Review of 2023: The active ETF market delivers

Published

- Assets under management (AUM): Grow from $340 billion to exceed $450 billion by year-end 2023

- Full-year cash flow: Make it three years in a row with over $80 billion

- Mutual fund to ETF conversions: 15+ issuers will complete mutual fund to ETF conversions totaling over $20 billion

- Active semi-transparent: 10+ ETFs will launch, and assets will exceed $7.5 billion

- Growth milestone: At least two issuers will eclipse $75 billion in AUM

So how did we do in 2023?

- Assets have grown to over $530 billion. Well exceeding our prediction and resulting in a 1 Year CAGR of nearly 56%.

- Cash flow totaled nearly $128 billion for the year, led by a record breaking Q4 that saw nearly $50 billion enter the market. On the heels of this, our three-peat became a reality.

- The industry welcomed 36 active ETFs from 18 separate issuers via conversion, with combined assets on conversion of $13.7 billion. Maybe a half point for hitting on the number of conversions and missing on the total?

- Eight new active semi-transparent ETFs came to market and assets now stand at $5.7 billion. Despite continued investment limitations, these ETFs experienced record cash flow of nearly $2 billion of inflows. Double the total for full year 2022.

Hitting three and a half out of five of our predictions marks continued improvement over our two for five performance in 2021 and three for five performance in 2022. All told, the active ETF market delivered in a big way in 2023.

Beyond our bold predictions, there are a few additional stats from the year that stood out to us:

- Active ETF cash flow as a percentage of total ETF industry cash flow: 21.5%, down from ~30% during the first three quarters of the year, yet continuing to well exceed the market’s ~5% asset market share

- Quarterly cash flow: $46.8 billion, a new quarerly record that resets the tables for 2024

- Active ETF launches as a percentage of total ETF launches: 73.5%, another new record for the industry; activity was spread across 395 ETFs and 125 issuers

- Firms with positive cash flow: 204 firms, over 75% of issuers; up over 5% compared to the prior quarter end of 2023

- ETFs with positive cash flow: 930 active ETFs, or roughly 70% of all ETFs; up 5% compared to the prior quarter end of 2023

Quarterly Active ETF Cash Flows

Source: Factset as of 12/31/2023

Passive vs Active Quarterly Cash Flows

Source: Factset as of 12/31/2023

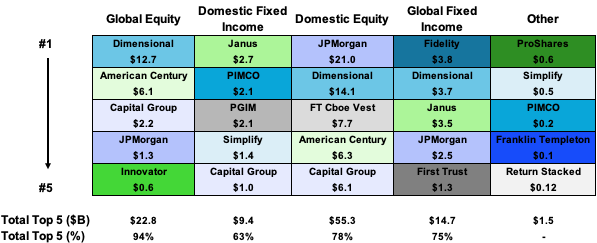

The actively managed ETF industry continued to see mixed growth across asset classes through the year-end. Equity flows remained the story of the industry, leading the way with $95.4 billion. Investors favored domestic equity exposure (+$71.1 billion) to global (+$24.3 billion). ETFs that focused on core building-block exposures, value tilts or offered an options overlay continued to lead the way. Fixed income flows, $35.4 billion, remained in favor of global exposures (+$19.6 billion) vs. domestic exposures (+$14.7 billion). For global exposures, investors demonstrated ongoing interest in more Core+/Go-anywhere strategies along with Janus Henderson’s CLO ETF (JAAA, +$3.5 billion). For domestic exposures, short term/cash alternatives, municipal and MBS strategies were in favor. Currencies ended the year with positive inflows of nearly $480 million led by ProShares Bitcoin Futures ETF (BITO, +$570 million). Alternatives again reversed their trend and ended the year with outflows of $302 million. Commodities and asset allocation strategies all saw outflows through the year. The outflows were led by commodities (-$1.5 billion, +~$400 million quarter-over-quarter).

Active ETF Flows by Asset Class

Source: Factset as of12/31/2023

| Global Equity | Domestic Equity | Domestic Fixed Income | Global Fixed Income | Commodities | Asset Allocation | Alternatives | Currency | |

|---|---|---|---|---|---|---|---|---|

| AUM Leader | Dimensional | Dimensional | JPMorgan | First Trust | Invesco | WisdomTree | First Trust | ProShares |

| AUM Leader $B | $36.1 | $72.7 | $27.7 | $17.3 | $4.6 | $1.3 | $1.2 | $1.7 |

| Q4 CF Leader | Dimensional | Dimensional | Janus | Dimesional | First Trust | PlanRock | Simplify | ProShares |

| Q4 CF Leader $B | $3.2 | $4.2 | $1.6 | $1.6 | $0.02 | $0.1 | $0.1 | $0.36 |

| 24' CF Leader | Dimensional | JPMorgan | Janus | Fidelity | PIMCO | Innovator | Simplify | ProShares |

