Fast & Furious Start to 2021 Growth

February 25, 2021

News from the Active ETF Market

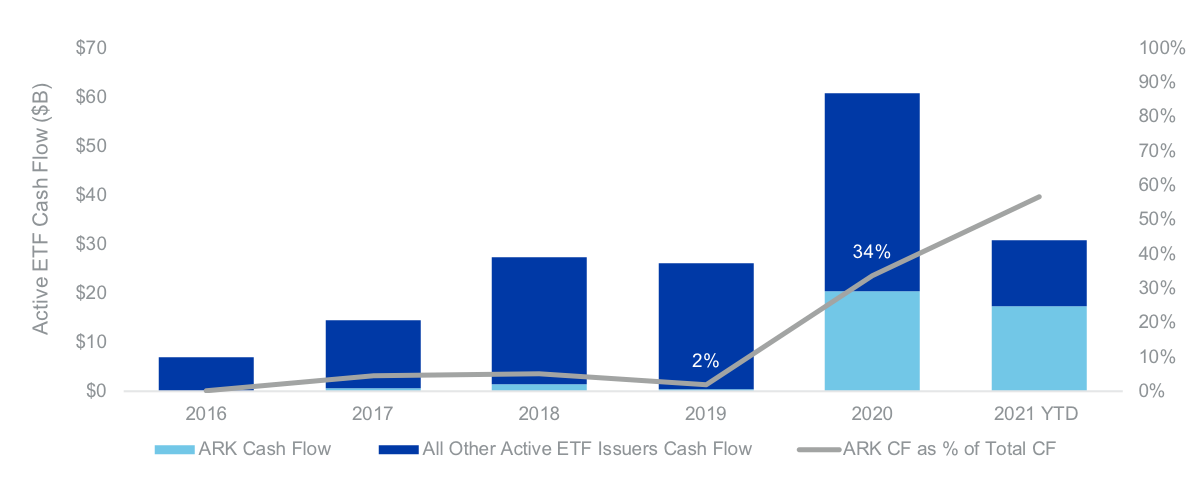

In just under two months, the active ETF market has seen $30.7 billion in cash flow year-to-date (YTD). No, that’s not a typo! The market has already received more cash flow YTD than all prior full calendar years, excluding 2020. ARK remains a primary driver of this remarkable start, capturing $17.4 billion - or 57% - of active ETF industry cash flow YTD. Outside of ARK, though, industry growth remains very strong. The $13.3 billion in YTD cash flow has shattered the prior full-Q1 record of $5.9 billion set in 2018. Notably, and important for broad industry opportunity, growth remains very diversified, with nearly 60% of issuers on pace to break Q1 2020 cash flow records.

The Growth of Active ETFs

Source FactSet as of 2/19/2021

Competition Heats Up in the Semi-Transparent ETF Market

In January’s update, the NYSE analyzed the early successes of semi-transparent ETFs, covering the market’s rapid rise to over $1 billion in assets under management (AUM), early product diversity and well-functioning secondary markets. There’s been no shortage of market news in the month since, including six new product launches, two new asset managers announcing market entry and SEC approval of the market’s first custom basket capabilities using the NYSE Active Proxy Structure.

New Launches

Gabelli: On Feb. 1, Gabelli launched its first semi-transparent ETF: ESG-focused Gabelli Love Our Planet & People ETF (LOPP). Notably, Gabelli is offering a full fee waiver for the first $100 million invested for up to a year. Additionally, on Feb. 16, Gabelli launched the innovation-focused Gabelli Growth Innovators ETF (GGRW).

Fidelity: On Feb. 2, Fidelity doubled down on its active equity lineup with the launch of four new ETFs, including a clone of its flagship Magellan Fund. With this launch Fidelity now offers seven semi-transparent ETFs.

- Fidelity Magellan ETF (FMAG)

- Fidelity Growth Opportunities ETF (FGRO)

- Fidelity Real Estate Investment ETF (FPRO)

- Fidelity Small-Mid Cap Opportunities (FSMO)

New Market Entry & Product Announcements

Nuveen: On Feb. 4, current ETF sponsor Nuveen filed for relief to launch three semi-transparent ETFs using the NYSE Active Proxy Structure. The three initial ETFs listed in the filing include:

- Nuveen Small-Cap Select ETF

- Nuveen Santa Barbara Dividend Growth ETF

- Nuveen Winslow Large-Cap Growth ETF

- Putnam Focused Large Cap Growth ETF

- Putnam Focused Large Cap Value ETF

- Putnam Sustainable Future ETF

- Putnam Sustainable Leaders ETF

Additional Insights on the Active ETF Market

- Brown Brothers Harriman, Exchange Thoughts: The NYSE teamed up with BBH to co-author “Active ETFs: Helping Managers Navigate the Various ETF Structures,” a guide for asset managers on key considerations for assessing the active ETF market.

- The Wall Street Journal, Markets & ETFs: Michael Wursthorn provides perspective from bank channel executives at Bank of America and UBS on their approach to approving semi-transparent ETFs on their wealth management platforms.

