Enduring stability during times

of stress in the markets

The U.S. equity market has been riding a bull since March 2009, rising more than 300 percent over that period without experiencing a decline of 20 percent. With yields on 10-year Treasuries rising above 3 percent, their highest level since 2011, the S&P 500 slipped 3.3 percent on Wednesday, its biggest decline since February.

In times like these, sophisticated stock traders join individual investors in adjusting their behavior, often returning to the public exchanges from alternative venues at the same time market makers providing liquidity are adjusting to the dramatically changed risk profile. The result is a wider spread in displayed quotes -- a sign of deepening anxiety.

In these stressful moments, the NYSE’s market model proves its mettle. On the Exchange floor, Designated Market Markers (DMMs) are accountable to execute trades, providing lit quotes and committing liquidity in the NYSE’s 2,300 listed companies.

This week, the quoted spreads between bids and offers unsurprisingly widened when volatility spiked on Wednesday and Thursday. Quoted spreads of stocks listed on exchanges other than NYSE, increased by over 50% more than those of NYSE-listed companies, highlighting our market model’s value.

Furthermore, the closing auction delivers a critical benchmark for both listed companies and investors. At their posts on the NYSE floor, the DMMs guarantee that all auction orders, priced through the closing auction, are fully executed -- which is unique to the NYSE market model. At the same time, DMMs contribute human judgment as well as capital to determine closing prices that accurately reflect the mix of buy and sell interest at the end of the day.

