Notable Headlines, Regulatory Filings & October Recap

November 12, 2020

NYSE Arca files for generic listing standards for semi-transparent ETFs

NYSE Arca is the first exchange to file for generic listing standards for semi-transparent ETFs. If approved, asset managers launching these ETFs will no longer be subject to approval on a one-off basis and individual Exchange rule filings for each product won’t be required. This will accelerate time-to-market and reduce the associated costs with launching active, semi-transparent ETFs. The full filing can be found here.

Fidelity follows the NYSE's lead in seeking additional basket flexibility for active managers

On Oct. 30, Fidelity amended its exemptive relief filing with the SEC to allow for additional basket flexibility within its active ETFs. The NYSE had previously filed jointly with Natixis Investment Managers in August to seek additional basket creation flexibility for asset managers who do not wish to disclose their actual portfolio holdings daily. If approved, asset managers using these structures will be able to construct creation/redemption baskets that differ from the daily tracking basket and proxy portfolio. This will improve the operational efficiency of the structures and potentially reduce costs for sponsors. The full filing from NYSE/Natixis can be found here, and from Fidelity here.

SEC publishes a notice for Invesco's non-transparent structure, meanwhile Eaton Vance files their fourth amendment

On Nov. 9, Invesco announced that the SEC published a notice of the firm’s application for its non-transparent ETF structure. Under the Invesco model, key data metrics would be published each trading day to offer a clear view into the portfolio value without disclosing the full ETF holdings. Additionally, the model would introduce multiple NAV strikes a day in order to provide multiple creation and redemption windows for authorized participants. The full release can be found here.

On Nov. 5, Eaton Vance announced an updated amendment to its application for its semi-transparent ETF solution, the ClearhedgeTM Method. As proposed, ETFs using this structure would publicly disclose a “NAV Reference Portfolio” designed to closely track the daily performance of the actual portfolio. Liquidity providers would also be able to enter “Clearhedge Swap” transactions with the ETF to act as a precise hedge of their ETF share positions. The full release can be found here.

