Looking Beyond the Headlines, Record Active Cash Flow

March 11, 2021

News from the Active ETF Market

Last month, we examined the fast and furious start to 2021 for the active ETF industry, noting the significant impact of ARK. By no means, however, is the rest of the industry lagging in growth. As a refresher, year-to-date total active ETF industry cash flow is $31.4 billion, a record-smashing figure. Excluding ARK, this total is $16.3 billion, still a record for any similar period in history.

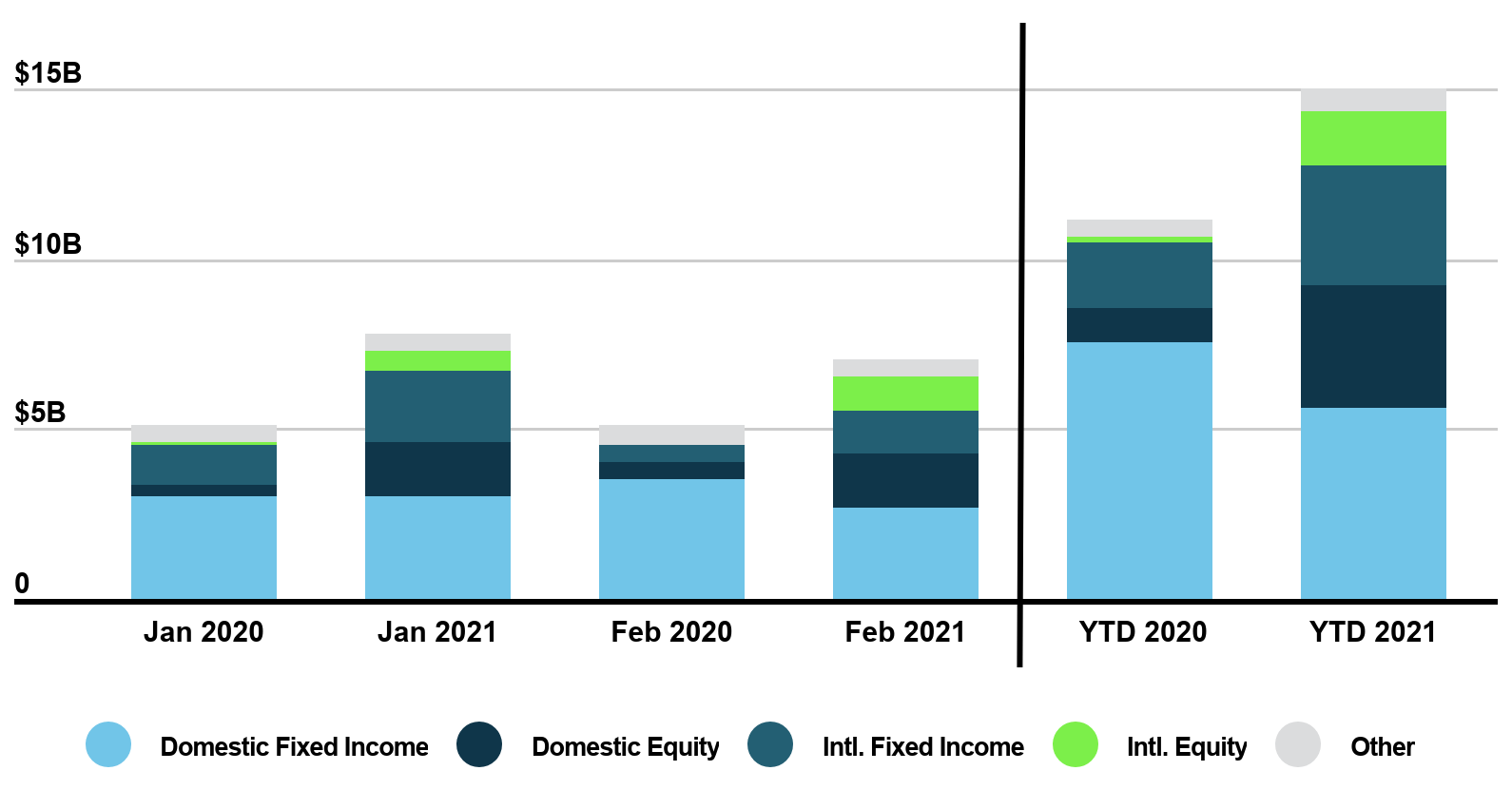

Active ETF Cash Flow By Asset Category 2020-2021 YTD

(Excludes ARK)

