November 25, 2019

NYSE Group exchanges introduced improved handling for Minimum Fill instructions (“Min Fill”) on the Pillar technology platform earlier this year. With this functionality, market participants can elect to prevent multiple orders from being aggregated to satisfy the Min Fill. An order marked with a Min Fill instruction will not return a fill for less than the Min Fill quantity, even if multiple contra orders would add together to meet the Min Fill amount.

Usage of the improved Min Fill functionality has already increased our average fill size. NYSE Arca midpoint order average fill size has grown about 7%, from 198 shares to 211 shares.1

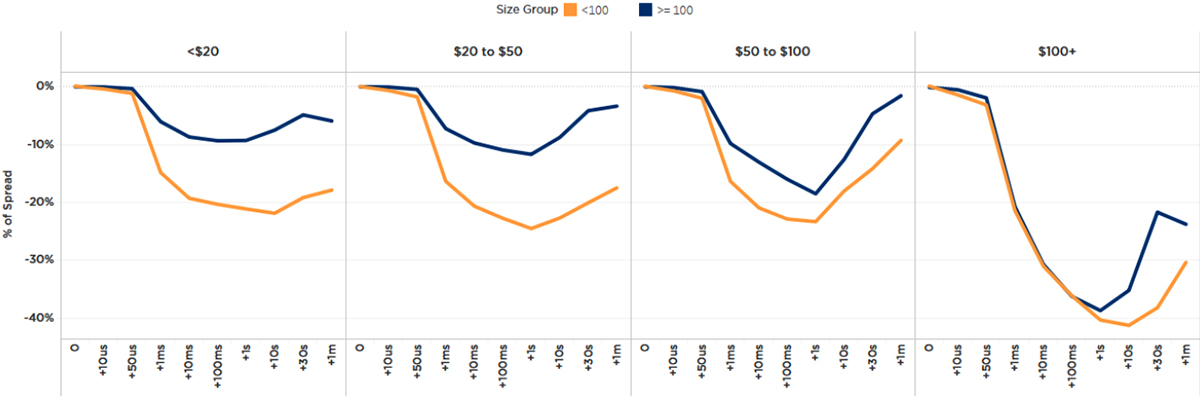

Measuring the Impact of Odd Lots on Resting Midpoint Orders

- A common goal when implementing a Min Fill instruction on an exchange is, at a minimum, to filter out odd lot executions.

- We are able to validate this approach with data by using trade markouts.

- NYSE Group calculates markout statistics at several time points for every trade on the Pillar trading platform.

- We find a measurable difference between the post-trade markouts on odd lot fills compared to round lot or mixed lot fills.

- We limit our analysis to trades where incoming orders are smaller than resting orders, and find that odd lots exhibit much worse post-trade price patterns.

- This suggests that many liquidity-taking odd lots are not simply the end of a larger parent order but rather part of a larger sequence of child or parent orders impacting price.

- However, as the stock price increases, odd lot fills tend to experience post-trade performance similar to round lot and mixed lot fills.

Arca Limit Day MPL Markouts

Data: October 2019 — Arca posted midpoint orders filled against constraside orders of a smaller size

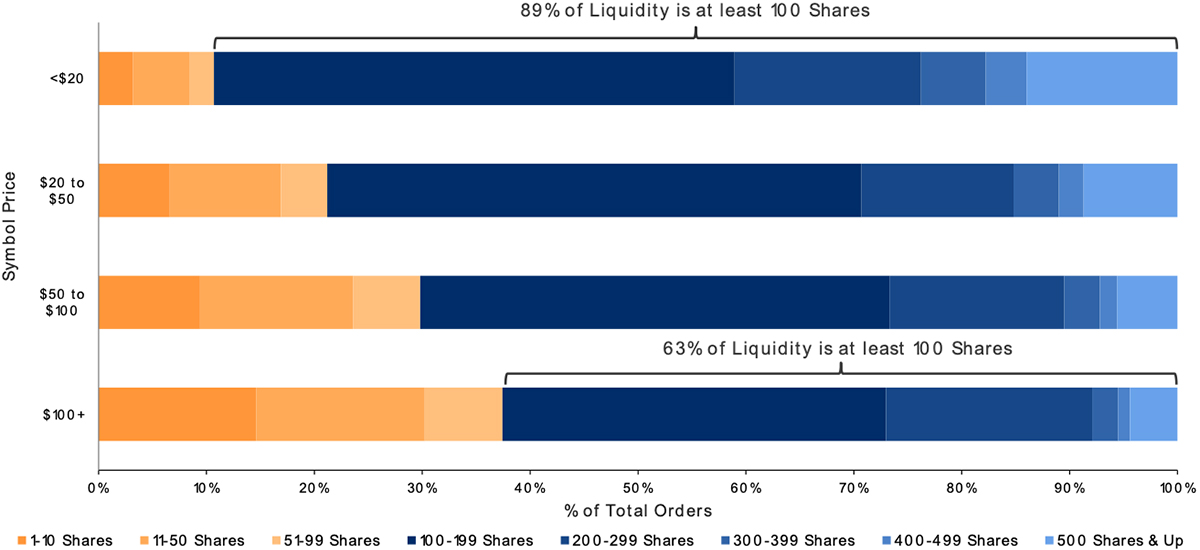

Choosing a Min Fill Size

- When implementing a Min Fill instruction, market participants need to balance the tradeoff between missed liquidity and improved execution quality.

- Stock price must be taken into account, as it will significantly impact the size of available contraside liquidity. The chart below shows the percent of total IOC orders priced at or better than the midpoint, broken down by order size and symbol price. For example, a user that implements a Min Fill quantity of 100 shares across all stocks will access 81% of available liquidity in stocks priced <$20, but only 63% of available liquidity in stocks priced at least $100.

Arca Limit IOC Order Size by Symbol Price

Data: October 2019 — Arca Limit IOC Orders priced at or better than midpoint

Next Steps

- The improved Min Fill capabilities allow Market Participants to be in more control over their fill size, and as we’ve shown, this can significantly impact the execution quality and the amount of available liquidity.

- To take advantage of this new functionality, visit nyse.com/pillar for specifications and differences documentation which describe the functionality.

- To be notified of future posts on odd lots and other topics, click here to subscribe to our blog.

1 Midpoint fills for stocks priced between $10 and $50 in Q2 and Q3 2019

NYSE Research Insights

Find all of NYSE Research's articles on market quality, market structure, auctions, and options.