| 24' CF Leader $B | $12.7 | $21.0 | $2.7 | $3.8 | $0.2 | $0.1 | $0.5 | $0.58 |

Source: Factset as of 12/31/2023

At the issuer level, Dimensional (+$31.3 billion) pulled further away from JPMorgan ($+24.0 billion) to claim the 2024 cash-flow crown. Dimensional secured the crown through consistent growth across its lineup, keeping its streak of positive cash flow into 100% of its 38 ETFs. Meanwhile, JPMorgan retained the two biggest cash-flow winners for the year: JEPI (+$12.9 billion) and JEPQ (+$6.8 billion). American Century/Avantis (+$13.1 billion), Capital Group (+$10.5 billion) and First Trust/Cboe Vest (+$8.2 billion) rounded out the top five. American Century/Avantis (+$4.8 billion) and Capital Group (+4.7 billion) both saw flows accelerate in quarter four across their lineups and into their broader market, lower cost actively managed ETFs. Notably, Capital Group ended the year with inflows into all 14 of its ETFs, while American Century/Avantis had inflows into 39 of its 42 ETFs. First Trust’s primary flows were across a range of its defined outcome strategies with Cboe Vest (+$7.7 billion). The lineup was led by its Fund of Buffer ETF (BUFR, +$1.9 billion). Janus (+$6.2 billion), Fidelity (+$4.6 billion), Innovator (+$3.8 billion), PIMCO (+2.9 billion, $1.6 billion in in Q4), PGIM (+$2.2 billion), Simplify (+$1.8 billion), YieldMax (+1.7 billion), Putnam (+$1.4 billion), T. Rowe Price (+$1.3 billion, +~$600 in Q4), Principal (+$1.1 billion, +~$750 million in Q4) and Amplify (+$1 billion, +~$625 million in Q4) rounded out the list of issuers with greater than $1 billion in cash flows for their actively managed lineups. Janus was carried by continued flows in its CLO ETF (JAAA, +$3.4 billion, +$1.4 billion in Q4) and new inflows into its mortgage-backed security ETF (JMBS, +$2.7 billion, +$1.6 billion in Q4). Fidelity’s flows were driven by additional inflows into its Total Bond ETF (FBND, +$3.9 billion, +$1.3 billion quarter-over-quarter). Notably, Fidelity also converted 11 mutual funds into ETFs representing $9.1 billion at conversion. PIMCO, Principal and Amplify saw the largest quarter-over-quarter growth amongst this group. PIMCO was led by increased interest in its short-maturity ETF, MINT, (+$1.4 billion, +$0.7 billion in Q4). Principal was led by its Mega Cap ETF, USMC, (+$600 million, +$410 million in Q4) and Amplify by its Transformational Data Sharing ETF, BLOK (+$380 million, +$412 in Q4). Lastly, YieldMax was the novel story of 2023. Its alternative income focused lineup grew to 18 ETFs during the year and flows were led by +$1.0 billion into its Tesla focused ETF, TSLY.

2023 Cash Flow Leaders by Asset Class

Source: Factset as of 12/31/2023

Through the year, over 75% of issuers experienced positive cash flows and 64 firms had cash flows in excess of $100 million. In addition to the issuers mentioned above, Direxion (+$962 million), Vanguard (+$936 million), AB (+$913 million), Allianz (+$832 million), Franklin Templeton (+$831 million), Neos (+$818 million), Envestnet (+$797 million), Alpha Architect (+$737 million), VictoryShares (+$682 million), ProShares (+$580 million), DoubleLine (+$560 million), Main Funds (+$516 million), and Hartford (+$510 million) all eclipsed $500 million in flows. Direxion was led by its single stock levered ETF tied to Tesla (TSLL, +$575 million) as well as the recently launched non-leverage/inverse ETF with Howard Capital Management (HCMT, +$203 million). Vanguard and AB were led by flows into their ultra-short term fixed income ETFs, VUSB (+$807 million), YEAR (+$445 million) and TAFI (+$231 million). Other notable leaders amongst this group included: Neos’s income focused, SPYI (+$553 million), Alpha Architect’s ultra short focused, BOXX (+$674 million) and Hartford’s core bond focused, HTRB (+$413 million).

| Ticker | Top 10 ETFs by Cash Flow | 2023 ($M) |

|---|---|---|

| JEPI | JPMorgan Equity Premium Income ETF | $12,936 |

| JEPQ | J.P. Morgan Nasdaq Equity Premium Income ETF | $6,828 |

| DFAC | Dimensional U.S. Core Equity 2 ETF | $4,220 |

| FBND | Fidelity Total Bond ETF | $3,865 |

| JAAA | Janus Detroit Street Trust Janus Henderson AAA CLO ETF | $3,405 |

| CGDV | Capital Group Dividend Value ETF | $3,324 |

| AVUV | Avantis U.S. Small Cap Value ETF | $2,959 |

| JMBS | Janus Henderson Mortgage-Backed Securities ETF | $2,707 |

| DFIC | Dimensional International Core Equity 2 ETF | $2,548 |

| AVDV | Avantis International Small Cap Value ETF | $2,279 |

Source: Factset as of 9/30/2023

| Ticker | Bottom 10 ETFs by Cash Flow | 2023 ($M) |

|---|---|---|

| JPST | JPMorgan Ultra-Short Income ETF | $(1,415) |

| NEAR | BlackRock Short Maturity Bond ETF | $(1,089) |

| ICSH | BlackRock Ultra Short-Term Bond ETF | $(1,075) |

| SRLN | SPDR Blackstone Senior Loan ETF | $(900) |

| PDBC | Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF | $(860) |

| LMBS | First Trust Low Duration Opportunities ETF | $(813) |

| FTGC | First Trust Global Tactical Commodity Strategy Fund | $(711) |

| ARKK | ARK Innovation ETF | $(620) |

| FTSM | First Trust Enhanced Short Maturity ETF | $(603) |

| INFL | Horizon Kinetics Inflation Beneficiaries ETF | $(584) |

Source: Factset as of 12/31/2023

At the product level, roughly 70% of active ETFs saw positive flows through the year and 333 experienced flows over $50 million (often viewed as a general break-even measure for an ETF). The industry’s asset weighted expense ratio ticked down 1 bps to 0.42%. Roughly 75% of all cash flows went into ETFs with expense ratios below the industry average, a 5% drop from the prior quarter of 2023. Despite this, only 97 of the 395 ETFs launched during the year offered an expense ratio below the industry average.