Source FactSet as of 3/5/2021

Growth has been widespread. Only one asset class — U.S. Fixed Income — has not yet experienced an increase in year-over-year growth. Across equity strategies, cash flow increased ~5X year-over-year to $5.2 billion. This expansion is supported by several new ETFs along with strong investor adoption. Nine of the top 20 ETFs by cash flow year-to-date have launched within the last calendar year. Additionally, investors continue to show interest in thematic based strategies with ETFs focused on cannabis, SPACs and blockchain technologies.

|

US Equity ETFs |

2021 YTD |

2020 YTD |

|---|---|---|

AdvisorShares Pure US Cannabis ETF |

$779,860,100 |

$- |

JPMorgan Equity Premium Income ETF |

$392,820,250 |

$- |

Dimensional US Core Equity Market ETF |

$250,758,135 |

$- |

AdvisorShares Pure Cannabis ETF |

$179,706,742 |

$4,103,519 |

Innovator S&P 500 Power Buffer ETF - January |

$173,119,250 |

$146,817,250 |

Avantis U.S. Equity ETF |

$163,382,178 |

$25,927,863 |

SPAC and New Issue ETF |

$130,657,180 |

$- |

Avantis U.S. Small Cap Value ETF |

$128,752,618 |

$23,886,646 |

Innovator S&P 500 Power Buffer ETF - February |

$90,782,850 |

$65,800,820 |

Amplify CWP Enhanced Dividend Income ETF |

$89,554,500 |

$6,099,500 |

|

International Equity ETFs |

2021 YTD |

2020 YTD |

|---|---|---|

Amplify Transformational Data Sharing ETF |

$536,028,500 |

$(8,684,500) |

Avantis Emerging Markets Equity ETF |

$120,267,840 |

$24,903,710 |

Dimensional International Core Equity Market ETF |

$120,087,800 |

$- |

Amplify Lithium & Battery Technology ETF |

$98,167,000 |

$551,500 |

Amplify Seymour Cannabis ETF |

$91,505,365 |

$646,610 |

Dimensional Emerging Core Equity Market ETF |

$90,039,160 |

$- |

Horizon Kinetics Inflation Beneficiaries ETF |

$79,163,513 |

$- |

Avantis International Small Cap Value ETF |

$69,527,601 |

$17,389,632 |

Main Thematic Innovation ETF |

$58,978,800 |

$- |

Roundhill Streaming Services & Technology ETF |

$52,208,457 |

$- |

Across fixed income, aggregate flows are flat year-over-year at $9.2 billion. A combination of renewed interest in senior loan, inflation-protected and ultra-short-term strategies is leading growth in this sector.

