Q&A with Natixis Investment Managers

October 29, 2020

Nick Elward

Head of Institutional Products and ETFs, Natixis Investment Managers

This week we sit down with ETF issuer and global asset manager Natixis Investment Managers to discuss its entry into the active ETF market and the recent launch of three active, semi-transparent ETFs.

Natixis Investment Managers is one of the 20 largest asset managers in the world by assets under management (AUM), totaling more than $1 trillion. The firm has more than 20 specialized investment managers across mutual funds, separate accounts and ETFs. Nick, can you tell us about Natixis’s decision to enter the active ETF market in late 2016?

In 2014, we began our research into the ETF business. We carefully considered the factors and channels that may drive its growth, contemplated whether there would be a long-term place in the ETF industry for active equity products and thought through the infrastructure build-out to establish the business. We had been seeing a trend toward financial advisors and institutional investors liking ETFs, mostly due to their tax efficiency, lower fees and tradability. We knew this trend had staying power and wanted to bring these benefits to our investors.

As a result, in 2015 we began interviewing vendors, met market makers, discussed opportunities with ETF ecosystem experts like the New York Stock Exchange, and presented our recommendation to launch the business to our Board of Trustees. After receiving their agreement on the business build-out, we began assembling the internal staff, vendor team and project launch team. This all culminated with us launching our first active ETF in late 2016. Since that time, we have launched four more.

Natixis was an early believer in the semi-transparent ETF market and ultimately decided to work with the NYSE. What led to the decision to choose the NYSE Active Proxy Structure?

After launching two active transparent ETFs in 2016 and 2017, we knew we were on the right track of creating products that could really help our investors. However, very few of our affiliate portfolio management teams were comfortable with the Active ETF requirement of disclosing full holdings daily. The portfolio manager teams feared that predatory traders may front run their best trades and other investors may free-ride their holdings. Therefore, we knew we needed to solve for this, and the only solution was to ask the SEC for permission to launch active, semi-transparent ETFs.

With this, we wanted to find a participant in the ETF space that had the credibility, know-how and approach to achieve regulatory approval of a new product that would be acceptable to future investors. We tested several providers’ approaches to addressing this problem, and thought the NYSE offered the best balance of allowing us to be transparent with our holdings where desired, and non-transparent where necessary, such as on stocks we were currently trading. In addition to that, the NYSE Active Proxy Structure is backed by a very strong algorithm and tool.

After several tests of this tool, using actual Natixis investment strategies, we found that we were able to create a proxy portfolio that very closely tracked the actual portfolios we were running. More specifically, in one of the scenarios, we tested one of our flagship investment strategies over a 10-year period, and were extremely satisfied with the result. Ever since we launched our three active, semi-transparent ETFs using the NYSE Active Proxy Structure, we have had very high correlation of our actual portfolio returns each day to that of the proxies.

Among Natixis’s three semi-transparent ETFs is the industry’s first multi-managed, semi-transparent ETF. Why did Natixis launch a multi-managed product and what, if any, additional challenges did you incur?

We launched two standard active, semi-transparent ETFs with the NYSE, both managed by our affiliate Vaughan Nelson. One is focused on mid-cap stocks (VNMC) and one is focused on building a very concentrated portfolio (VNSE). Both have performed strongly since their launches.

The third ETF we launched (EQOP) is a collaboration between two of our most well-known and well-respected affiliates, Loomis Sayles and Harris Associates. EQOP combines the value investing of Harris Associates with the growth investing of Loomis Sayles into a single multi-managed ETF focused on beating the S&P 500. EQOP has a sister mutual fund with a track record going back 26 years (1994 launch year). EQOP is very similar to the sister mutual fund, but over time should prove to be more tax efficient and less expensive.

In terms of the challenges of launching a multi-managed product, there were a few. We had two initial stock lists that needed to be folded down to one Portfolio Listing File (PLF) and one proxy portfolio. By working with the NYSE and State Street, our custodian, we created a new process for handling this all-new ETF structure.

What are your early observations on the trading and adoption of the 15 semi-transparent ETFs that are in market today, including Natixis’s three products? What obstacles or opportunities do you see on the horizon for these products?

It’s great that 15 ETFs are already in the market as of the end of October, and I expect more to launch soon. As with any new product, adoption is typically slow, especially with some of the independent and wirehouse firms. They tend to want to see how the products trade, and want to see some level of adoption, before they add the ETF to their already sizeable platform of products.

With that in mind, the registered investment adviser channel normally is the early adopter of new products, having more autonomy to buy newer products early on in the process. We have seen this at Natixis, and it’s likely that the other early launchers of active, semi-transparent ETFs have seen the same trends.