| Expense Ratio | 12/31/23 AUM | Q4 2023 CF | % AUM | % CF | # ETFs |

|---|---|---|---|---|---|

| 0-25 | $188,010,231,893 | $38,812,310,211 | 35% | 30% | 141 |

| 26-50 | $180,016,090,280 | $63,304,224,858 | 34% | 49% | 289 |

| 51-75 | $81,200,905,689 | $11,021,039,815 | 15% | 9% | 361 |

| 76+ | $82,832,414,826 | $14,770,037,064 | 16% | 12% | 5304 |

| xpense Ratio | 12/31/22 AUM | Q4 2022 CF | % AUM | % CF | # ETFs |

|---|---|---|---|---|---|

| 0-25 | $127,062,738,204 | $35,420,360,196 | 37% | 39% | 99 |

| 26-50 | $100,193,266,255 | $36,617,826,661 | 29% | 40% | 200 |

| 51-75 | $59,934,785,356 | $3,158,814,260 | 17% | 3% | 258 |

| 76+ | $60,506,428,036 | $16,250,329,665 | 17% | 18% | 374 |

Source: Factset as of 12/31/2023

2023 Launch Monitor

Domestic Equity

179 ETFs Launched

$18.8 B Assets Raised

Domestic Fixed Income

44 ETFs Launched

$4.5 B Assets Raised

Asset Allocation

33 ETFs Launched

$1.1 B Assets Raised

Int'l/Global Equity

83 ETFs Launched

$5.9 B Assets Raised

Int'l/Global Fixed Income

27 ETFs Launched

$2.2 B Assets Raised

Other

29 ETFs Launched

$679 B Assets Raised

Source: FactSet as of 12/29/2023, figures include MF-ETF conversions; Other includes Alternative, Commodities & Currencies

During 2023, 395 (+146 compared to 2022) actively managed ETFs launched, raising $33.2 billion (+$20.6 billion compared to 2022) in assets. Launches came from 125 different issuers, including 61 first-time issuers. ETF development continued to focus on equities with over 65% of new ETFs focused on the asset class. FT/Cboe Vest led launches with 23 ETFs. Innovator (+19), iShares/BlackRock (+18), YieldMax (+16) and Fidelity (+13) rounded out the top five. JPMorgan raised the most assets into its 11 new ETFs with $2.9 billion, while Fidelity (+$9.7 billion) and Dimensional (+$1.2 billion) were most aided by conversions.

Bold predictions for 2024

We have five new bold predictions for what 2024 will entail:

- AUM: Grow from $530 billion to exceed $750 billion by year-end 2024

- Full-year cash flow: A new highwater mark of over $150 billion

- Launch activity: 400 new active ETFs from over 100 issuers

- Growth milestone: One quarter of over $50 billion in cash flow and one issuer with over $40 billion for the year

- Regulatory: Either active, semi-transparent will see expansion to another asset class or multi-share class will receive approval by the SEC

Active ETF Stat Pack

| Firms | |||

|---|---|---|---|

| # of Issuers | 250 | ||

| # of New Issuers 2023 | 57 | ||

| Products | Assets | ||

| # of ETFs | 1257 | AUM ($B) | $492.34 |

| # of New Launches 2023 | 373 | 3 Yr AUM CAGR | 45% |

| Avg. ER | 0.42% | 5 Yr AUM CAGR | 48% |

| Cash Flow | Trading | ||

| YTD Cash Flow ($B) | $109.56 | YTD ADV (Shares) | 139,845,388 |

| 3 Yr Cash Flow | $288.19 | YTD ADV ($) | $4.54 B |

| 5 Yr Cash Flow | $365.57 | YTD Avg. Spread (bps)* | 28.38 |

Source: Factset & NYSE Internal Database and Consolidated Tape Statistics as of 7/21/2023

*Simple average

Active, Semi-Transparent ETFs

| Ticker | Inception | Name | AUM | YTD Flows | 30 Day Median Spread (bps) | ADV (shares) | Structure | LMM | Expense Ratio |

|---|---|---|---|---|---|---|---|---|---|

| VNSE | 09/17/2020 | Natixis Vaughan Nelson Select ETF | $32,089,369 | $15,344,674 | 13.48 | 5,403 | NYSE AMS | Citadel | 0.80% |

| VNMC | 09/17/2020 | Natixis Vaughan Nelson Mid Cap ETF | $3,639,689 | -$4,182,982 | 13.82 | 693 | NYSE AMS | Citadel | 0.85% |

| ESGA | 07/15/2020 | American Century Sustainable Equity ETF | $177,416,982 | $39,665,416 | 11.22 | 6,696 | NYSE AMS | Citadel | 0.39% |

| MID.ETF | 07/15/2020 | American Century Mid Cap Growth Impact ETF | $56,117,820 | $19,680,693 | 13.51 | 3,791 | NYSE AMS | Citadel | 0.45% |

| ESGY | 07/01/2021 | American Century Sustainable Growth ETF | $12,836,068 | $4,021,109 | 9.56 | 1,521 | NYSE AMS | Citadel | 0.39% |

| NDVG | 08/05/2021 | Nuveen Dividend Growth ETF | $12,926,138 | $4,021,189 | 8.15 | 1,269 | NYSE AMS | Citadel | 0.64% |

| NSCS | 08/05/2021 | Nuveen Small Cap Select ETF | $6,473,688 | $0 | 11.22 | 112 | NYSE AMS | Citadel | 0.85% |

| NWLG | 08/05/2021 | Nuveen Winslow Large-Cap Growth ESG ETF | $6,517,500 | $188,861 | 8.54 | 126 | NYSE AMS | Citadel | 0.64% |

| SAEF | 11/16/2021 | Schwab Ariel ESG ETF | $20,218,600 | $4,622,400 | 39.03 | 2,860 | NYSE AMS | Flow Traders | 0.59% |

| IWLG | 06/23/2022 | IQ Winslow Large Cap Growth ETF | $23,743,850 | $3,717,510 | 15.78 | 572 | NYSE AMS | Citadel | 0.60% |

| IWFG | 06/23/2022 | IQ Winslow Focused Large Cap Growth ETF | $7,547,820 | $0 | 17.59 | 102 | NYSE AMS | Citadel | 0.65% |

| TSME | 10/05/2022 | Thrivent Small-Mid Cap ESG ETF | $162,299,328 | $72,922,429 | 13.18 | 26,376 | NYSE AMS | RBC | 0.65% |

| JPSV | 03/08/2023 | JPMorgan Active Small Cap Value ETF | $14,572,350 | $3,389,450 | 6.90 | 678 | NYSE AMS | Citadel | 0.74% |

