Data Insights

Quoting in Today’s Market Favors the Primary Exchange Group

November 10, 2020

The NYSE Group operates five equities exchanges: NYSE, NYSE Arca, NYSE American, NYSE National and NYSE Chicago. Each venue offers unique listings and/or trading models to meet the varied needs of today’s complex equities marketplace. The exchanges’ electronic matching engines all operate on a single technology, NYSE Pillar, located in a single data center in Mahwah, NJ. This creates a network of diverse yet easily-accessible liquidity when investors seek to trade. In aggregate, the NYSE Group exchanges offer the best prices and most liquidity for the majority of U.S.-listed securities.

Quoting at the Best Price

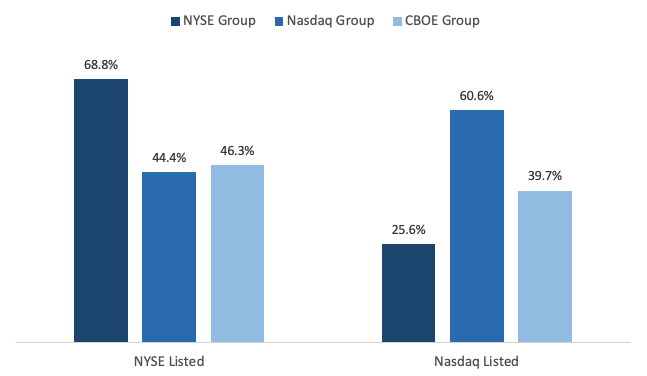

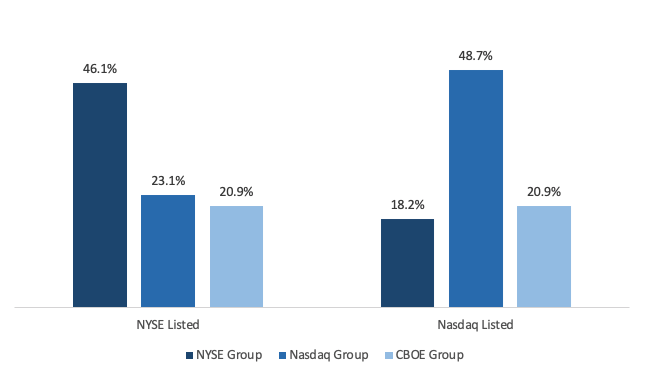

When an investor is about to trade, they look at the quoted price in the market1. This market quote is made of the best prices from each exchange; trading venues that quote more often at the best prices are contributing more to price discovery and liquidity. One way to measure this contribution is the percent of time during the trading day that an exchange group is quoting at both the best bid and offer in the market.

The charts below show performance of exchange groups with respect to trading of securities listed on one of the exchanges in the group. The data shows that exchange groups that include the primary listing market deliver better market quality in those listed securities than other exchange groups (i.e., the NYSE Group is best at NYSE Group-listed securities, Cboe is best at Cboe Group-listed securities, etc.). Additionally, the NYSE Group quotes NYSE Group-listed securities at the best price more often than Nasdaq Group does its own listings.

Corporate Issues: Percentage Time Quoting at the Best Price

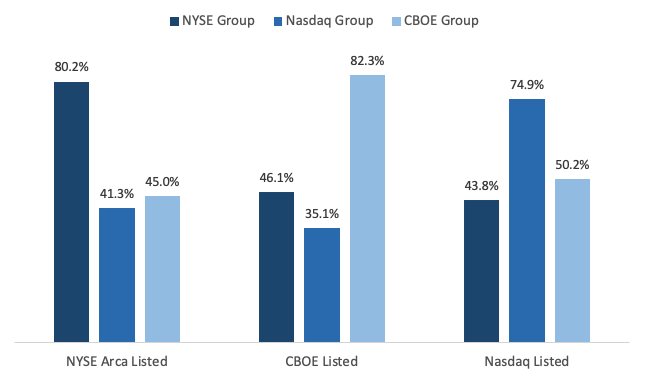

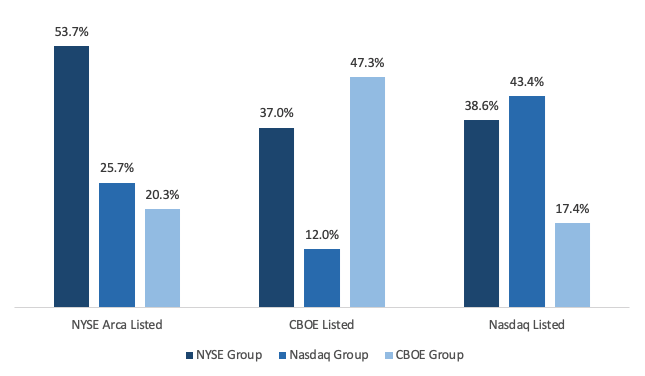

Calculating this metric for ETFs highlights an important nuance: a high proportion of less liquid listed securities, which tend to have fewer market makers than active securities, can lead to the primary listing exchange group to have a very high share of time with the best price. For example, only 15% of ETFs listed on Cboe had an average daily volume over 100,000 shares, compared to 30% of NYSE Arca-listed ETFs.