- The ETF Educator, ETF Buzz: In the Feb. 19 edition of ETF Store President Nate Geraci’s weekly note, he shares articles on the success of ARK, Putnam’s entry into the ETF market, ETF vs. mutual fund growth and more.

- Seeking Alpha, Let’s Talk ETFs: Host Jonathan Liss sits down with Greg Friedman, Fidelity’s Head of ETF Management and Strategy, to discuss the firm’s active ETFs and the early adoption they are seeing.

Active ETF Stat Pack

| Firms | |||

| # of Issuers | 97 | ||

| # of New Issuers 2021 | 4 | ||

| Products | Assets | ||

| # of ETFs | 505 | AUM ($B) | $210.81 |

| # of New Launches 2021 | 33 | 3 Yr AUM CAGR | 165% |

| Avg. ER | 0.56% | 5 Yr AUM CAGR | 57% |

| Cash Flow | Trading | ||

| YTD Cash Flow ($B) | $30.7 | YTD ADV (Shares) | 60,264,534 |

| 3 Yr Cash Flow | $139.4 | YTD ADV ($) | $4.01 B |

| 5 Yr Cash Flow | $162.8 | YTD Avg. Spread (bps)* | 29.40 |

Active, Semi-Transparent Update

|

Ticker |

Inception |

Name |

AUM |

Flows |

Avg. Spread (bps) |

ADV (shares) |

Structure |

LMM |

Expense Ratio |

|---|---|---|---|---|---|---|---|---|---|

EQOP |

09/17/2020 |

Natixis U.S. Equity Opportunities ETF |

$12,553,471 |

$ - |

14.39 |

121 |

NYSE AMS |

Citadel |

0.90% |

VNSE |

09/17/2020 |

Natixis Vaughan Nelson Select ETF |

$6,591,744 |

$288,685 |

15.91 |

705 |

NYSE AMS |

Citadel |

0.90% |

VNMC |

09/17/2020 |

Natixis Vaughan Nelson Mid Cap ETF |

$9,042,795 |

$880,401 |

23.06 |

865 |

NYSE AMS |

Citadel |

0.85% |

ESGA |

07/15/2020 |

American Century Sustainable Equity ETF |

$125,384,010 |

$10,551,998 |

15.11 |

11,185 |

NYSE AMS |

Citadel |

0.39% |

MID |

07/15/2020 |

American Century Mid Cap Growth Impact ETF |

$11,227,540 |

$2,784,123 |

15.28 |

2,028 |

NYSE AMS |

Citadel |

0.45% |

FDG |

04/02/2020 |

American Century Focused Dynamic Growth ETF |

$238,613,964 |

$3,069,548 |

14.44 |

22,308 |

ActiveShares |

Citadel |

0.45% |

FLV |

04/02/2020 |

American Century Focused Large Cap Value ETF |

$182,158,120 |

$7,708,194 |

16.45 |

9,071 |

ActiveShares |

Citadel |

0.42% |

CFCV |

05/28/2020 |

ClearBridge Focus Value ETF |

$3,239,866 |

$545 |

32.12 |

140 |

ActiveShares |

GTS |

0.50% |

FBCG |

06/04/2020 |

Fidelity Blue Chip Growth ETF |

$286,004,080 |

$70,583,078 |

19.99 |

227,294 |

Fidelity Proxy |

GTS |

0.59% |

FBCV |

06/04/2020 |

Fidelity Blue Chip Value ETF |

$52,759,770 |

$8,096,170 |

24.12 |

44,434 |

Fidelity Proxy |

GTS |

0.59% |

FMIL |

06/04/2020 |

Fidelity New Millennium ETF |

$33,811,310 |

$10,152,280 |

24.39 |

31,743 |

Fidelity Proxy |

GTS |

0.59% |

FGRO |

02/04/2021 |

Fidelity Growth Opportunities ETF |

$12,919,625 |

$10,883,843 |

5.87 |

79,688 |

Fidelity Proxy |

Citadel |

0.59% |

FMAG |

02/04/2021 |

Fidelity Magellan ETF |

$3,537,625 |

- |

10.99 |

266,950 |

Fidelity Proxy |

RBC |

0.59% |

FPRO |

02/04/2021 |

Fidelity Magellan ETF |

$3,516,485 |

$1,510,388 |

7.36 |

16,712 |

Fidelity Proxy |

CItadel |

0.59% |

FSMO |

02/04/2021 |

Fidelity Small/Mid-Cap Opportunities ETF |

$7,351,225 |

$5,270,880 |

16.75 |

48,026 |

Fidelity Proxy |

RBC |

0.59% |

TCHP |

08/05/2020 |

T. Rowe Price Blue Chip Growth ETF |

$90,761,840 |

$23,303,856 |

9.81 |

49,063 |

T Rowe Proxy |

Virtu |

0.57% |

TDVG |

08/05/2020 |

T. Rowe Price Dividend Growth ETF |

$45,871,163 |

$8,271,175 |

7.01 |

17,137 |

T Rowe Proxy |

RBC |

0.50% |

TEQI |

08/05/2020 |

T. Rowe Price Equity Income ETF |

$29,101,365 |

$4,560,107 |

9.88 |

7,414 |

T Rowe Proxy |

Virtu |

0.54% |