| LSGR | 06/29/2023 | Natixis Loomis Sayles Focused Growth ETF | $5,925,444 | $5,249,975 | 10.82 | 1,708 | NYSE AMS | Citadel | 0.59% |

| SGLC | 03/31/2023 | SGI U.S. Large Cap Core ETF | $101,908,478 | $89,835,673 | 20.78 | 29,003 | NYSE AMS | GTS | 0.85% |

| FDG | 04/02/2020 | American Century Focused Dynamic Growth ETF | $186,427,020 | $14,119,835 | 8.59 | 12,731 | NYSE AMS | Citadel | 0.45% |

| FLV | 04/02/2020 | American Century Focused Large Cap Value ETF | $211,268,413 | -$17,517,759 | 9.59 | 8,793 | NYSE AMS | Citadel | 0.42% |

| FBCG | 06/04/2020 | Fidelity Blue Chip Growth ETF | $1,027,557,037 | $372,284,922 | 10.04 | 166,714 | Fidelity Proxy | GTS | 0.59% |

| FBCV | 06/04/2020 | Fidelity Blue Chip Value ETF | $120,366,135 | -$20,479,562 | 13.72 | 18,618 | Fidelity Proxy | GTS | 0.59% |

| FMIL | 06/04/2020 | Fidelity New Millennium ETF | $173,381,673 | $64,566,434 | 10.48 | 21,901 | Fidelity Proxy | GTS | 0.59% |

| FGRO | 02/04/2021 | Fidelity Growth Opportunities ETF | $233,354,455 | $115,146,574 | 12.24 | 59,901 | Fidelity Proxy | Citadel | 0.59% |

| FMAG | 02/04/2021 | Fidelity Magellan ETF | $53,732,773 | $48,723 | 8.45 | 9,992 | Fidelity Proxy | RBC | 0.59% |

| FPRO | 02/04/2021 | Fidelity Real Estate Investment ETF | $14,246,058 | -$3,585,448 | 13.36 | 2,823 | Fidelity Proxy | Citadel | 0.59% |

| FSMO | 02/04/2021 | Fidelity Small/Mid-Cap Opportunities ETF | $43,460,003 | $9,831,950 | 8.89 | 8,085 | Fidelity Proxy | RBC | 0.60% |

| FSST | 06/17/2021 | Fidelity Sustainability U.S. Equity ETF | $11,303,454 | $1,988,623 | 10.62 | 1,186 | Fidelity Proxy | RBC | 0.59% |

| FDWM | 06/17/2021 | Fidelity Women's Leadership ETF | $3,606,983 | $346,522 | 13.11 | 927 | Fidelity Proxy | RBC | 0.59% |

| TCHP | 08/05/2020 | T. Rowe Price Blue Chip Growth ETF | $469,921,337 | $70,052,379 | 6.27 | 86,215 | T Rowe Proxy | Virtu | 0.57% |

| TDVG | 08/05/2020 | T. Rowe Price Dividend Growth ETF | $348,761,278 | $43,966,143 | 6.26 | 56,411 | T Rowe Proxy | RBC | 0.50% |

| TEQI | 08/05/2020 | T. Rowe Price Equity Income ETF | $139,680,773 | $34,320,135 | 12.63 | 12,237 | T Rowe Proxy | Virtu | 0.54% |

| TGRW | 08/05/2020 | T. Rowe Price Growth Stock ETF | $60,197,260 | $7,041,557 | 6.83 | 5,986 | T Rowe Proxy | RBC | 0.52% |

| TSPA | 06/08/2021 | T. Rowe Price U.S. Equity Research ETF | $93,908,183 | $62,138,697 | 7.67 | 12,305 | T Rowe Proxy | RBC | 0.34% |

| IVRA | 12/22/2020 | Invesco Real Assets ESG ETF | $3,283,954 | $0 | 43.19 | 921 | Fidelity Proxy | Citadel | 0.59% |

| LOPP | 02/01/2021 | Gabelli Love Our Planet & People ETF | $11,663,300 | -$1,165,600 | 33.47 | 370 | ActiveShares | GTS | 0.00% |

| GGRW | 02/16/2021 | Gabelli Growth Innovators ETF | $3,176,700 | $183,240 | 50.05 | 259 | ActiveShares | GTS | 0.90% |

| GAST | 01/05/2022 | Gabelli Asset ETF | $4,666,210 | -$453,400 | 34.66 | 49 | ActiveShares | GTS | 0.00% |

| GABF | 05/11/2022 | Gabelli Financial Services Opportunities ETF | $9,094,250 | $1,881,965 | 38.42 | 762 | ActiveShares | GTS | 0.04% |

| GCAD | 01/03/2023 | Gabelli Commercial Aerospace & Defense ETF | $4,392,545 | $1,391,375 | 30.08 | 551 | ActiveShares | GTS | 0.00% |

| FRTY | 03/01/2021 | Alger Mid Cap 40 ETF | $28,318,125 | -$4,848,000 | 61.10 | 8,019 | ActiveShares | Virtu | 0.60% |

| ATFV | 05/04/2021 | Alger 35 ETF | $13,110,000 | $1,099,250 | 57.51 | 1,943 | ActiveShares | Virtu | 0.55% |

| AWEG | 03/07/2023 | Alger Weatherbie Enduring Growth ETF | $4,452,000 | $2,826,625 | 57.94 | 1,058 | ActiveShares | Virtu | 0.65% |

| CLIA | 05/09/2023 | Veridien Climate Action ETF | $25,371,955 | $23,864,528 | 76.09 | 9,683 | ActiveShares | GTS | 0.85% |

| REIT | 02/26/2021 | ALPS Active REIT ETF | $19,905,053 | $844,850 | 36.35 | 2,918 | Blue Tractor | GTS | 0.68% |

| STNC | 03/16/2021 | Hennessy Stance ESG Large Cap ETF | $59,701,519 | $11,117,203 | 18.64 | 2,502 | Blue Tractor | GTS | 0.85% |

