomed the return of the Trading Floor. Despite the reduced headcount, Floor Brokers played a significant role in liquidity formation in both the Opening and Closing Auctions.

- Investors sought out Floor Brokers for the most challenging situations: when HTZ and LTM both opened late in the day after regulatory halts, Floor Brokers accounted for more than 27% of executed volume in each auction.

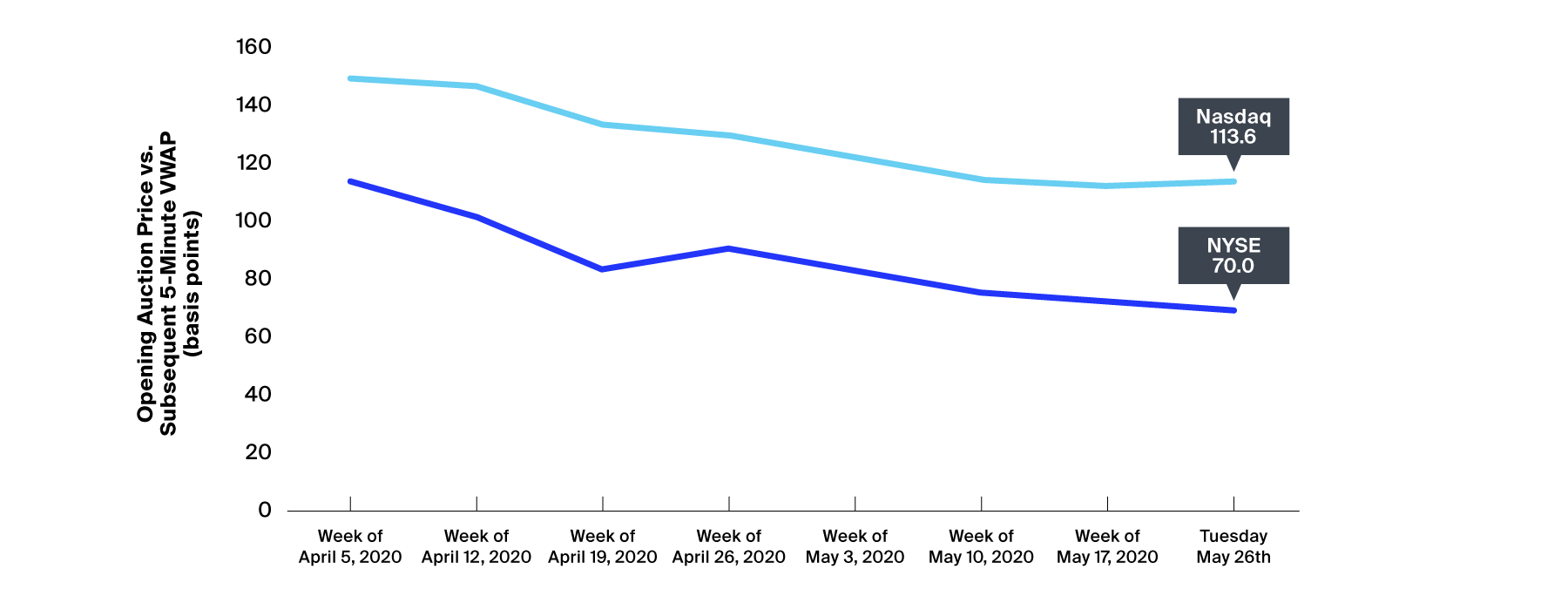

- The NYSE Opening Auction saw 5% less price dislocation today compared to last week; for comparison Nasdaq stocks experienced 1% more price dislocation today.

Opening Auction Price Dislocation

All Corporate Stocks

- In the Closing Auction, Floor Brokers returned to their key function: providing flexible and knowledgeable access to the largest equity liquidity event in the world.

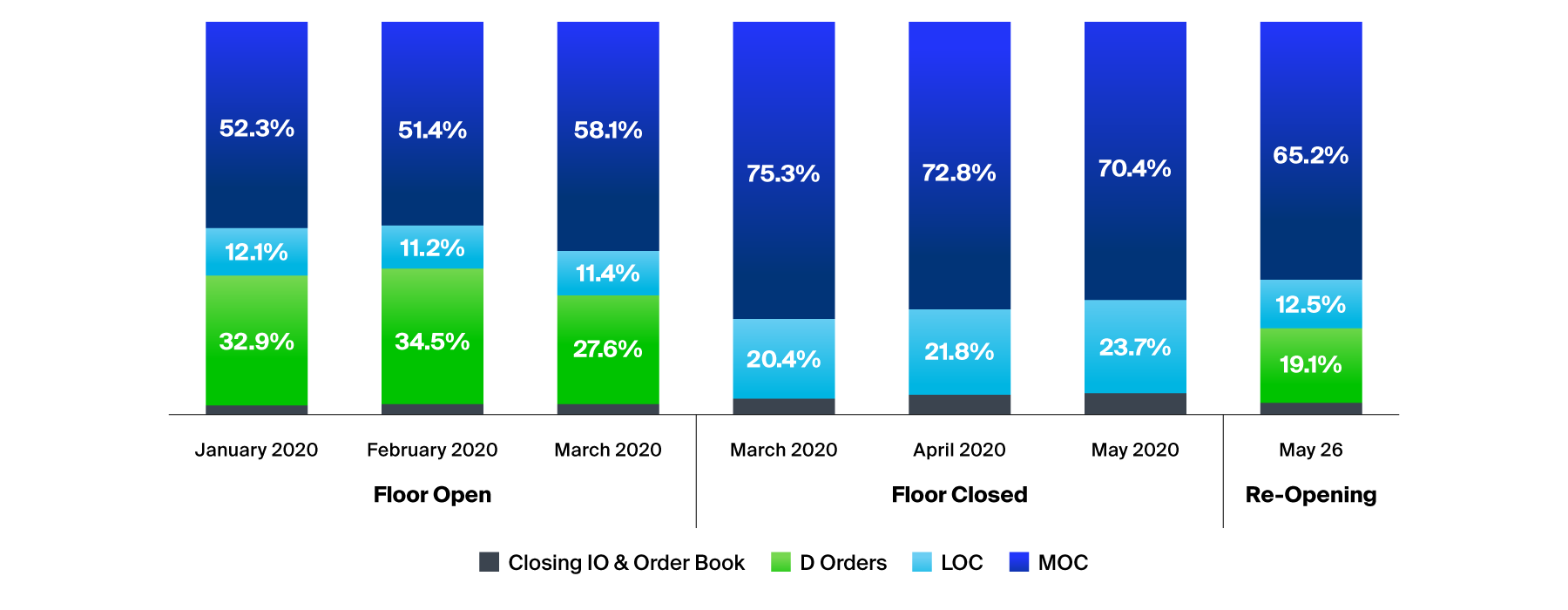

- D Orders accounted for 19.1% of Closing Auction volume.

Closing Auction Order Type Usage

To leverage Floor Brokers’ unique capabilities, please contact your Floor Broker or view the Floor Broker directory. For any other questions on the floor re-opening contact [email protected].

NYSE Research Insights

Find all of NYSE Research's articles on market quality, market structure, auctions, and options.