ETFs: Percentage Time Quoting at the Best Price

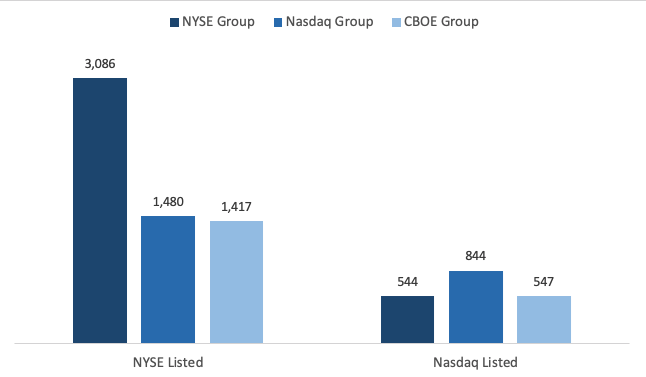

Showing the Most Interest

While having the best price is important, the amount of shares displayed in the quote is also a key indicator in price formation. The NYSE Group, on average, provides more than twice the liquidity in NYSE -listed corporate stocks compared to other trading venues. On the other hand, Nasdaq only provides about 55% more liquidity in its own issues than other venues.

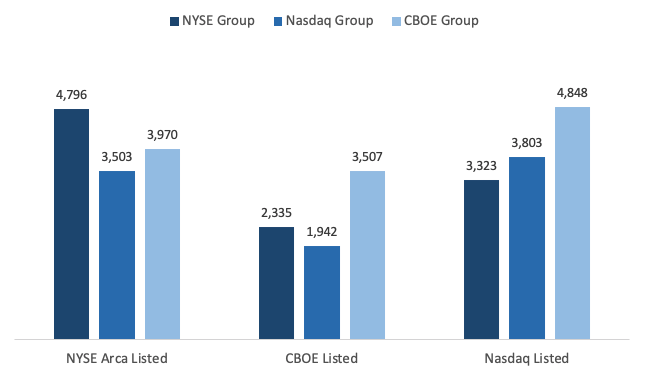

Corporate Issues: Average Shares at the Best Price

ETFs trade differently than corporate stocks, as the relationship with underlying securities allows market participants to quote relatively larger size than in the underlyings directly. This increased quoting capability can also lead to greater liquidity dispersion among venues. Despite this, the NYSE Group also maintains a strong advantage in shares displayed at the best price in its listed ETFs versus other exchange groups.

ETFs: Average Shares at the Best Price

Setting the Best Price

As part of the market’s dynamic price discovery process, traders and investors can express their views by improving existing quoted prices with new, more aggressive quoted prices (e.g., submitting a bid to buy at $10.01 when the existing best bid is $10.00). Traditionally, market participants have been more likely to use primary listings markets to establish new price levels. We find that today’s market structure can broaden this behavior to venues in the exchange group to which the primary listing market belongs, as traders leverage both the price discovery function of the primary market and the different trading models of sister venues. We see this clearly in the data: for corporate stocks, the exchange group that includes the primary listing exchange sets new price levels roughly twice as much as the nearest competing exchange groups.

Corporate Issues: Setting the Best Price

In ETFs, the NYSE Group sets the best price in its ETF listings far more than other exchange groups and competes aggressively in non-primary ETFs as well, highlighting the NYSE Group’s status as the top venue for trading ETFs.

ETFs: Setting the Best Price

1 All data are sourced from the NYSE Pillar trading platform for the full month of October 2020. Statistics are equal-weighted across all NYSE, Nasdaq, NYSE Arca and Cboe BZX listings, excluding Nasdaq Nextshares and ticker CBOE. Time at the inside is the time that the exchange group maintains the best quote on both the bid size and the offer side. First to best price measures frequency that one of the exchange group’s markets is the first to set a better bid or better quote. The shares at the best price measures the average of the number of shares the exchange group displays at the best bid and the best offer averaged over the full trading day. For example, if an exchange group was at the inside for half of the day, and when it is at the inside, it averaged 200 shares, the result is 100 share (1/2 * 200).

NYSE Research Insights

Find all of NYSE Research's articles on market quality, market structure, auctions, and options.