| DYTA | 03/30/2023 | SGI Dynamic Tactical ETF | $106,713,648 | $100,089,014 | 19.20 | 37,635 | Blue Tractor | GTS | 0.95% |

| PFUT | 05/26/2021 | Putnam Sustainable Future ETF | $210,111,780 | $152,099,026 | 30.33 | 17,218 | Fidelity Proxy | Virtu | 0.64% |

| PLDR | 05/26/2021 | Putnam Sustainable Leaders ETF | $421,385,512 | $335,040,982 | 9.56 | 84,672 | Fidelity Proxy | RBC | 0.59% |

| PGRO | 05/26/2021 | Putnam Focused Large Cap Growth ETF | $45,773,664 | $25,343,209 | 9.34 | 7,024 | Fidelity Proxy | RBC | 0.56% |

| PVAL | 05/26/2021 | Putnam Focused Large Cap Value ETF | $259,866,372 | $95,508,369 | 28.35 | 40,952 | Fidelity Proxy | Virtu | 0.56% |

| HFGO | 11/09/2021 | Hartford Large Cap Growth ETF | $103,039,370 | -$353,118 | 14.21 | 2,304 | Fidelity Proxy | Citadel | 0.60% |

| SEMI | 03/30/2022 | Columbia Seligman Semiconductor and Technology ETF | $31,628,530 | $10,101,725 | 27.35 | 4,079 | Fidelity Proxy | Virtu | 0.75% |

| CAPE | 04/05/2022 | DoubleLine Shiller CAPE U.S. Equities ETF | $353,164,140 | $75,876,400 | 15.12 | 44,271 | ActiveShares | Citadel | 0.65% |

| FMCX | 04/25/2022 | FMC Excelsior Focus Equity ETF | $85,013,500 | $273,400 | 31.07 | 284 | ActiveShares | GTS | 0.70% |

| BYRE | 05/19/2022 | Principal Real Estate Active Opportunities ETF | $9,261,916 | $3,345,446 | 26.26 | 1,947 | Fidelity Proxy | Virtu | 0.65% |

| JHAC | 11/02/2023 | John Hancock Fundamental All Cap Core ETF | $2,404,380 | $1,065,800 | 26.66 | 5,493 | Fidelity Proxy | Virtu | 0.72% |

| Total/Average | $5,650,904,383 | $1,847,878,412 | 21.24 | 840,647 | 0.58% |

Source: Factset & NYSE Internal Database and Consolidated Tape Statistics as of 12/31/2023

*Simple average

Q4 2024 Launch Recap

| Ticker | Name | Issuer | Launch Date | Asset Class | AUM |

|---|---|---|---|---|---|

| ZALT | Innovator U.S. Equity 10 Buffer ETF - Quarterly | Innovator | 10/02/2023 | Equity | $45,867,750 |

| OCTJ | Innovator Premium Income 30 Barrier ETF - October | Innovator | 10/02/2023 | Equity | $23,517,975 |

| OCTH | Innovator Premium Income 20 Barrier ETF - October | Innovator | 10/02/2023 | Equity | $18,786,155 |

| EETH | ProShares Ether Strategy ETF | ProShares | 10/02/2023 | Currency | $16,806,433 |

| LOCT | Innovator Premium Income 15 Buffer ETF - October | Innovator | 10/02/2023 | Equity | $15,652,000 |

| EALT | Innovator U.S. Equity 5 to 15 Buffer ETF - Quarterly | Innovator | 10/02/2023 | Equity | $15,025,890 |

| EFUT | VanEck Ethereum Strategy ETF | VanEck | 10/02/2023 | Currency | $14,910,280 |

| HOCT | Innovator Premium Income 9 Buffer ETF - October | Innovator | 10/02/2023 | Equity | $12,081,900 |

| OCTQ | Innovator Premium Income 40 Barrier ETF - October | Innovator | 10/02/2023 | Equity | $8,405,250 |

| OCTD | Innovator Premium Income 10 Barrier ETF - October | Innovator | 10/02/2023 | Equity | $4,871,080 |

| BTOP | Bitwise Bitcoin and Ether Equal Weight Strategy ETF | Bitwise | 10/02/2023 | Currency | $3,414,587 |

| BETH | ProShares Bitcoin & Ether Market Cap Weight Strategy ETF | ProShares | 10/02/2023 | Currency | $2,909,125 |

| AETH | Bitwise Ethereum Strategy ETF | Bitwise | 10/02/2023 | Currency | $2,420,739 |

| BETE | ProShares Bitcoin & Ether Equal Weight Strategy ETF | ProShares | 10/02/2023 | Currency | $1,699,017 |

| SOVF | Sovereign's Capital Flourish Fund | Sovereign's Capital Management, LLC | 10/03/2023 | Equity | $29,548,234 |

| SMIZ | Zacks Small/Mid Cap ETF | Zacks Investment Management | 10/03/2023 | Equity | $12,854,654 |

| FDGR | Foundations Dynamic Growth ETF | Foundations | 10/03/2023 | Equity | $1,112,172 |

| FDVL | Foundations Dynamic Value ETF | Foundations | 10/03/2023 | Equity | $1,090,193 |

| FDCE | Foundations Dynamic Core ETF | Foundations | 10/03/2023 | Equity | $ 836,720 |

| FDTB | Foundations Dynamic Income ETF | Foundations | 10/03/2023 | Fixed Income | $ 762,086 |

| CVRT | Calamos Convertible Equity Alternative ETF | Calamos | 10/04/2023 | Fixed Income | $5,385,067 |

| JTEK | JPMorgan U.S. Tech Leaders ETF | JPMAM | 10/05/2023 | Equity | $ 191,099,025 |

| BUSA | Brandes U.S. Value ETF | Brandes | 10/05/2023 | Equity | $43,734,400 |

| BINV | Brandes International ETF | Brandes | 10/05/2023 | Equity | $29,778,000 |

| BSMC | Brandes U.S. Small-Mid Cap Value ETF | Brandes | 10/05/2023 | Equity | $21,769,332 |