Spotlight: October 2020

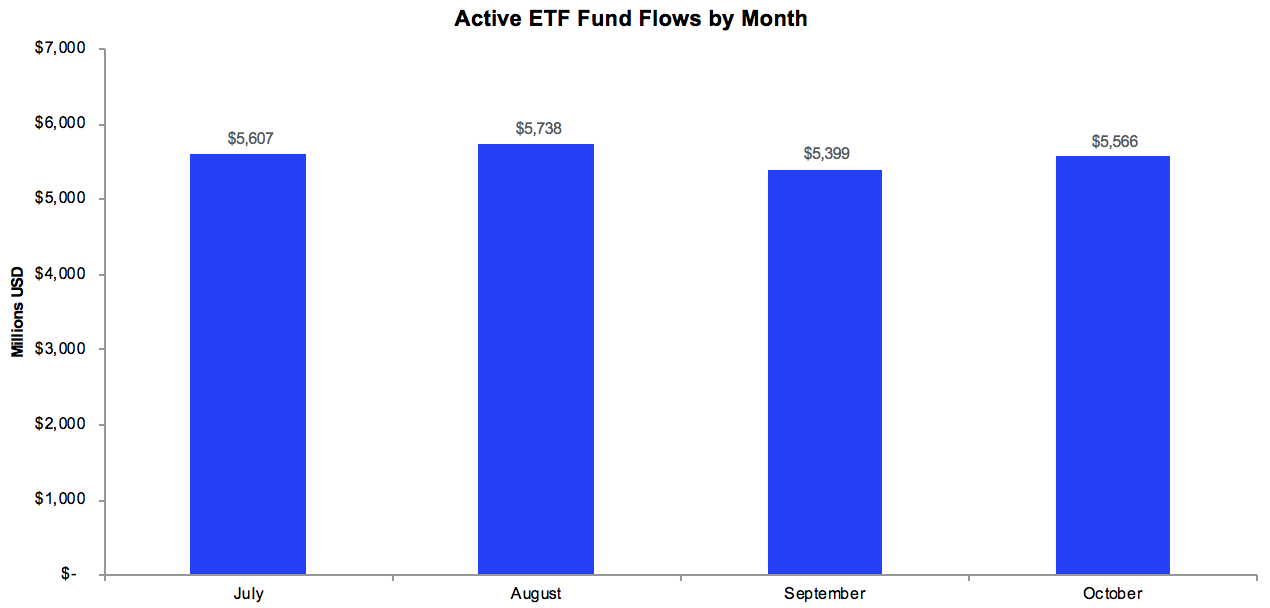

The active ETF market maintained its 2020 momentum in October, gaining $5.6 billion in new cash flow. Year-to-date cash flow is now $42.0 billion and assets under management now totals $145 billion.

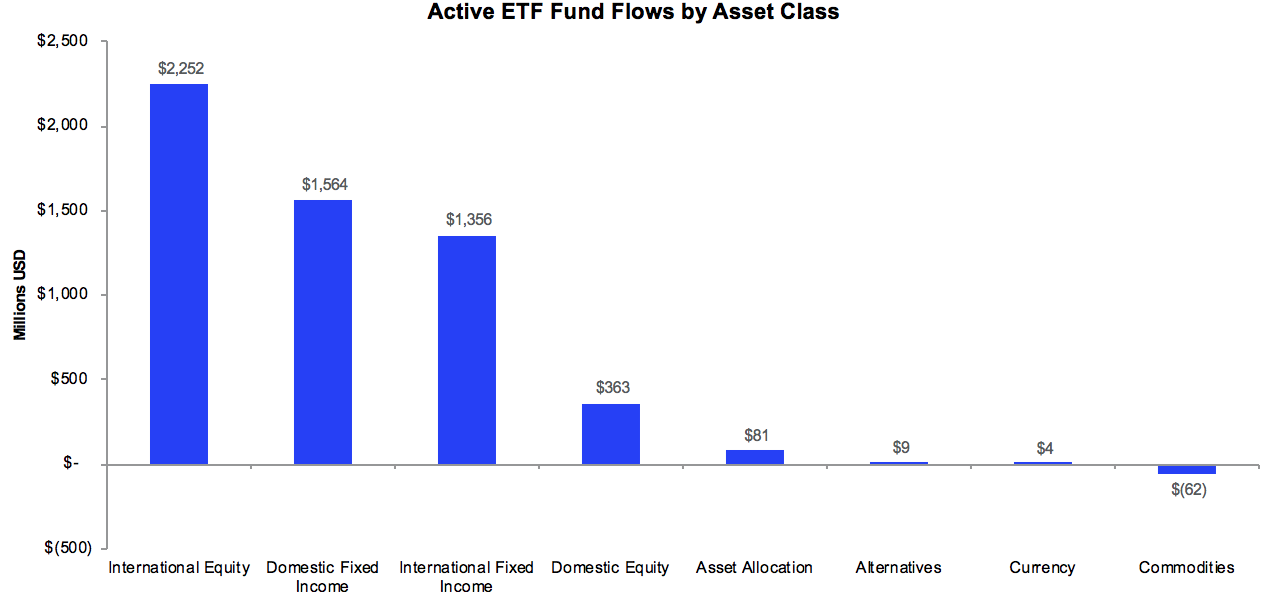

Continued interest in thematic Equity ETF strategies and ultra/short-term Fixed Income strategies, paired with new adoption of interest rate hedged Fixed Income strategies, helped lead market growth during October.