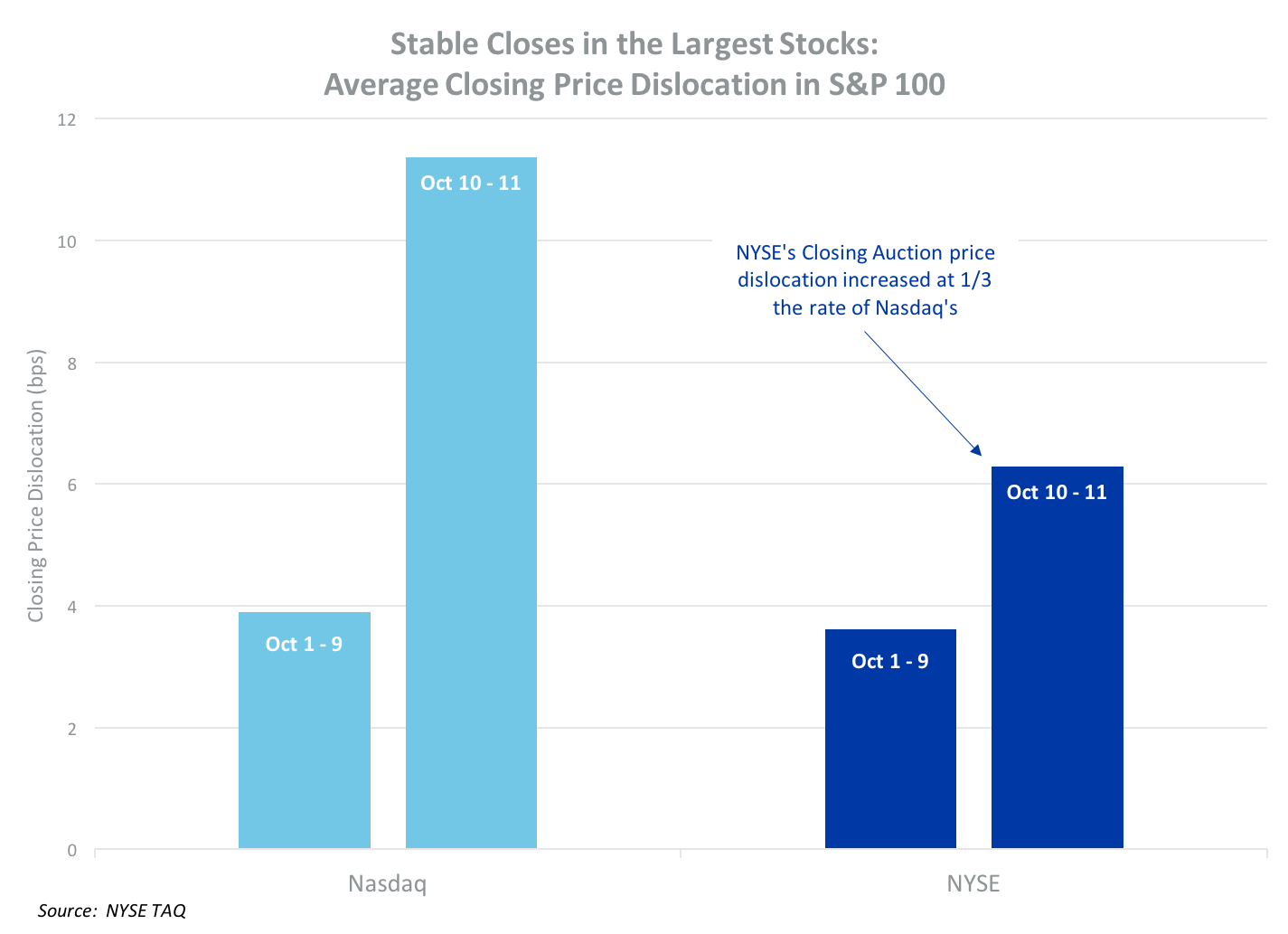

The chart below shows that NYSE’s closing auction incurs less price dislocation from the average share price before the auction and, therefore, better reflects market prices.

NYSE is able to deliver superior results because we have the flexibility to incentivize behavior by compensating those market makers that benefit the public quote, which means better prices for investors. In response to calls from upstart exchanges and market professionals, government proposals are being considered that would remove that flexibility, despite the fact that issuers and investors have the right to choose where they prefer to list and trade.

