March 26, 2020

The NYSE operated in a fully electronic manner for the first time ever on March 23, 2020, when the Trading Floor was temporarily closed as a precautionary measure in response to the spread of COVID-19. While auctions that include the option for the DMM to conduct the auction on the Trading Floor will always provide the best performance, NYSE all-electronic auctions still allow Designated Market Makers (DMMs) to participate and provide unique liquidity.

Exchange-Facilitated Auctions

Just as when the Floor is open, DMM’s can electronically facilitate an opening, reopening, or closing auction. In any auction facilitated by a DMM - whether from the Trading Floor or electronically -- all better-priced interest, which includes Market Orders, Market-on-Open (MOO) Orders, Market-on-Close (MOC) Orders, and better-priced limit orders, are guaranteed an execution in the auction.

When the Trading Floor is closed, and there is no option for the DMM to conduct the auction on the Trading Floor, and the DMM does not electronically conduct the auction, NYSE conducts an exchange-facilitated auction. Exchange-facilitated auctions only allow the auction price to move a specified amount (generally 10% from the last sale), which may occasionally result in unfilled Market, MOO, MOC, or better-priced limit orders.

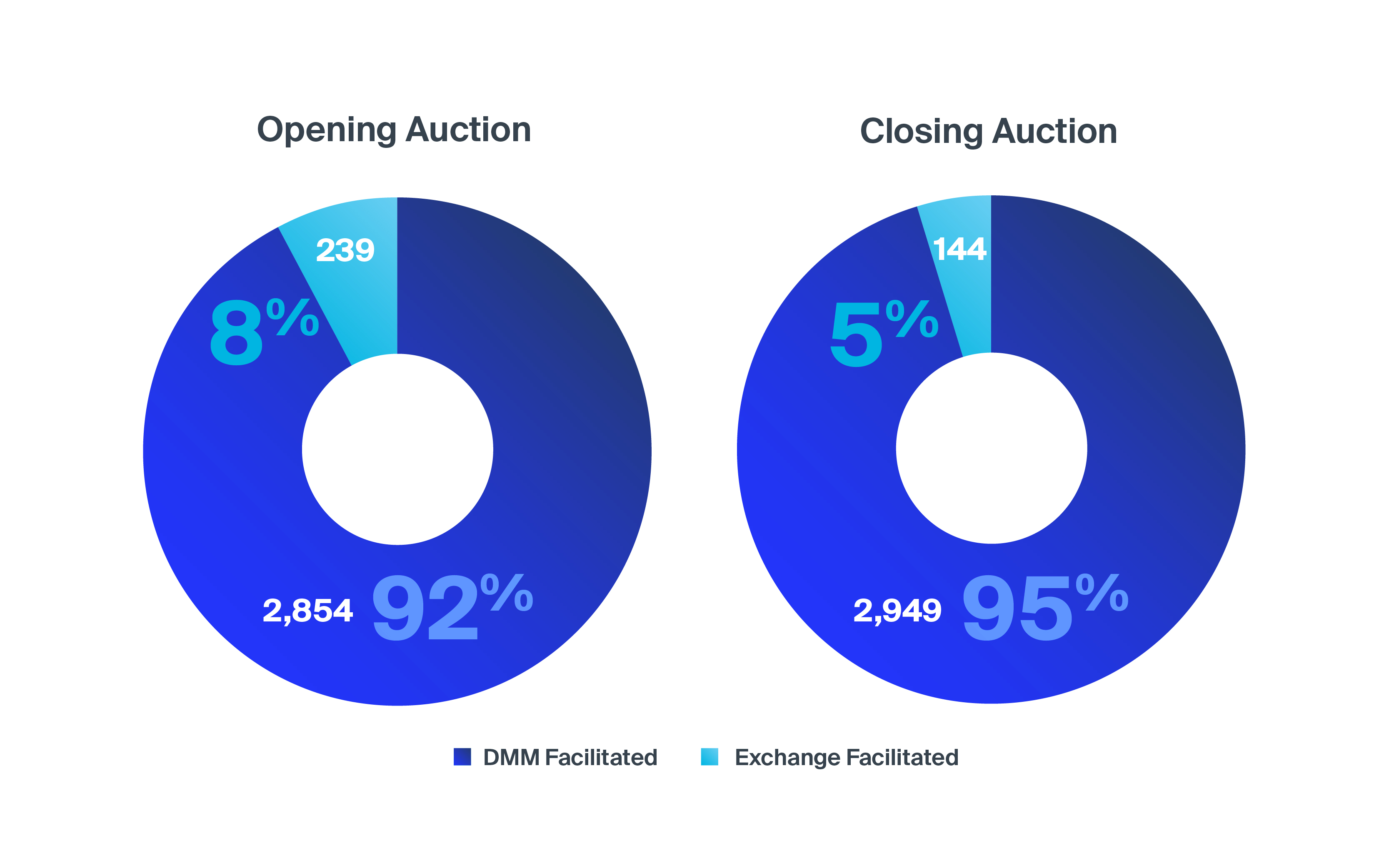

This week, NYSE DMMs have electronically conducted the vast majority of NYSE-listed auctions.

