March 1, 2018

Kevin Tyrell, Head of Equities Strategy and Research, NYSE

While most people know that the NYSE Closing Auction is the single largest liquidity event in the U.S. market, accounting for more than 6% of NYSE-listed volume on a regular basis, fewer are aware of the additional auction liquidity available at nearby price points.

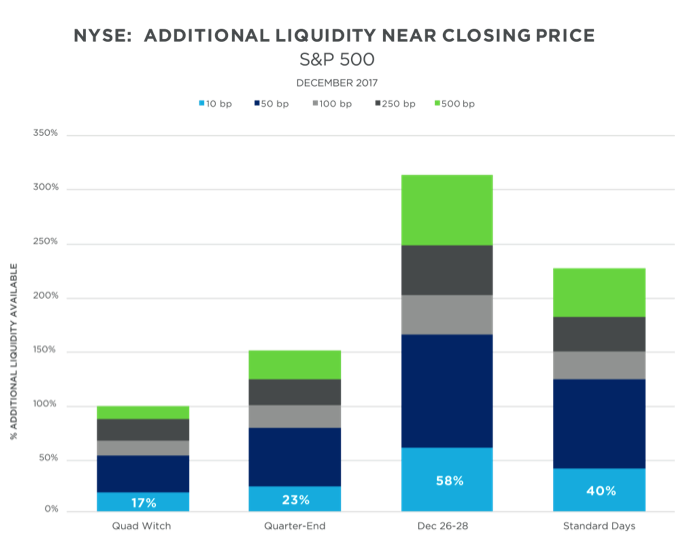

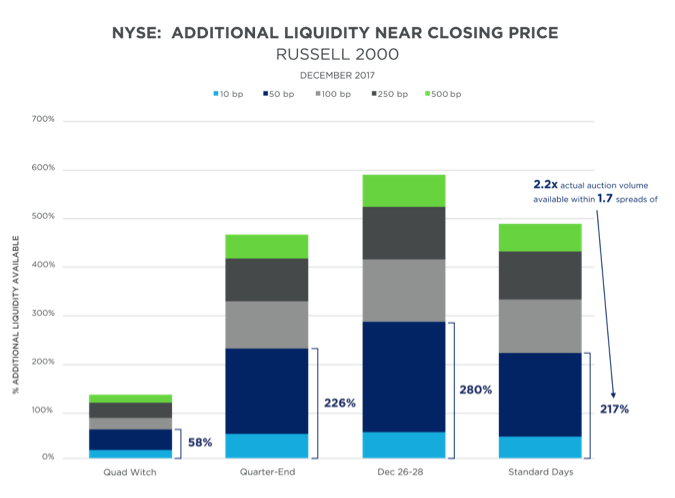

To highlight this effect, we show the cumulative additional liquidity available on various days in December for NYSE-listed Russell 2000 and S&P 500 stocks, with colors indicating the distance of the liquidity from the final closing price. The median spread for NYSE-listed Russell 2000 stocks is roughly 29 bps, meaning all additional liquidity represented in green and blue on the Russell chart are on average within 2 spreads of the final closing price. The chart shows that traders who seek out this liquidity, by leveraging a floor broker’s experience and capabilities or by submitting orders at various price points, can find material additional volume.

Get NYSE's Data Insights

NYSE Research Insights

Find all of NYSE Research's articles on market quality, market structure, auctions, and options.