|

Fixed Income ETFs |

2021 YTD |

2020 YTD |

|---|---|---|

SPDR Blackstone Senior Loan ETF |

$1,373,876,495 |

$(577,693,132) |

Quadratic Interest Rate Volatility & Inflation Hedge ETF |

$1,295,491,608 |

$9,458,174 |

JPMorgan High Yield Reserach Enhanced ETF |

$1,092,652,000 |

$5,193,000 |

JPMorgan Ultra-Short Income ETF |

$675,158,000 |

$1,691,712,000 |

First Trust TCW Opportunistic Fixed Income ETF |

$466,564,200 |

$421,671,400 |

First Trust Low Duration Opportunities ETF |

$457,709,350 |

$1,197,223,050 |

PIMCO Enhanced Short Maturity Active ETF |

$328,706,700 |

$1,517,163,200 |

JPMorgan Ultra-Short Municipal Income ETF |

$295,862,500 |

$65,678,000 |

First Trust Senior Loan Fund |

$232,183,150 |

$102,734,750 |

PIMCO Enhanced Low Duration Active ETF |

$177,718,000 |

$48,124,200 |

Additional Insights on the Active ETF Market

- Brown Brothers Harriman, 2021 Global ETF Survey: BBH’s eighth annual global ETF investor survey reveals that 71% of U.S. investors expect to increase their exposure to active ETFs, which is a 9% increase year-over-year. 91% of investors expressed interest in semi-transparent structures, with 51% saying they would “definitely” buy in the next six months. The survey also covers investor product development preferences, selection criteria and observations across Active, Thematic, ESG, and Fixed Income ETFs.

- J.P. Morgan Asset Management, Global ETF Study: J.P. Morgan’s 2020 investor study discusses investor preferences on active ETF allocation strategies by investor size, drivers of active ETF provider selection by investor type and drivers of individual active ETF selection by investor type.

- The ETF Educator, ETF Buzz: In the March 6 edition of ETF Store President Nate Geraci’s weekly note, he shares articles on the ETF settlement cycle, fixed income ETF trading mechanics, ARK’s future and more.

Active ETF Stat Pack

| Firms | |||

| # of Issuers | 98 | ||

| # of New Issuers 2021 | 5 | ||

| Products | Assets | ||

| # of ETFs | 514 | AUM ($B) | $199.99 |

| # of New Launches 2021 | 42 | 3 Yr AUM CAGR | 162% |

| Avg. ER | 0.55% | 5 Yr AUM CAGR | 55% |

| Cash Flow | Trading | ||

| YTD Cash Flow ($B) | $30.80 | YTD ADV (Shares) | 66,779,000 |

| 3 Yr Cash Flow | $140.50 | YTD ADV ($) | $4.57 B |

| 5 Yr Cash Flow | $165.30 | YTD Avg. Spread (bps)* | 29.58 |

Source: Factset & NYSE Internal Database and Consolidated Tape Statistics as of 3/5/2021