| GSC | Goldman Sachs Small Cap Core Equity ETF | GSAM | 10/05/2023 | Equity | $13,604,610 |

| ALUM | USCF Aluminum Strategy Fund | USCF | 10/06/2023 | Commodities | $3,925,613 |

| XFLX | FundX Flexible ETF | FundX | 10/09/2023 | Fixed Income | $57,131,255 |

| XRLX | FundX Investment Conservative ETF | FundX | 10/09/2023 | Asset Allocation | $54,907,557 |

| SQY | YieldMax SQ Option Income Strategy ETF | YieldMax | 10/11/2023 | Equity | $27,541,508 |

| FEPI | REX FANG & Innovation Equity Premium Income ETF | REX Shares | 10/11/2023 | Equity | $23,523,750 |

| JBND | JPMorgan Active Bond ETF | JPMAM | 10/12/2023 | Fixed Income | $ 158,963,400 |

| QUVU | Hartford Quality Value ETF | Hartford Funds | 10/16/2023 | Equity | $ 169,851,675 |

| NBGR | Neuberger Berman Global Real Estate ETF | Neuberger Berman | 10/16/2023 | Equity | $6,294,246 |

| NBCE | Neuberger Berman China Equity ETF | Neuberger Berman | 10/16/2023 | Equity | $5,065,385 |

| TSLT | T-REX 2X Long Tesla Daily Target ETF | REX Shares | 10/19/2023 | Equity | $64,127,700 |

| PAPI | Parametric Equity Premium Income ETF | Morgan Stanley | 10/19/2023 | Equity | $23,163,030 |

| PHEQ | Parametric Hedged Equity ETF | Morgan Stanley | 10/19/2023 | Equity | $22,134,000 |

| EVHY | Eaton Vance High Yield ETF | Morgan Stanley | 10/19/2023 | Fixed Income | $21,201,680 |

| EVIM | Eaton Vance Intermediate Municipal Income ETF | Morgan Stanley | 10/19/2023 | Fixed Income | $21,197,080 |

| EVSB | Eaton Vance Ultra-Short Income ETF | Morgan Stanley | 10/19/2023 | Fixed Income | $20,140,000 |

| NVDX | T-Rex 2X Long NVIDIA Daily Target ETF | REX Shares | 10/19/2023 | Equity | $18,172,000 |

| CGRO | CoreValues Alpha Greater China Growth ETF | MSA Power Funds | 10/19/2023 | Equity | $7,667,888 |

| ITDC | iShares LifePath Target Date 2035 ETF USD | iShares | 10/19/2023 | Asset Allocation | $5,462,100 |

| TSLZ | T-Rex 2X Inverse Tesla Daily Target ETF | REX Shares | 10/19/2023 | Equity | $4,544,000 |

| ITDD | iShares LifePath Target Date 2040 ETF | iShares | 10/19/2023 | Asset Allocation | $4,104,045 |

| ITDB | iShares LifePath Target Date 2030 ETF | iShares | 10/19/2023 | Asset Allocation | $3,817,156 |

| ITDE | iShares LifePath Target Date 2045 ETF USD | iShares | 10/19/2023 | Asset Allocation | $3,288,492 |

| ITDF | iShares LifePath Target Date 2050 ETF USD | iShares | 10/19/2023 | Asset Allocation | $2,734,150 |

| ITDG | iShares LifePath Target Date 2055 ETF | iShares | 10/19/2023 | Asset Allocation | $2,731,840 |

| ITDH | iShares LifePath Target Date 2060 ETF USD | iShares | 10/19/2023 | Asset Allocation | $2,731,840 |

| ITDI | iShares LifePath Target Date 2065 ETF | iShares | 10/19/2023 | Asset Allocation | $2,731,840 |

| ITDA | iShares LifePath Target Date 2025 ETF USD | iShares | 10/19/2023 | Asset Allocation | $2,707,550 |

| IRTR | iShares LifePath Retirement ETF | iShares | 10/19/2023 | Asset Allocation | $2,702,500 |

| NVDQ | T-Rex 2X Inverse NVIDIA Daily Target ETF | REX Shares | 10/19/2023 | Equity | $1,124,592 |

| GOCT | FT Cboe Vest U.S. Equity Moderate Buffer ETF - October | FT Cboe Vest | 10/23/2023 | Equity | $ 195,717,565 |

| XOCT | FT Cboe Vest U.S. Equity Enhance & Moderate Buffer ETF - October | FT Cboe Vest | 10/23/2023 | Equity | $33,576,859 |

| MRNY | YieldMax MRNA Option Income Strategy ETF | YieldMax | 10/24/2023 | Equity | $2,949,088 |

| GPIX | Goldman Sachs S&P 500 Core Premium Income ETF | GSAM | 10/26/2023 | Equity | $22,833,512 |

| GPIQ | Goldman Sachs Nasdaq 100 Core Premium Income ETF | GSAM | 10/26/2023 | Equity | $22,353,300 |

| BUFZ | FT Cboe Vest Laddered Moderate Buffer ETF | FT Cboe Vest | 10/26/2023 | Equity | $18,214,863 |

| BLCR | BlackRock Large Cap Core ETF | iShares | 10/26/2023 | Equity | $6,428,914 |

| TSLP | Kurv Yield Premium Strategy Tesla (TSLA) ETF | Kurv | 10/27/2023 | Equity | $1,134,188 |

| NFLP | Kurv Yield Premium Strategy Netflix (NFLX) ETF | Kurv | 10/27/2023 | Equity | $ 552,002 |

| AAPY | Kurv Yield Premium Strategy Apple (AAPL) ETF | Kurv | 10/27/2023 | Equity | $ 534,696 |

| IWMY | Defiance R2000 Enhanced Options Income ETF | Defiance ETFs | 10/31/2023 | Equity | $94,287,500 |

| AMZP | Kurv Yield Premium Strategy Amazon (AMZN) ETF | Kurv | 10/31/2023 | Equity | $ 547,802 |

| GOOP | Kurv Yield Premium Strategy Google (GOOGL) ETF | Kurv | 10/31/2023 | Equity | $ 540,282 |