Source: Factset as of 10/30/2020

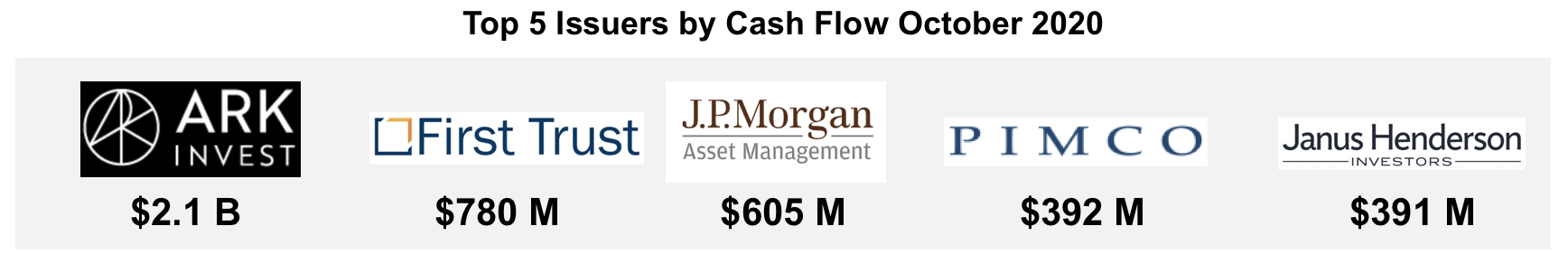

At the issuer level, ARK Funds posted a record month of $2.1 billion in cash flow across its five thematic ETFs. Its success was well distributed, with four of the firm’s five ETFs making the industry’s top 10 cash flow list for the month. Market leaders First Trust ($740 million), J.P. Morgan ($588 million) and PIMCO ($392 million) drove Fixed Income growth during the month, with support from relative newcomer Janus Henderson ($440 million). Other notable contributions came from Fidelity ($150 million), American Century ($145 million) and State Street Global Advisors ($139 million).

Top 10 ETFs by Cash Flow ($M) | ||

ARKK |

ARK Innovation |

986.8 |

IGBH |

iShares Interest Rate Hdg. LT Corp. Bond |

525.4 |

ARKG |

ARK Genomic Revolution |

473.5 |

JPST |

J.P. Morgan Ultra-Short Income |

403.4 |

ARKW |

ARK Next Generation Internet |

355.7 |

FIXD |

First Trust TCW Opportunistic FI |

296.8 |

VNLA |

Janus Henderson Short Duration Income |

289.7 |

LMBS |

First Trust Low Duration Opportunities |

249.8 |

ICSH |

iShares Ultra-Short Term Bond |

209.7 |

ARKF |

ARK Fintech Innovation |

204.6 |

|

Top 10 Total Cash Flow |

3,995.0 |

Bottom 10 ETFs by Cash Flow ($M) | ||

|---|---|---|

NEAR |

iShares Short Maturity |

(997.4) |

PDBC |

Invesco Opt. Yld. Diversified Commodity |

(83.7) |

EMLP |

First Trust NA Energy Infrastructure |

(71.4) |

AWTM |

Aware Ultra-Short Duration Enhanced Income |

(49.6) |

FTSL |

First Trust Senior Loan |

(30.0) |

PNOV |

Innovator S&P 500 Power Buffer-Nov. |

(26.7) |

DFEB |

FT Cboe Vest U.S. Equity Deep Buffer-Feb. |

(26.4) |

BJAN |

Innovator S&P 500 Buffer ETF-Jan. |

(22.4) |

HUSV |

First Trust Horizon Managed Vol. Domestic |

(22.3) |

RISN |

Inspire Tactical Balanced ESG |

(20.0) |

|

Bottom 10 Total Cash Flow |

(1,350.0) |

Active ETF Stat Pack

| Firms | |||

| # of Issuers | 83 | ||

| # of New Issuers 2020 | 20 | ||

| Products | Assets | ||

| # of ETFs | 431 | AUM ($B) | $145.06 |

| # of New Launches 2020 | 121 | 3 Yr AUM CAGR | 152% |

| Avg. ER | 0.50% | 5 Yr AUM CAGR | 49% |

| Cash Flow | Trading | ||

| YTD Cash Flow ($B) | $41.9 | YTD ADV (Shares) | 36,236,137 |

| 3 Yr Cash Flow | $98.6 | YTD ADV ($) | $1.48 B |

| 5 Yr Cash Flow | $118.7 | YTD Avg. Spread (bps)* | 40.45 |

Source: Factset & NYSE Internal Database and Consolidated Tape Statistics as of 10/30/2020

