September 19, 2019

Last month, the NYSE successfully migrated the NYSE Equities platform to NYSE Pillar technology. Thanks to a substantial effort from the entire NYSE trading community, the migration went off without a hitch and Pillar, a fully integrated, high throughput, low latency, deterministic, and highly redundant trading system, is now the backbone of one of the most important financial institutions in the world.

How Does This Benefit Me?

Pillar's anticipated benefits are already being realized. In particular, the new "Native Gateway" order entry protocols offer dramatic improvements for members and their clients:

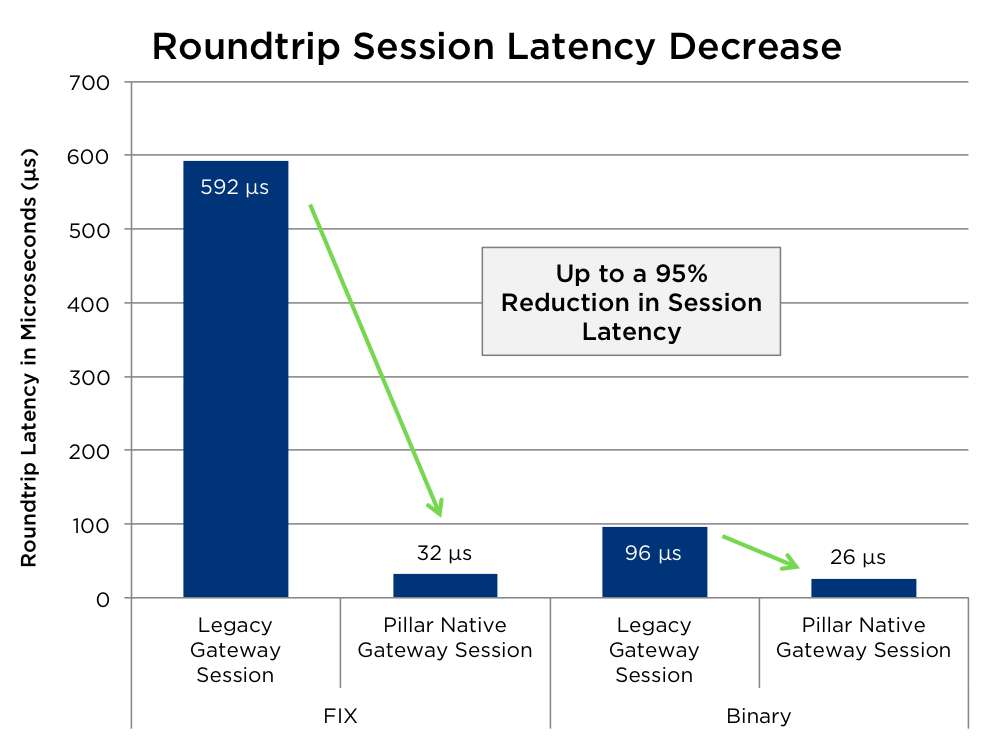

- Up to a 95% Reduction in Latency: The roundtrip latency on NYSE Pillar order entry sessions via Pillar matching engines has been reduced from ~592μs to ~32μs for FIX and from ~96μs to ~26μs for Binary, getting client orders into the market much faster. With a 92% improvement in the 99th percentile latency results, clients can also have more confidence in improved performance consistency regardless of market conditions.

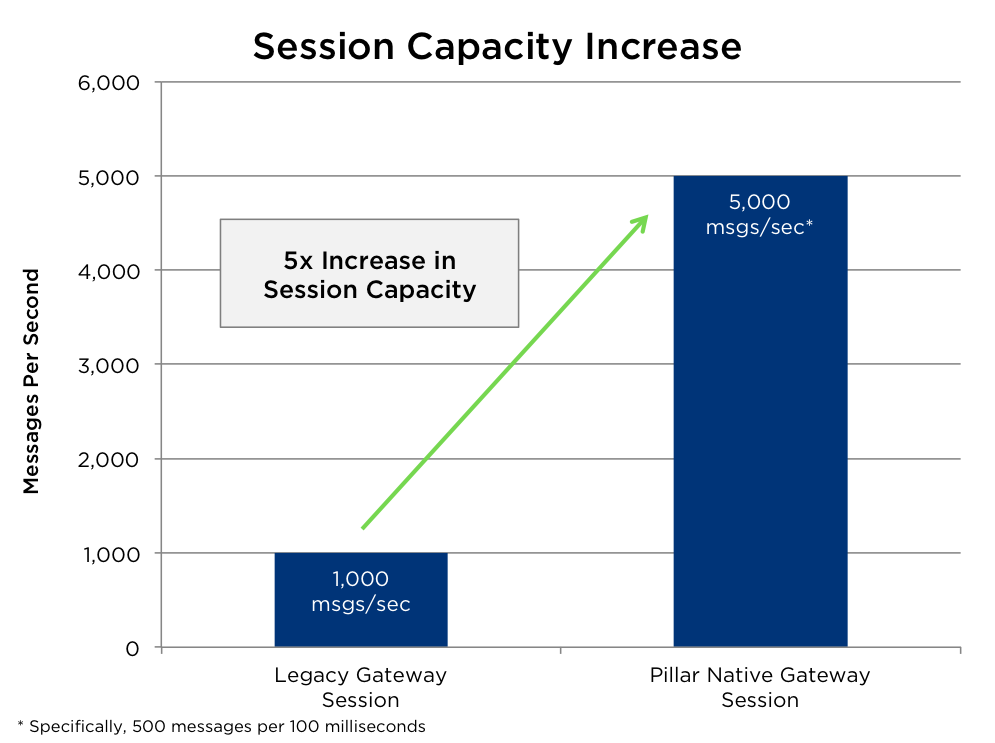

- Cost reduction: The amount of messages capable of being processed over an order entry session has increased from 1,000 messages per second to 5,000 messages per second (500 messages per 100 milliseconds, to be specific). This increase enables clients to submit 5 times the amount of orders over one single session. Session fees have remained unchanged, resulting in cost-reduction opportunities for the industry.

Pillar offers clients significant performance improvements at no additional cost.

To take advantage of Pillar's performance, visit www.nyse.com/pillar for specifications, differences documentation, and assistance in testing and registration. If you do not connect directly to the NYSE, contact your broker to ensure they are utilizing the Pillar Native Gateway technology.

If you would like to learn more about Pillar, listen to our podcast Inside the ICE House, where the technologists that designed Pillar discuss the history of the system and the effort involved in the migration.

NYSE Research Insights

Find all of NYSE Research's articles on market quality, market structure, auctions, and options.