Auction Type - March 23, 2020

Auction Price Dislocation

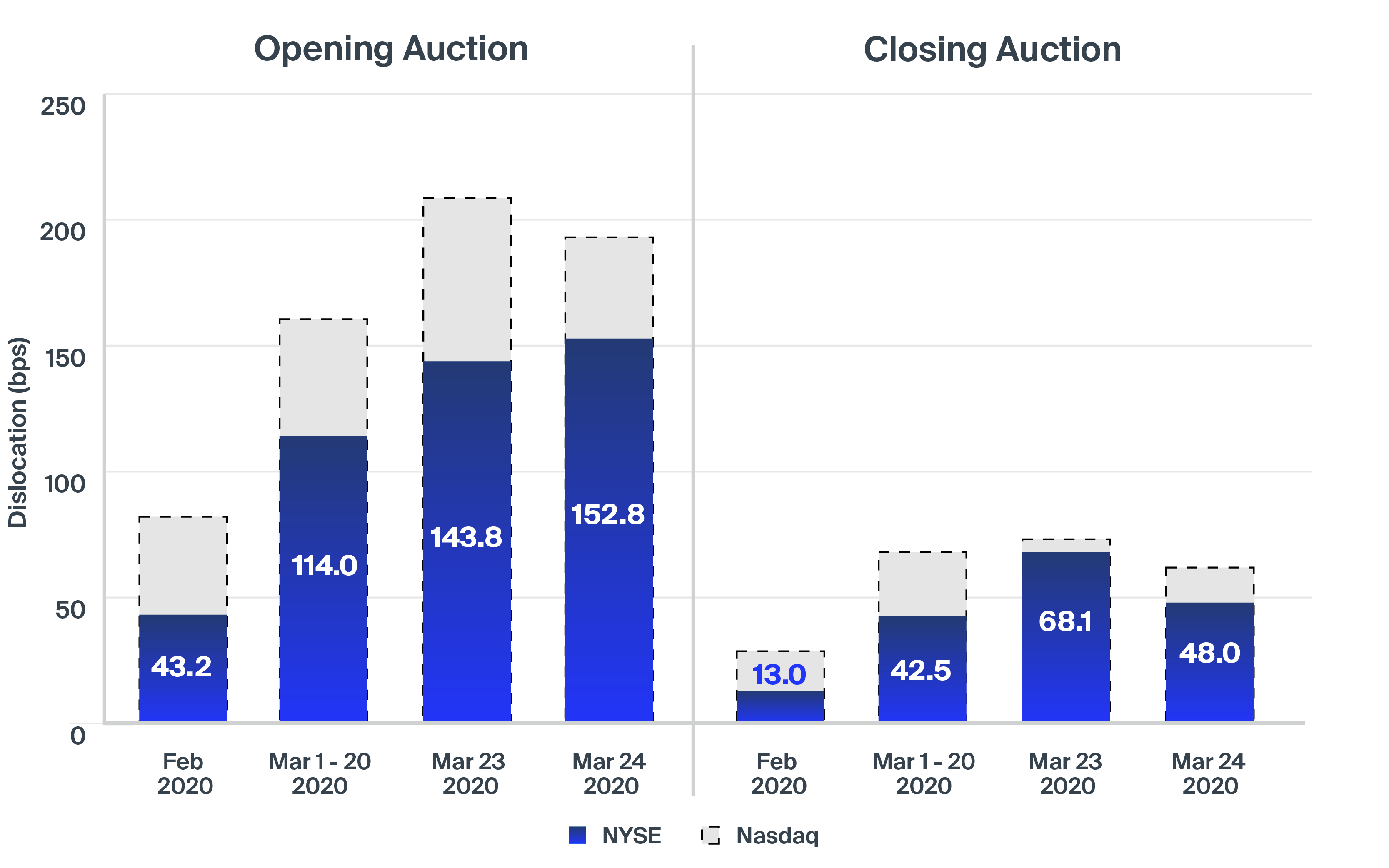

Auction Price Dislocation can be used to compare execution quality for auctions. For opening auctions, we measure the listing-market opening price against the VWAP from the subsequent 5 minutes of trading. For closing auctions, we measure the listing-market closing price against the VWAP from the prior 2 minutes of trading.

The following Auction Price Dislocation metrics show NYSE performing as expected during the temporary Trading Floor closure; price dislocation has increased relative to Floor-based auctions, but NYSE still outperforms electronic models that operate without DMMs.