*Simple average

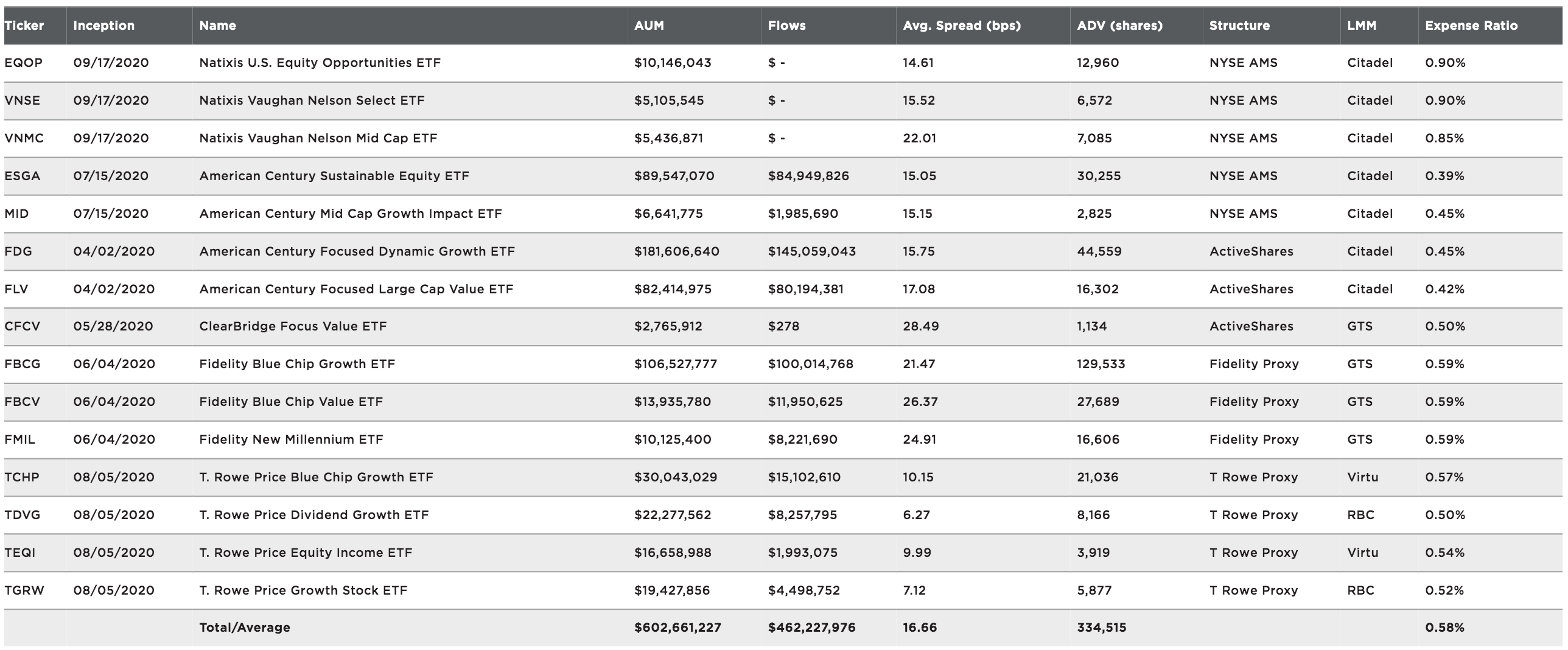

Active, Semi-Transparent Update

Source: Factset & NYSE Internal Database and Consolidated Tape Statistics as of 10/30/2020