TGRW |

08/05/2020 |

T. Rowe Price Growth Stock ETF |

$32,463,760 |

$4,770,528 |

7.96 |

10,031 |

T Rowe Proxy |

RBC |

0.52% |

IVDG |

12/22/2020 |

Invesco Focused Discovery Growth ETF |

$1,314,000 |

$ - |

24.24 |

2,274 |

Invesco Model |

Citadel |

0.59% |

IVLC |

12/22/2020 |

Invesco US Large Cap Core ESG ETF |

$1,242,000 |

$ - |

14.93 |

997 |

Fidelity Proxy |

Citadel |

0.48% |

IVRA |

12/22/2020 |

Invesco Real Assets ESG ETF |

$1,249,000 |

$ - |

19.88 |

2,051 |

Fidelity Proxy |

Citadel |

0.59% |

IVSG |

12/22/2020 |

Invesco Select Growth ETF |

$1,301,000 |

$ - |

17.70 |

1,766 |

Invesco Model |

Citadel |

0.48% |

LOPP |

02/01/2021 |

Gabelli Love Our Planet & People ETF |

$7,526,040 |

$4,464,910 |

23.55 |

18,562 |

ActiveShares |

GTS |

0.90% |

GGRW |

2/16/2021 |

Gabelli Growth Innovators ETF |

$2,461,500 |

$ - |

74.74 |

1,642 |

ActiveShares |

GTS |

0.48% |

|

|

Total/Average |

$1,209,223,093 |

$188,306,008 |

16.39 |

696,952 |

|

|

0.59% |

Source: Factset & NYSE Internal Database and Consolidated Tape

Statistics as of 2/19/2021

*Simple average

February Active ETF Launches

|

Ticker |

Name |

Issuer |

Launch Date |

Asset Class |

AUM |

|---|---|---|---|---|---|

LOPP |

Gabelli Love Our Planet & People ETF |

GAMCO Investors, Inc. |

02/01/2021 |

Equity |

$4,604,400 |

FEBZ |

TrueShares Structured Outcome (February) ETF |

TrueMark Investments |

02/01/2021 |

Equity |

$1,275,605 |

SENT |

AdvisorShares Alpha DNA Equity Sentiment ETF |

AdvisorShares |

02/03/2021 |

Equity |

$46,219,935 |

MBND |

SPDR Nuveen Municipal Bond ETF |

State Street |

02/04/2021 |

Fixed Income |

$30,029,671 |

FGRO |

Fidelity Growth Opportunities ETF |

Fidelity |

02/04/2021 |

Equity |

$2,060,000 |

FMAG |

Fidelity Magellan ETF |

Fidelity |

02/04/2021 |

Equity |

$3,537,625 |

FPRO |

Fidelity Real Estate Investment ETF |

Fidelity |

02/04/2021 |

Equity |

$2,009,990 |

FSMD |

Fidelity Small-Mid Cap Opportunities ETF |

Fidelity |

02/04/2021 |

Equity |

$2,066,750 |

SUBZ |

Roundhill Streaming Services & Technology ETF |

Roundhill Investments |

02/10/2021 |

Equity |

$48,080,070 |

VABS |

Virtus Newfleet ABS/MBS ETF |

Virtus Investment Partners |

02/10/2021 |

Fixed Income |

$6,262,100.19 |

GGRW |

Gabelli Growth Innovators ETF |

GAMCO Investors, Inc. |

02/16/2021 |

Equity |

$2,461,500 |

EFIX |

First Trust TCW Emerging Markets Debt ETF |

First Trust |

02/18/2021 |

Fixed Income |

$20,079,040.16 |

QCON |

American Century Quality Convertible Securities ETF |

American Century Investments |

02/18/2021 |

Fixed Income |

$2,982,366 |

QPFF |

American Century Quality Preferred ETF |

American Century Investments |

02/18/2021 |

Fixed Income |

$3,001,815 |

|

Total |

14 New Funds Launched |

|

|

|

$91,803,976 |

Source: Factset & NYSE Internal Database and Consolidated Tape

Statistics as of 2/5/2021

*Simple average

NYSE ETF Summit & Active ETF Webinar Series Replay

Missed the NYSE ETF Summit or our Active ETF Webinar series?

Visit HomeofETFs.com to catch-up

Hear from ETF experts from each of the various active ETF structure providers, fund sponsors such as American Century, Fidelity, PIMCO and T. Rowe Price, liquidity providers such as Flow Traders and Jane Street, and service providers such as BNY Mellon and State Street.

NYSE ETF Education Series

Join the NYSE ETF Team and industry experts in our series of educational webcasts. sign up by emailing us at [email protected]

Visit HomeofETFs.com to catch-up on past webinars