As for how the ETFs are trading, I’ve been impressed that spreads have generally been quite tight. This is a testament to the work that firms like the NYSE have done to create an ETF structure that allows for the creation of proxy portfolios that closely track the actual portfolios, and lead market makers, such as ours, Citadel, in being aggressive with their bids and asks.

With respect to obstacles ahead of us, it’s really a matter of time before these products see significant adoption. I guess the greatest challenge is being patient enough to wait until the buyers begin large-scale investing in active, semi-transparent ETFs.

With oversight of an ETF lineup that includes both fixed income and equity strategies, as well as fully-transparent and semi-transparent ETFs, what guidance would you provide sponsors as they consider expanding their product offering to include actively-managed ETFs?

The most important guidance I could give to a prospective issuer of an ETF business is to focus on distribution. The product structuring, infrastructure, operations, marketing and vendor relationships are all important work to get done, but this is all highly achievable and in the ETF business’s control. The key challenge for issuers is to ensure their sales and key accounts teams are ready to support the sale of ETFs. This could include restructuring the compensation arrangement or developing a select list to prioritize education for the sales team. If a new issuer has the support of their distribution team, in addition to the support of executive management and the CEO, the probability of success is greatly increased.

Active ETF Stat Pack

| Firms | |||

| # of Issuers | 81 | ||

| # of New Issuers 2020 | 19 | ||

| Products | Assets | ||

| # of ETFs | 430 | AUM ($B) | $145.58 |

| # of New Launches 2020 | 118 | 3 Yr AUM CAGR | 153% |

| Avg. ER | 0.50% | 5 Yr AUM CAGR | 49% |

| Cash Flow | Trading | ||

| YTD Cash Flow ($B) | $41.1 | YTD ADV (Shares) | 35,643,671 |

| 3 Yr Cash Flow | $98.3 | YTD ADV ($) | $1.47 B |

| 5 Yr Cash Flow | $118.2 | YTD Avg. Spread (bps)* | 41.16 |

Source: Factset & NYSE Internal Database and Consolidated Tape Statistics as of 10/23/2020