*Simple average

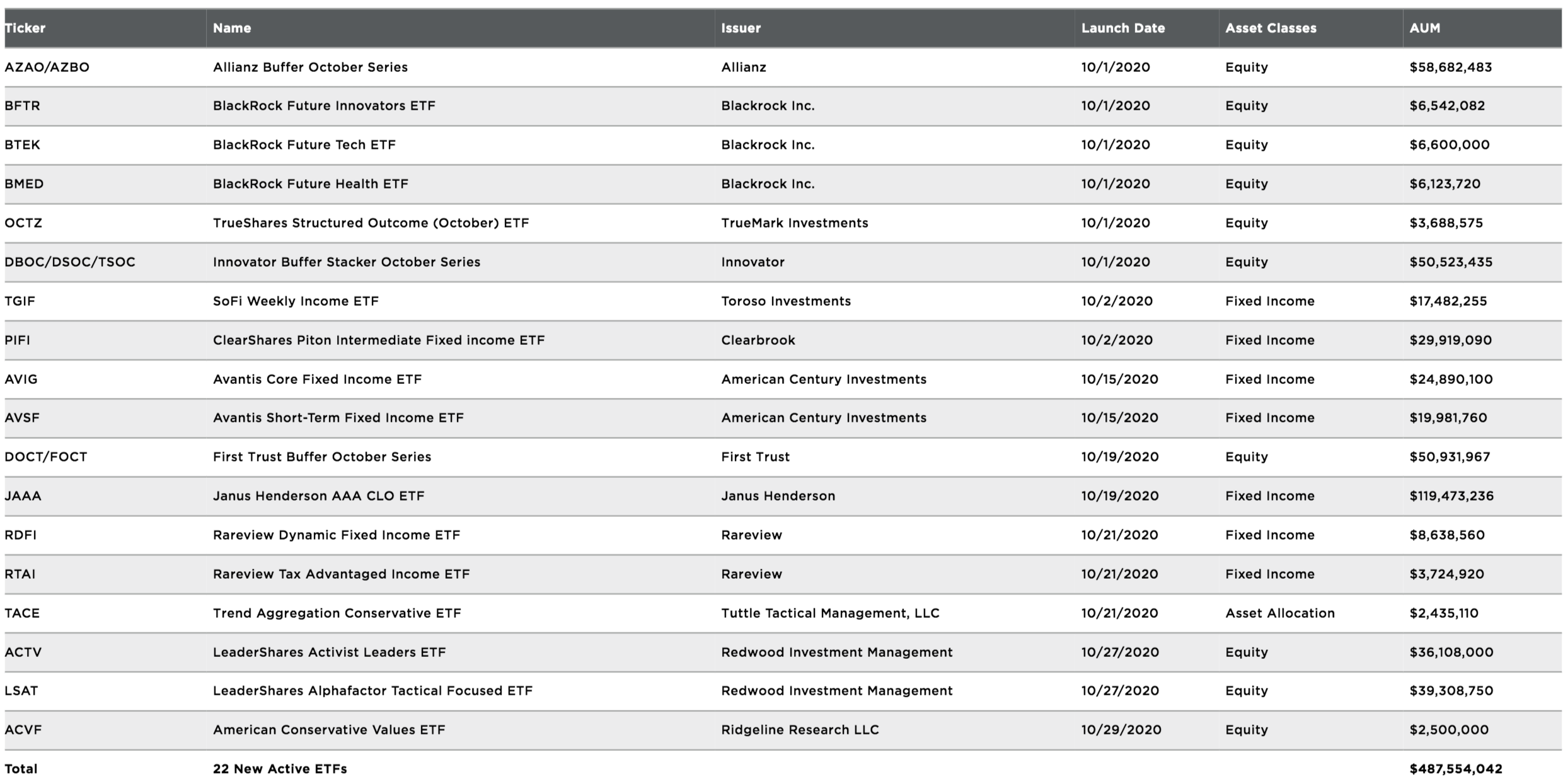

October Active ETF Launches

Source: Factset as of 10/30/2020

NYSE ETF Summit & Active ETF Webinar Series Replay

Missed the NYSE ETF Summit or our Active ETF Webinar series?

Visit HomeofETFs.com to catch-up

You'll find opportunities to hear from:

Hear from ETF experts from each of the various active ETF structure providers, fund sponsors such as American Century, Fidelity, PIMCO and T. Rowe Price, liquidity providers such as Flow Traders and Jane Street, and service providers such as BNY Mellon and State Street.