April 5, 2018

Kevin Tyrell, Head of Strategy and Research, NYSE Equities

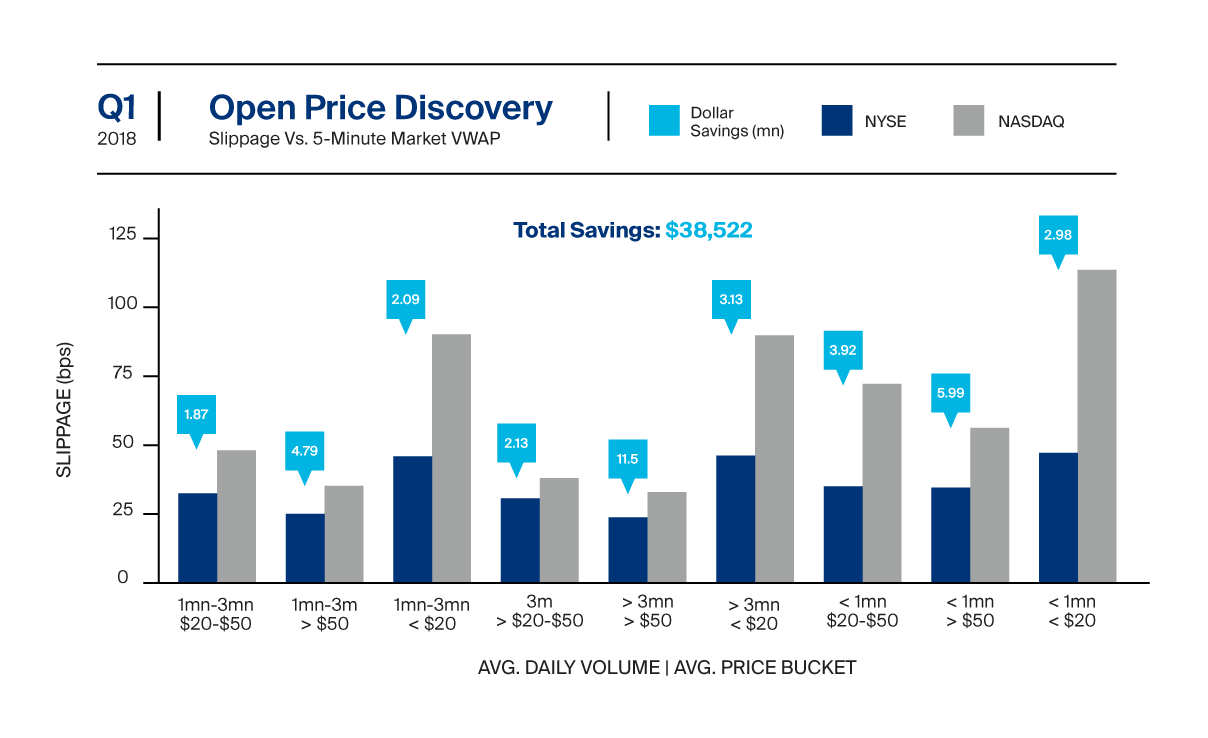

We’ve discussed the importance and liquidity of closing auctions, but during periods of high volatility the opening auction is also a key source of liquidity. What’s more, the NYSE opening process reduces investor transaction costs by tens of billions of dollars per year.

Opening auctions on NYSE, like IPO auctions and closing auctions, are overseen by the Designated Market Maker (DMM). DMMs can open a stock in an automated manner or, depending on the situation, run a manual auction to aggregate interest and open at a more iterative price. This is especially important for stock-specific events such as IPOs or openings after earnings, or when market-wide volatility increases.

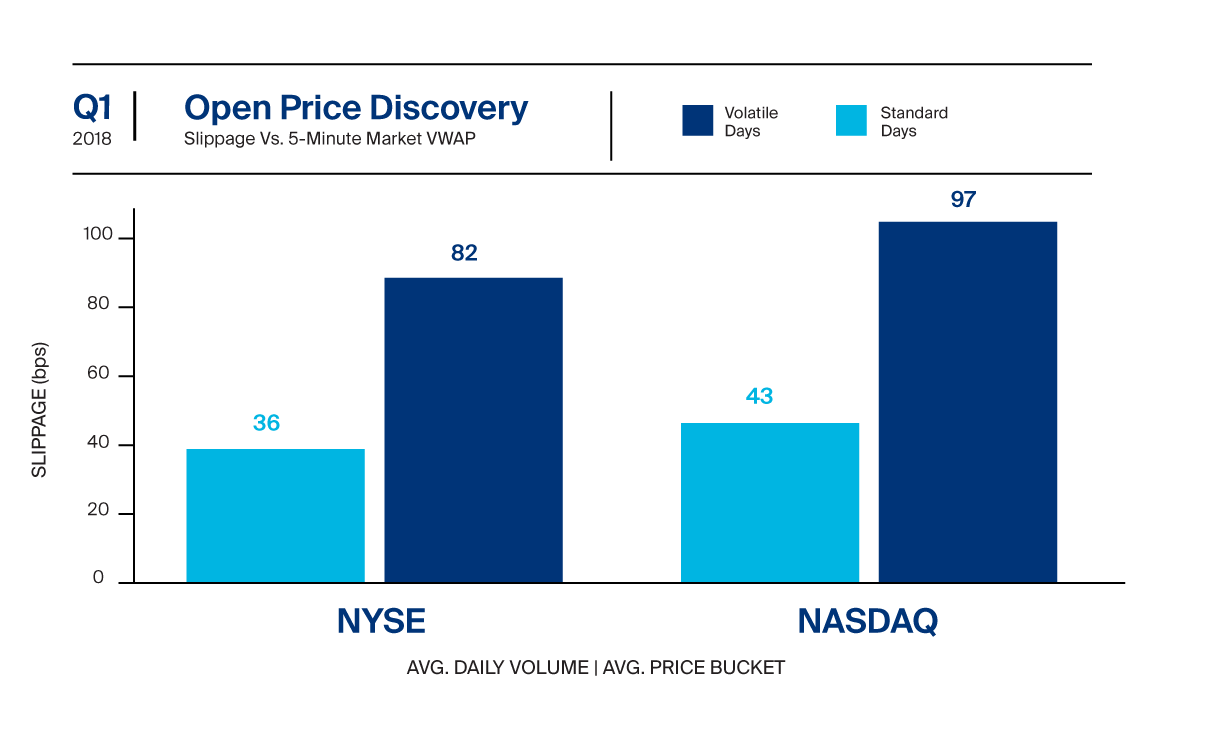

To assess the opening auction’s performance, we analyzed price discovery on the most volatile days in Q1 2018 (Feb. 5&6, March 1&2, March 26-28) relative to price discovery on other “standard” days. We measured open price discovery by comparing the open auction price with the market VWAP over the five minutes following the open auction. As expected during volatile periods, slippage vs. the opening price increased, but NYSE’s opening price performance changed less than electronic venues such as Nasdaq. NYSE-listed securities’ slippage increased by seven basis points while Nasdaq price changes following the open increased by 15 bps.

NYSE Research Insights

Find all of NYSE Research's articles on market quality, market structure, auctions, and options.