| MSFY | Kurv Yield Premium Strategy Microsoft (MSFT) ETF | Kurv | 10/31/2023 | Equity | $ 523,438 |

| INOV | Innovator International Developed Power Buffer ETF November | Innovator | 11/01/2023 | Equity | $2,703,500 |

| DFVX | Dimensional US Large Cap Vector ETF | Dimensional Fund Advisors | 11/02/2023 | Equity | $ 129,148,450 |

| SRHR | SRH REIT Covered Call ETF | SRH Funds | 11/02/2023 | Equity | $53,094,870 |

| JHMU | John Hancock Dynamic Municipal Bond ETF | John Hancock | 11/02/2023 | Fixed Income | $22,227,810 |

| JDOC | JPMorgan Healthcare Leaders ETF | JPMAM | 11/02/2023 | Equity | $10,776,000 |

| JHAC | John Hancock Fundamental All Cap Core ETF | John Hancock | 11/02/2023 | Equity | $2,390,740 |

| DVDN | Kingsbarn Dividend Opportunity ETF | Kingsbarn | 11/02/2023 | Equity | $ 593,040 |

| FFOG | Franklin Focused Growth ETF | Franklin Templeton | 11/06/2023 | Equity | $56,402,878 |

| SHRT | Gotham Short Strategies ETF | Gotham Asset Management | 11/06/2023 | Equity | $16,860,584 |

| MTBA | Simplify MBS ETF | Simplify | 11/07/2023 | Fixed Income | $ 189,960,802 |

| TBG | TBG Dividend Focus ETF | TBG | 11/07/2023 | Equity | $46,171,150 |

| LQAI | LG QRAFT AI-Powered U.S. Large Cap Core ETF | ETC | 11/07/2023 | Equity | $3,837,679 |

| DFGP | Dimensional Global Core Plus Fixed Income ETF | Dimensional Fund Advisors | 11/08/2023 | Fixed Income | $ 149,135,280 |

| DGCB | Dimensional Global Credit ETF | Dimensional Fund Advisors | 11/08/2023 | Fixed Income | $90,270,000 |

| DFGX | Dimensional Global ex US Core Fixed Income ETF | Dimensional Fund Advisors | 11/08/2023 | Fixed Income | $68,607,500 |

| FTCB | First Trust Core Investment Grade ETF | First Trust | 11/08/2023 | Fixed Income | $15,892,542 |

| BEEZ | Honeytree U.S. Equity ETF | Honeytree | 11/08/2023 | Equity | $3,128,961 |

| AVMV | Avantis U.S. Mid Cap Value ETF | American Century | 11/09/2023 | Equity | $11,173,060 |

| AVEE | Avantis Emerging Markets Small Cap Equity ETF | American Century | 11/09/2023 | Equity | $8,016,690 |

| AVMC | Avantis U.S. Mid Cap Equity ETF | American Century | 11/09/2023 | Equity | $6,745,140 |

| BWTG | Brendan Wood TopGun Index ETF | Tuttle Capital Management | 11/09/2023 | Equity | $3,647,969 |

| SPQ | Simplify US Equity PLUS QIS ETF | Simplify | 11/14/2023 | Equity | $ 120,591,965 |

| DYNI | IDX Dynamic Innovation ETF | IDX | 11/14/2023 | Equity | $30,067,000 |

| ARKA | ARK 21Shares Active Bitcoin Futures Strategy ETF | ARK | 11/14/2023 | Currency | $4,192,890 |

| ARKZ | ARK 21Shares Active Ethereum Futures Strategy ETF | ARK | 11/14/2023 | Currency | $1,726,458 |

| SOF | Amplify Samsung SOFR ETF | Amplify | 11/15/2023 | Fixed Income | $ 150,435,000 |

| QLTY | GMO U.S. Quality ETF | GMO | 11/15/2023 | Equity | $48,573,120 |

| GHMS | Goose Hollow Multi-Strategy Income ETF | Goose Hollow | 11/15/2023 | Fixed Income | $12,917,500 |

| THTA | SoFi Enhanced Yield ETF | SoFi | 11/15/2023 | Fixed Income | $6,033,000 |

| ARKY | ARK 21Shares Active Bitcoin Ethereum Strategy ETF | ARK | 11/15/2023 | Currency | $5,084,784 |

| ARKD | ARK 21Shares Blockchain and Digital Economy Innovation ETF | ARK | 11/15/2023 | Asset Allocation | $1,995,114 |

| ARKC | ARK 21Shares Active On-Chain Bitcoin Strategy ETF | ARK | 11/15/2023 | Currency | $1,107,912 |

| SDCP | Virtus Newfleet Short Duration Core Plus Bond ETF | Virtus | 11/16/2023 | Fixed Income | $10,296,103 |

| FELG | Fidelity Enhanced Large Cap Growth ETF | Fidelity | 11/20/2023 | Equity | $ 2,098,898,370 |

| FELC | Fidelity Enhanced Large Cap Core ETF | Fidelity | 11/20/2023 | Equity | $ 1,938,624,394 |

| FELV | Fidelity Enhanced Large Cap Value ETF | Fidelity | 11/20/2023 | Equity | $ 1,862,825,479 |

| FMDE | Fidelity Enhanced Mid Cap ETF | Fidelity | 11/20/2023 | Equity | $ 1,436,437,548 |

| FENI | Fidelity Enhanced International ETF | Fidelity | 11/20/2023 | Equity | $ 1,361,546,283 |

| FESM | Fidelity Enhanced Small Cap ETF | Fidelity | 11/20/2023 | Equity | $ 496,041,143 |

| GNOV | FT Cboe Vest U.S. Equity Moderate Buffer ETF - November | FT Cboe Vest | 11/20/2023 | Equity | $ 163,254,548 |

| XNOV | FT Cboe Vest U.S. Equity Enhance & Moderate Buffer ETF - November | FT Cboe Vest | 11/20/2023 | Equity | $21,212,005 |