*Simple average

Active, Semi-Transparent Update

|

Ticker |

Inception |

Name |

AUM |

Flows |

Avg. Spread (bps) |

ADV (shares) |

Structure |

LMM |

Expense Ratio |

|---|---|---|---|---|---|---|---|---|---|

VNSE |

09/17/2020 |

Natixis Vaughan Nelson Select ETF |

$6,498,801 |

$288,685 |

22.92 |

574 |

NYSE AMS |

Citadel |

0.90% |

VNMC |

09/17/2020 |

Natixis Vaughan Nelson Mid Cap ETF |

$9,109,558 |

$880,401 |

26.44 |

1,709 |

NYSE AMS |

Citadel |

0.85% |

ESGA |

07/15/2020 |

American Century Sustainable Equity ETF |

$124,668,455 |

$15,373,030 |

15.33 |

11,487 |

NYSE AMS |

Citadel |

0.39% |

MID |

07/15/2020 |

American Century Mid Cap Growth Impact ETF |

$10,520,101 |

$3,597,873 |

15.37 |

2,379 |

NYSE AMS |

Citadel |

0.45% |

FDG |

04/02/2020 |

American Century Focused Dynamic Growth ETF |

$212,848,884 |

$3,069,548 |

11.66 |

22,878 |

ActiveShares |

Citadel |

0.45% |

FLV |

04/02/2020 |

American Century Focused Large Cap Value ETF |

$182,435,284 |

$9,658,303 |

15.6 |

10,955 |

ActiveShares |

Citadel |

0.42% |

CFCV |

05/28/2020 |

ClearBridge Focus Value ETF |

$3,217,386 |

($98) |

29.04 |

126 |

ActiveShares |

GTS |

0.50% |

FBCG |

06/04/2020 |

Fidelity Blue Chip Growth ETF |

$269,597,760 |

$82,303,950 |

16.06 |

236,357 |

Fidelity Proxy |

GTS |

0.59% |

FBCV |

06/04/2020 |

Fidelity Blue Chip Value ETF |

$56,610,225 |

$11,889,278 |

17.64 |

45,904 |

Fidelity Proxy |

GTS |

0.59% |

FMIL |

06/04/2020 |

Fidelity New Millennium ETF |

$36,316,225 |

$12,164,035 |

18.97 |

32,439 |

Fidelity Proxy |

GTS |

0.59% |

FGRO |

02/04/2021 |

Fidelity Growth Opportunities ETF |

$13,414,240 |

$12,857,893 |

5.6 |

66,756 |

Fidelity Proxy |

Citadel |

0.59% |

FPRO |

02/04/2021 |

Fidelity Real Estate Investment ETF |

$4,390,268 |

$2,492,368 |

6.3 |

15,715 |

Fidelity Proxy |

Citadel |

0.59% |

FSMO |

02/04/2021 |

Fidelity Small/Mid-Cap Opportunities ETF |

$9,876,200 |

$7,939,285 |

18.68 |

41,624 |

Fidelity Proxy |

RBC |

0.59% |

TCHP |

08/05/2020 |

T. Rowe Price Blue Chip Growth ETF |

$89,776,331 |

$29,386,364 |

9.74 |

48,911 |

T Rowe Proxy |

Virtu |

0.57% |

TDVG |

08/05/2020 |

T. Rowe Price Dividend Growth ETF |

$46,332,155 |

$9,980,602 |

7.62 |

16,508 |

T Rowe Proxy |

RBC |

0.50% |

TEQI |

08/05/2020 |

T. Rowe Price Equity Income ETF |

$31,217,640 |

$6,170,936 |

9.87 |

8,865 |

T Rowe Proxy |

Virtu |

0.54% |

TGRW |

08/05/2020 |

T. Rowe Price Growth Stock ETF |

$30,891,227 |

$5,637,854 |

8.8 |

10,443 |

T Rowe Proxy |

RBC |

0.52% |

IVDG |

12/22/2020 |

Invesco Focused Discovery Growth ETFF |

$1,149,311 |

$ - |

22.81 |

2,076 |

Invesco Model |

Citadel |

0.59% |

IVLC |

12/22/2020 |

Invesco US Large Cap Core ESG ETF |

$1,199,912 |

$ - |

15.05 |

882 |

Fidelity Proxy |

Citadel |

0.48% |

IVRA |

12/22/2020 |

Invesco Real Assets ESG ETF |

$1,238,312 |

$ - |

25.06 |

2,310 |

Fidelity Proxy |

Citadel |

0.59% |

IVSG |

12/22/2020 |

Invesco Select Growth ETF |

$1,192,712 |

$ - |

17.35 |

1,653 |

Invesco Model |

Citadel |

0.48% |

LOPP |

02/01/2021 |

Gabelli Love Our Planet & People ETF |

$7,424,855 |

$4,464,910 |

26.19 |

11,257 |

ActiveShares |

GTS |

0.90% |

GGRW |

02/16/2021 |

Gabelli Growth Innovators ETF |

$2,703,625 |

$591,500 |

42.10 |

1,876 |

ActiveShares |

GTS |

0.90% |

REIT |

02/26/2021 |

ALPS Active REIT ETF |

$8,568,048 |

$6,287,550 |

27.96 |

59,447 |

Blue Tractor |

GTS |

0.68% |

FRTY |

03/01/2021 |

Alger Mid Cap 40 ETF |