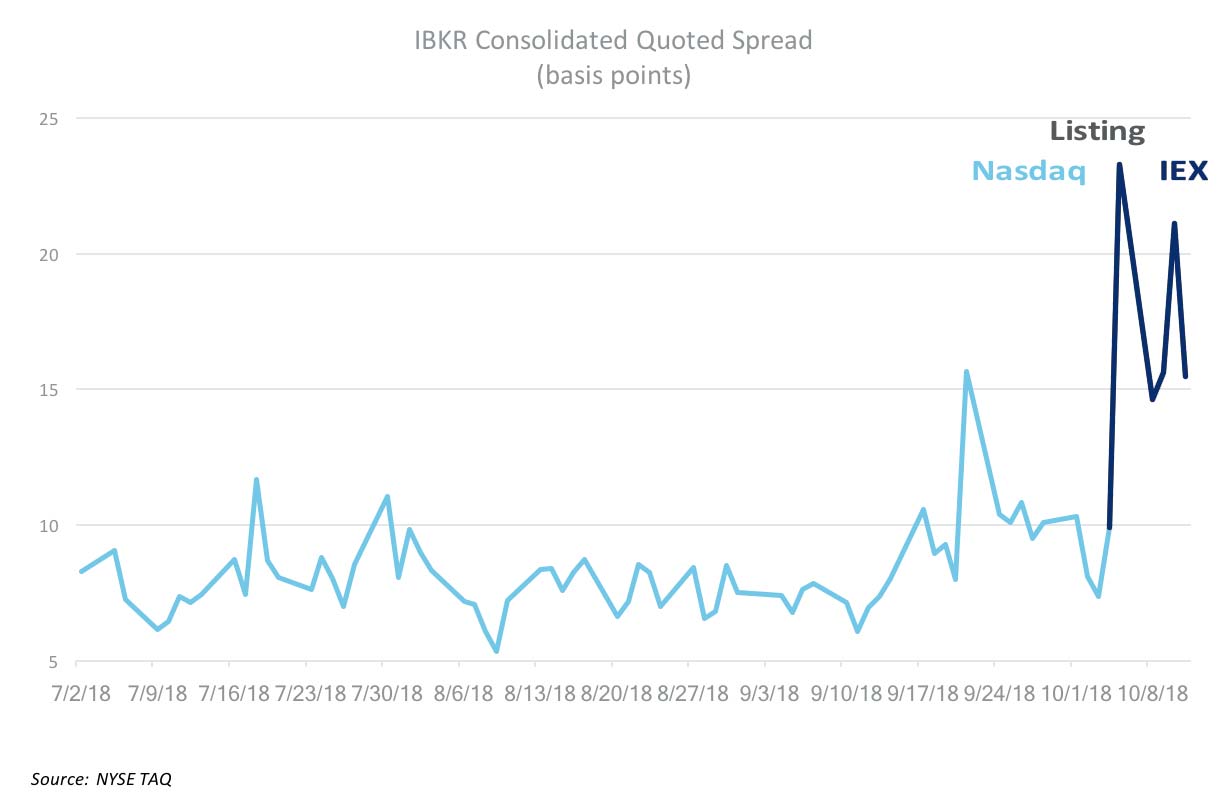

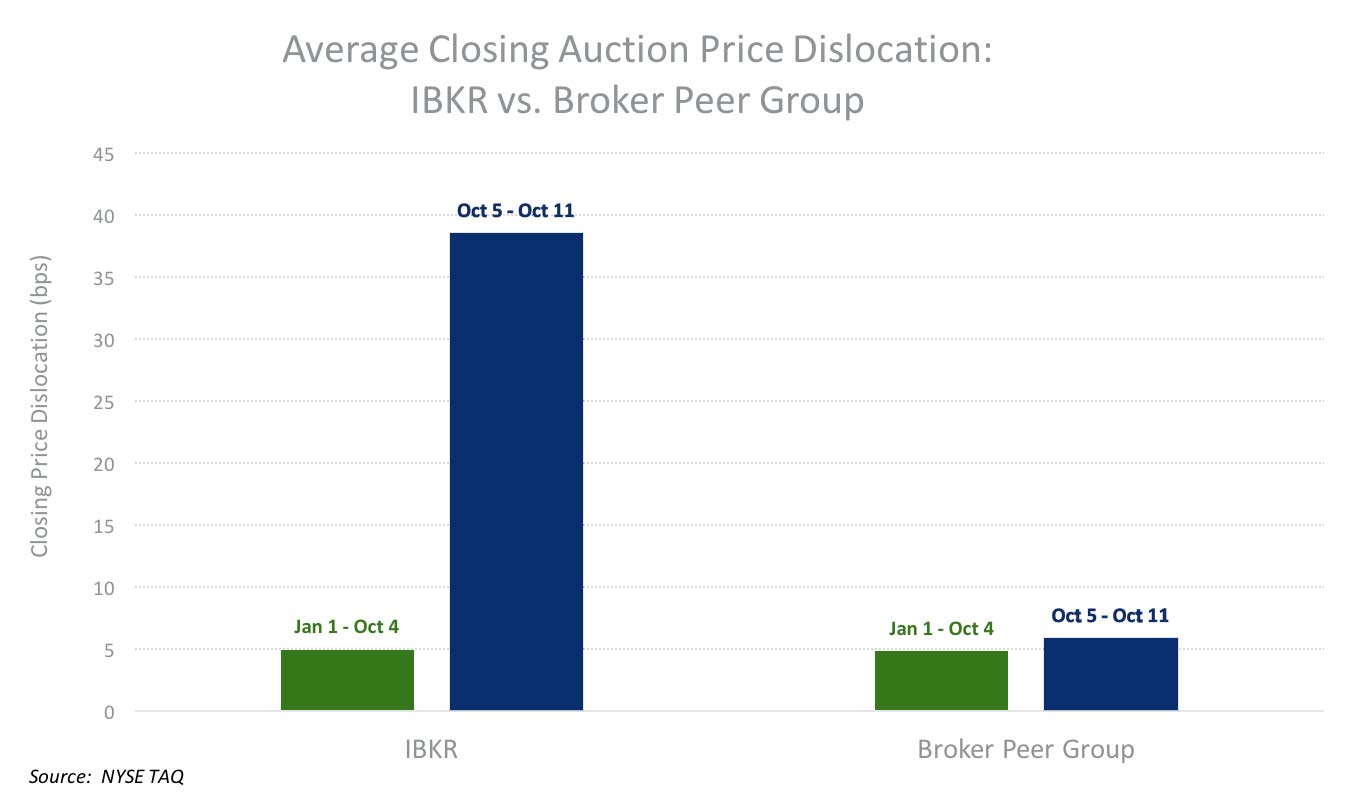

IEX touted the transfer of one stock, Interactive Brokers (IBKR), to its exchange in mid-September. This week was IEX’s first real test of how its new listing would perform under stressful conditions. The results were not good. Compared to the prior, less volatile week, IBKR’s displayed quote worsened, its closing auction experienced greater price dislocation, and performance against its peers on these grades didn’t measure up.

NYSE advocates that exchanges should be permitted to design market models ready to weather unexpected shocks to the system, as we have done by investing both in our powerful cutting-edge technology and the experienced human judgment of our DMMs. The best medicine for the continued health of the financial marketplace is to allow innovation and foster competition, and to recognize when these ingredients enable venues to deliver value to issuers and investors in any market condition.