| SNOV | FT Cboe Vest U.S. Small Cap Moderate Buffer ETF - November | FT Cboe Vest | 11/20/2023 | Equity | $16,924,442 |

| GHEE | Goose Hollow Enhanced Equity ETF | Goose Hollow | 11/20/2023 | Equity | $3,278,750 |

| AGQI | First Trust Active Global Quality Income ETF -VIII- | First Trust | 11/21/2023 | Equity | $89,296,067 |

| HRTS | Tema Cardiovascular and Metabolic ETF | Tema | 11/21/2023 | Equity | $18,059,900 |

| AIYY | YieldMax AI Option Income Strategy ETF | YieldMax | 11/28/2023 | Equity | $6,939,762 |

| SMCO | Hilton Small-MidCap Opportunity ETF | Hilton | 11/29/2023 | Equity | $16,263,300 |

| CPAI | Counterpoint Quantitative Equity ETF | Counterpoint Mutual Funds | 11/29/2023 | Equity | $9,131,346 |

| PWER | Macquarie Energy Transition ETF | Macquarie | 11/29/2023 | Equity | $5,613,468 |

| BILD | Macquarie Global Listed Infrastructure ETF | Macquarie | 11/29/2023 | Equity | $5,200,720 |

| STAX | Macquarie Tax-Free USA Short Term ETF | Macquarie | 11/29/2023 | Fixed Income | $5,094,000 |

| LBO | WHITEWOLF Publicly Listed Private Equity ETF | WHITEWOLF | 11/30/2023 | Equity | $1,340,350 |

| IDEC | Innovator International Developed Power Buffer ETF December | Innovator | 12/01/2023 | Equity | $13,581,803 |

| LSEQ | Harbor Long-Short Equity ETF | Harbor | 12/04/2023 | Alternatives | $13,199,670 |

| VGSR | Vert Global Sustainable Real Estate ETF | Vert | 12/04/2023 | Equity | $ 346,862,179 |

| RSSB | Return Stacked Global Stocks & Bonds ETF | Return Stacked | 12/05/2023 | Asset Allocation | $39,314,644 |

| SMTH | ALPS/SMITH Core Plus Bond ETF | ALPS | 12/06/2023 | Fixed Income | $ 128,000,750 |

| CARK | CastleArk Large Growth ETF | CastleArk | 12/07/2023 | Equity | $ 306,580,161 |

| VPLS | Vanguard Core Plus Bond ETF | Vanguard | 12/07/2023 | Fixed Income | $50,674,075 |

| TDI | Touchstone Dynamic International ETF | Touchstone Investments | 12/11/2023 | Equity | $51,849,035 |

| SCAP | InfraCap Small Cap Income ETF | Infrastructure Capital | 12/12/2023 | Equity | $6,058,872 |

| GQI | Natixis Gateway Quality Income ETF | Natixis | 12/13/2023 | Equity | $41,111,064 |

| TAFL | AB Tax-Aware Long Municipal ETF | AllianceBernstein | 12/13/2023 | Fixed Income | $25,638,726 |

| TAFM | AB Tax-Aware Intermediate Municipal ETF | AllianceBernstein | 12/13/2023 | Fixed Income | $25,484,719 |

| EYEG | AB Corporate Bond ETF | AllianceBernstein | 12/13/2023 | Fixed Income | $25,200,098 |

| CPLS | AB Core Plus Bond ETF | AllianceBernstein | 12/13/2023 | Fixed Income | $25,124,005 |

| BUFC | AB Conservative Buffer ETF | AllianceBernstein | 12/13/2023 | Equity | $8,838,490 |

| BRTR | BlackRock Total Return ETF | iShares | 12/14/2023 | Fixed Income | $79,693,250 |

| VCRB | Vanguard Core Bond ETF | Vanguard | 12/14/2023 | Fixed Income | $43,691,450 |

| PSH | PGIM Short Duration HIgh Yield ETF | PGIM | 12/14/2023 | Fixed Income | $25,227,500 |

| GSIB | Themes Global Systemically Important Banks ETF | Themes | 12/15/2023 | Equity | $ 507,328 |

| GDEC | FT Cboe Vest U.S. Equity Moderate Buffer ETF - December | First Trust | 12/18/2023 | Equity | $ 102,884,061 |

| PRAE | PlanRock Alternative Growth ETF | PlanRock | 12/19/2023 | Asset Allocation | $91,383,183 |

| PRMN | PlanRock Market Neutral Income ETF | PlanRock | 12/19/2023 | Alternatives | $22,166,326 |

| PJFM | PGIM Jennison Focused Mid-Cap ETF | PGIM | 12/19/2023 | Equity | $10,594,206 |

| PJBF | PGIM Jennison Better Future ETF | PGIM | 12/19/2023 | Equity | $10,547,481 |

| PJIO | PGIM Jennison International Opportunities ETF | PGIM | 12/19/2023 | Equity | $9,992,700 |

| XIDE | FT Cboe Vest U.S. Equity Buffer & Premium Income ETF - December | First Trust | 12/19/2023 | Equity | $4,527,060 |

| ABCS | Alpha Blue Capital US Small-Mid Cap Dynamic ETF | Alpha Blue | 12/19/2023 | Equity | $2,786,102 |

| JDVI | John Hancock Disciplined Value International Select ETF | John Hancock | 12/20/2023 | Equity | $15,295,620 |

| BCUS | Bancreek U.S. Large Cap ETF | Bancreek | 12/21/2023 | Equity | $3,523,884 |

Total - 150 New ETFs | Total | $ 14,051,950,360 |

Source: FactSet & NYSE Internal Database and Consolidated Tape Statistics as of 12/31/2023

Get NYSE's Active ETF Updates

Discover the ultimate destination for ETF investors

Search, compare, and learn about all things ETF

Brought to you by

ETF Central

Looking for data, insights, and commentary on the active ETF market? Visit ETFCentral.com to hear directly from experts across the ETF community and access their intuitive ETF and Segment screener to find what’s resonating with investors.