$3,869,000 |

$ - |

38.39 |

64,096 |

ActiveShares |

Virtu |

0.60% |

|

|

Total/Average |

$1,191,264,886 |

$237,664,999 |

19.08 |

783,675 |

|

|

0.61% |

Source: Factset & NYSE Internal Database and Consolidated Tape

Statistics as of 3/5/2021

*Simple average

February & March Active ETF Launches

|

Ticker |

Name |

Issuer |

Launch Date |

Asset Class |

AUM |

|---|---|---|---|---|---|

LOPP |

Gabelli Love Our Planet & People ETF |

GAMCO Investors, Inc. |

02/01/2021 |

Equity |

$7,424,855.00 |

FEBZ |

TrueShares Structured Outcome (February) ETF |

TrueMark Investments |

02/01/2021 |

Equity |

$1,874,145.00 |

SENT |

AdvisorShares Alpha DNA Equity Sentiment ETF |

AdvisorShares |

02/03/2021 |

Equity |

$50,433,405.00 |

MBND |

SPDR Nuveen Municipal Bond ETF |

State Street |

02/04/2021 |

Fixed Income |

$32,516,468.60 |

FGRO |

Fidelity Growth Opportunities ETF |

Fidelity |

02/04/2021 |

Equity |

$13,414,240.00 |

FMAG |

Fidelity Magellan ETF |

Fidelity |

02/04/2021 |

Equity |

$13,711,055.00 |

FPRO |

Fidelity Real Estate Investment ETF |

Fidelity |

02/04/2021 |

Equity |

$4,390,267.50 |

SUBZ |

Roundhill Streaming Services & Technology ETF |

Roundhill Investments |

02/10/2021 |

Equity |

$45,864,060.00 |

VABS |

Virtus Newfleet ABS/MBS ETF |

Virtus Investment Partners |

02/10/2021 |

Fixed Income |

$6,255,350.08 |

GGRW |

Gabelli Growth Innovators ETF |

GAMCO Investors, Inc. |

02/16/2021 |

Equity |

$2,703,625.000 |

EFIX |

First Trust TCW Emerging Markets Debt ETF |

First Trust |

02/18/2021 |

Fixed Income |

$19,642,039.28 |

QCON |

American Century Quality Convertible Securities ETF |

American Century Investments |

02/18/2021 |

Fixed Income |

$15,685,696.00 |

QPFF |

American Century Quality Preferred ETF |

American Century Investments |

02/18/2021 |

Fixed Income |

$3,077,966.00 |

KEJI |

Global X China Disruption ETF |

Global X |

02/24/2021 |

Equity |

$4,278,000.00 |

OPPX |

Corbett Road Tactical Opportunity ETF |

Exchange Traded Concepts |

02/25/2021 |

Asset Allocation |

$2,336,700.00 |

REIT |

ALPS Active REIT ETF |

SS∓C |

02/26/2021 |

Equity |

$8,568,047.60 |

FRTY |

Alger Mid Cap 40 ETF |

Alger Group Holdings LLC |

03/01/2021 |

Equity |

$3,869,000.00 |

MARZ |

TrueShares Structured Outcome (March) ETF |

TrueMark Investments |

03/01/2021 |

Equity |

$3,662,520.00 |

JSCP |

JPMorgan Short Duration Core Plus ETF |

JPMorgan Chase |

03/02/2021 |

Fixed Income |

$49,519,800.00 |

IGLD |

FT Cboe Vest Gold Strategy Target Income ETF |

First Trust |

03/03/2021 |

Commodities |

$2,955,939.41 |

FIGB |

Fidelity Investment Grade Bond ETF |

Fidelity |

03/04/2021 |

Fixed Income |

$9,953,220.00 |

FSEC |

Fidelity Investment Grade Securitized ETF |

Fidelity |

03/04/2021 |

Fixed Income |

$9,990,000.00 |

|

Total |

22 New Funds Launched |

|

|

|

$322,126,399.48 |

Source: Factset as of 3/5/2021

NYSE ETF Summit & Active ETF Webinar Series Replay

Missed the NYSE ETF Summit or our Active ETF Webinar series?

Visit HomeofETFs.com to catch-up

Hear from ETF experts from each of the various active ETF structure providers, fund sponsors such as American Century, Fidelity, PIMCO and T. Rowe Price, liquidity providers such as Flow Traders and Jane Street, and service providers such as BNY Mellon and State Street.

NYSE ETF Education Series

Join the NYSE ETF Team and industry experts in our series of educational webcasts. sign up by emailing us at [email protected]

Visit HomeofETFs.com to catch-up on past webinars