June 30, 2020

The annual Russell US Indexes Reconstitution in late June is a major event for investors and traders. FTSE Russell updates both market capitalization and investment style definitions, which means the impact cuts across companies of all sizes. This can result in large liquidity demand as index funds need to rebalance their portfolios and active investors seek to leverage the unusual liquidity in hard-to-trade securities.

The 2020 reconstitution on June 26 was expected to be one of the largest on record, and it did not disappoint. The NYSE Closing Auction had its second-largest trade ever by shares, executing 2.3 billion shares valued at nearly $70 billion. Nasdaq traded roughly 1.6 billion shares with a notional value of almost $57 billion.

NYSE Designated Market Makers (DMMs) may facilitate Closing Auctions electronically or with human manual intervention. Such DMM-facilitated Closing Auctions guarantee execution of all interest priced better than the auction price, including all Market orders.1 During index rebalances, this execution guarantee is key and provides advantages over competing exchanges' (or NYSE Exchange-facilitated) closing auctions, which have pre-determined price boundaries that can cause market orders to not fully execute.

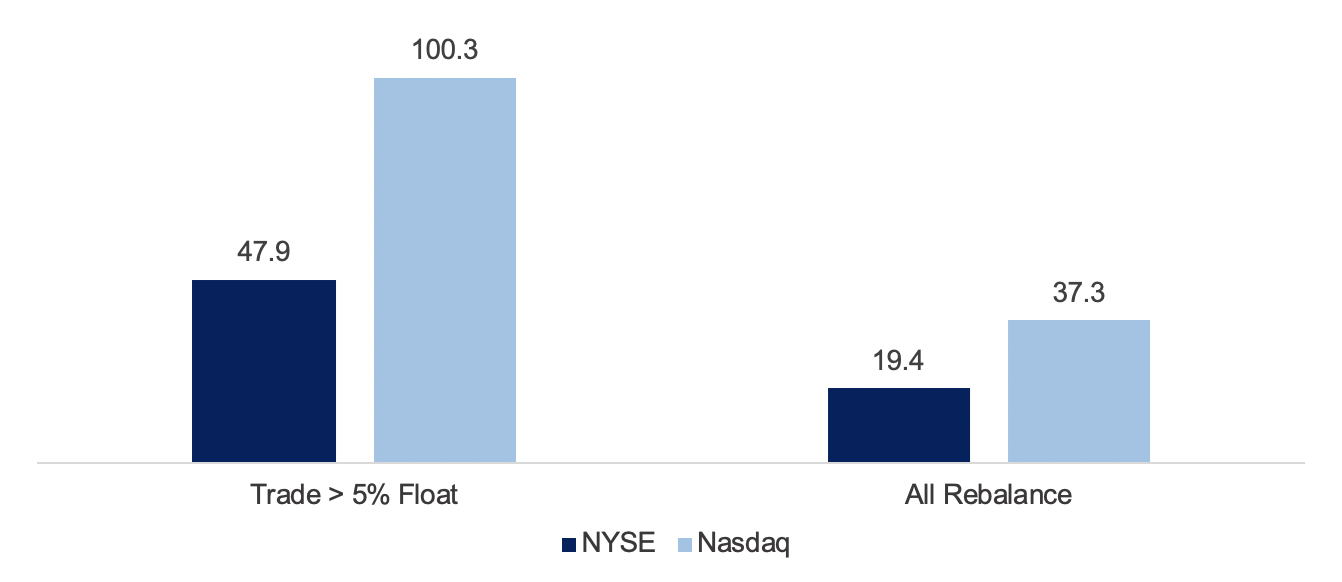

To assess the NYSE Closing Auction, we compared the volume-weighted average price during the final two minutes of trading to the closing auction price for securities that had a rebalance need. This difference, or price dislocation, indicates how well a closing process reflects market prices at the end of regular-hours trading. Lower dislocation means investors are receiving fairer prices. We found:

- If Nasdaq-listed securities in the rebalance enjoyed the same auction efficiency as NYSE securities, investors’ trading costs could have been reduced by as much as $99.5 million.

- Price dislocation for NYSE securities that had a rebalance need was 48% lower than impacted Nasdaq securities.

- For stocks that had a closing auction that accounted for at least 5% of the free float,2 NYSE's price dislocation was 52% lower than similar Nasdaq stocks.

2020 Russell Reconstitution Closing Auction Price Dislocation

Closing Price vs. Last 2-minute VWAP

Why This Matters

The NYSE Closing Auction remains the largest equity liquidity event in the world. With the NYSE Trading Floor partially re-opened, investors benefit from both the Closing Auction’s liquidity and fairer prices. These benefits are especially critical during major trading events such as index rebalances.

1 For the Russell Reconstitution all auctions were facilitated by DMMs and no securities closed via the Exchange-facilitated auction process.

2 138 NYSE securities and 271 Nasdaq securities meet this definition and had at least one trade in the last two minutes.

NYSE Research Insights

Find all of NYSE Research's articles on market quality, market structure, auctions, and options.