*Simple average

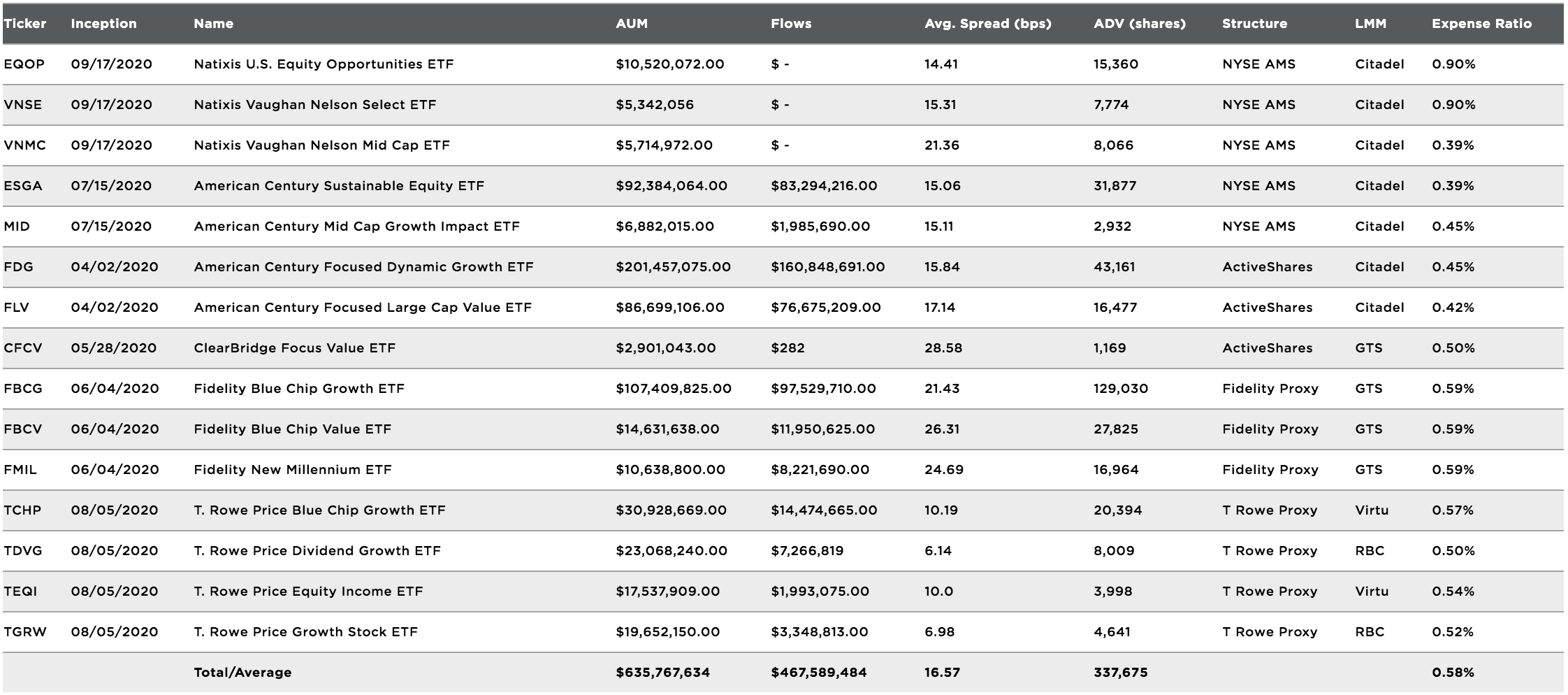

Active Semi-Transparent ETFs

Source: Factset & NYSE Internal Database and Consolidated Tape Statistics as of 10/23/2020

*Simple average

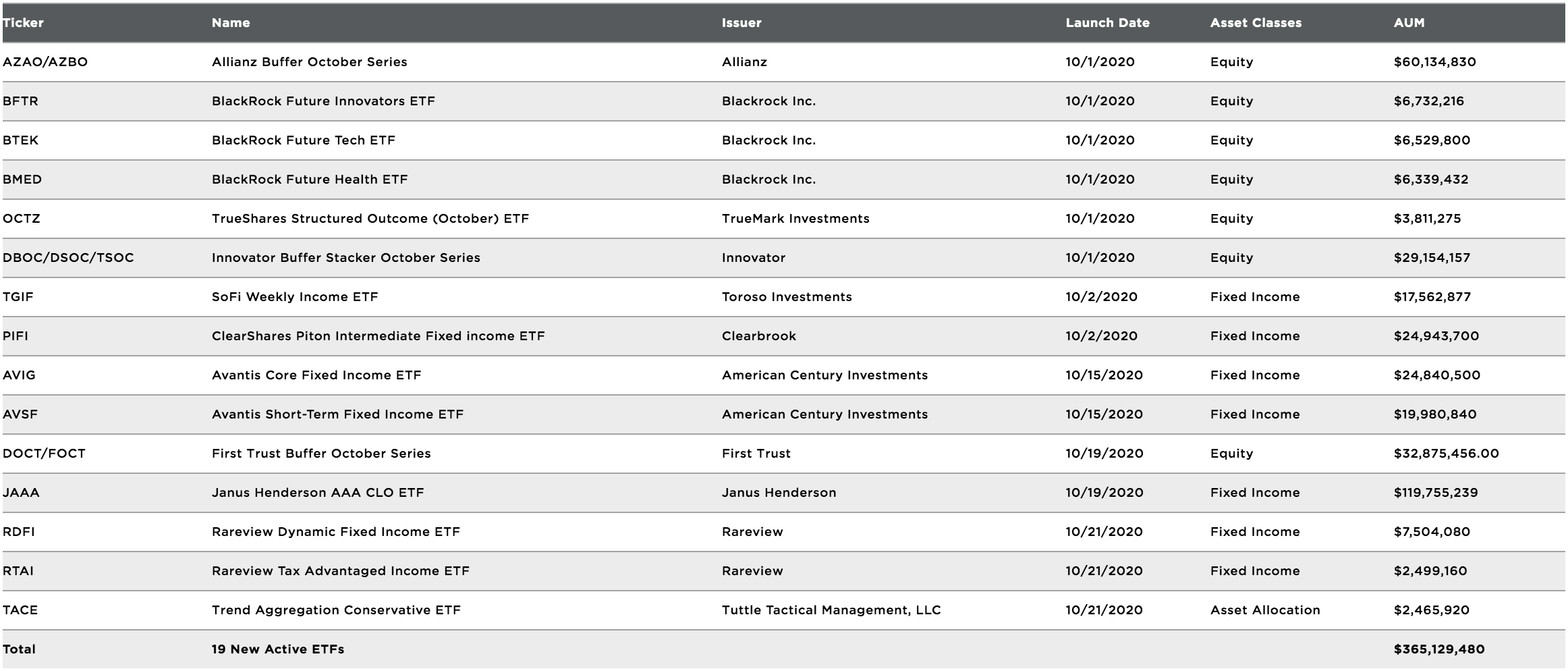

October Active ETF Launches

Source: Factset & NYSE Internal Database and Consolidated Tape Statistics as of 10/23/2020

*Simple average

NYSE ETF Summit & Active ETF Webinar Series Replay

Missed the NYSE ETF Summit or our Active ETF Webinar series?

Visit HomeofETFs.com to catch-up

You'll find opportunities to hear from:

- ETF experts from each of the various active ETF structure providers

- Fund sponsors, such as American Century, Fidelity, PIMCO and T. Rowe Price

- Liquidity providers, such as Flow Traders and Jane Street

- Service providers, such as BNY Mellon and State Street