Auction Dislocation

Auction Order Types

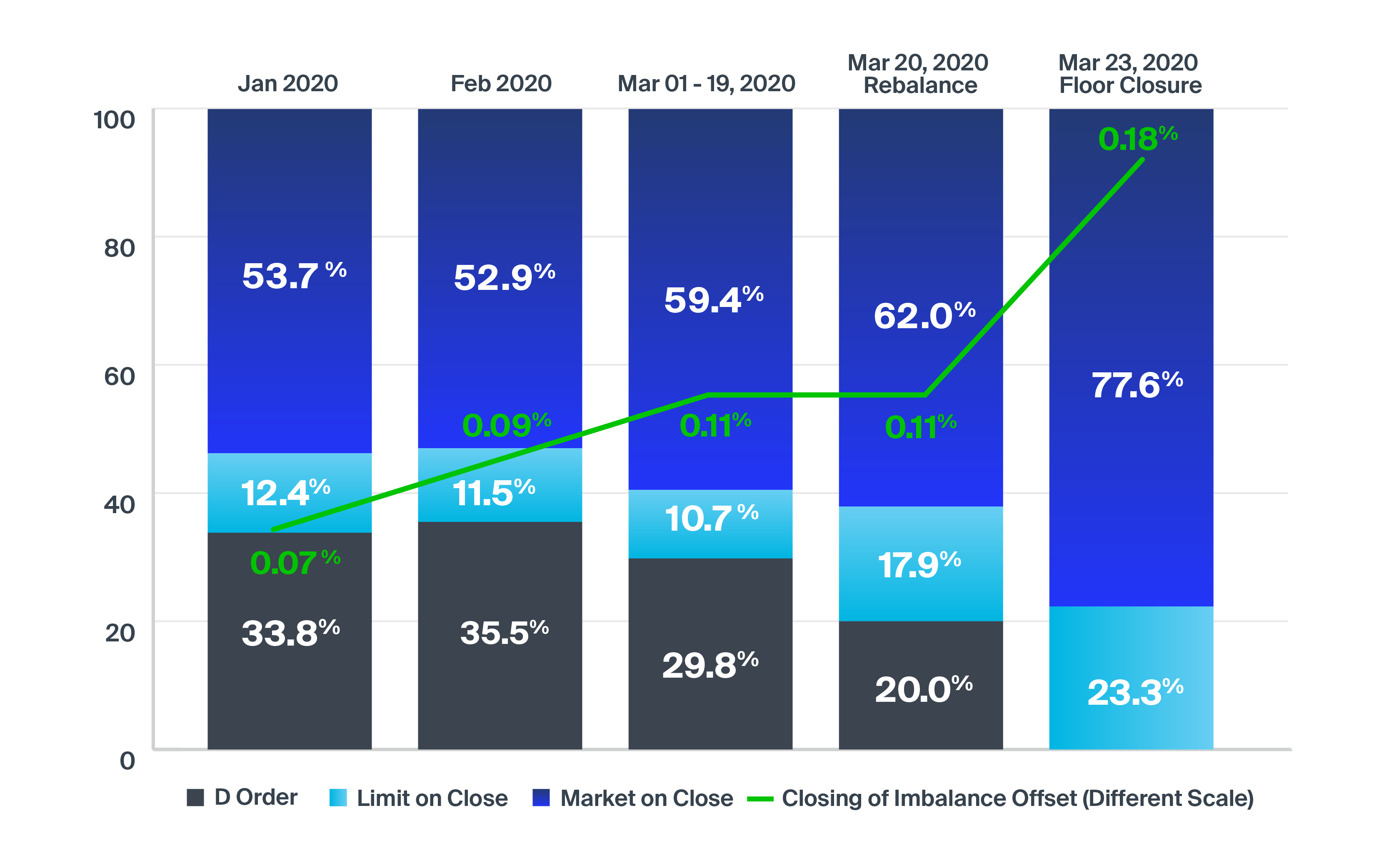

One of the major differences during the temporary Trading Floor closure is the unavailability of the Floor Brokers and their associated order types, such as the D Order. D Orders allow maximum flexibility in Closing Auction participation. In their absence, the following order types are available for fully-electronic auctions:

- Market On Open (MOO) / Market On Close (MOC)

- Limit On Open (LOO) / Limit On Close (LOC)

- Closing Imbalance Offset (IO)

Most NYSE members and clients are already using MOO/LOO and MOC/LOC. In fact, usage of these order types had already grown during the elevated volatility in March.

Most market participants are not using Closing IO orders, which provide additional flexibility into the close. Closing IO orders can be entered up until 4:00 pm on either side of the market, in response to any size imbalance. The functionality and timelines are described in greater detail in our Trading Floor Closure FAQ.

Closing Order Type Usage

Even while NYSE’s Trading Floor is temporarily closed, market participants can expect NYSE’s electronic auctions to outperform. If you have questions about the Trading Floor closure, or would like to discuss how to optimize your auction order type usage, reach out to [email protected].

NYSE Research Insights

Find all of NYSE Research's articles on market quality, market structure, auctions, and options.