May 15, 2018

On April 9, 2018, the New York Stock Exchange broke with 225 years of tradition and began trading stocks listed on other exchanges. By April 25th NYSE was trading more than 8,000 total names across the NMS universe - over 5,400 of which were listed on Tapes B (regional exchanges) and C (Nasdaq). By the beginning of May, NYSE had achieved an average market share of 0.75% in Tapes B & C trading.1

Participant Types & Usage

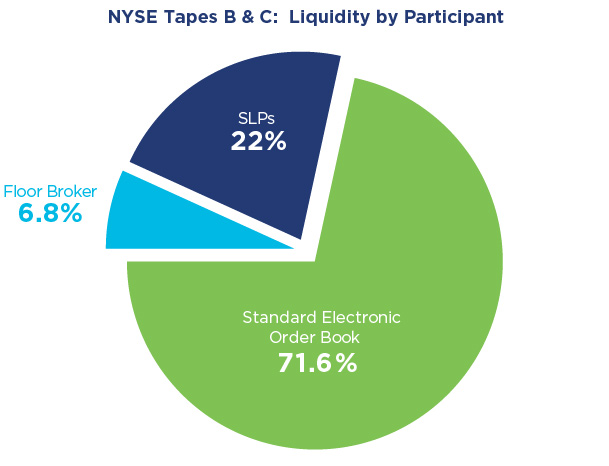

The NYSE market model for Tapes B & C is similar to the existing model for NYSE-listed securities. While Tapes B & C names do not benefit from a Designated Market Maker (DMM), the NYSE Floor Brokers and Supplemental Liquidity Providers (SLPs) continue to play key roles and together account for nearly 30% of liquidity provision.

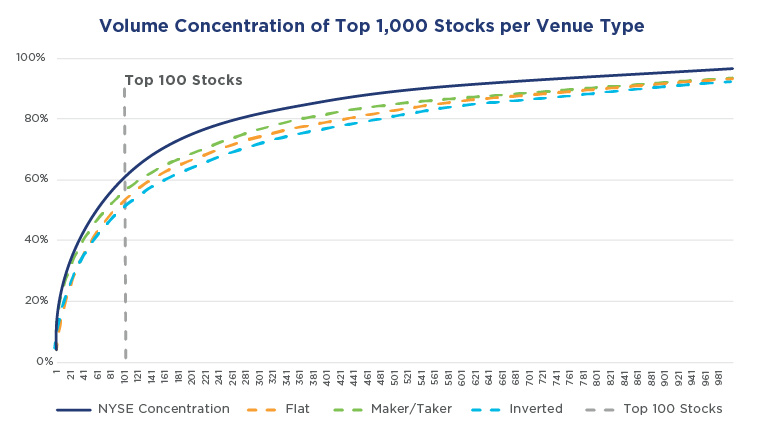

Across all participants, activity is slightly more concentrated in active names compared to more-established venues. The top 100 most-active Tapes B&C names on NYSE account for about 61% of total volume compared to 56% at other maker/taker venues.

Liquidity Concentration Results from Market Characteristics

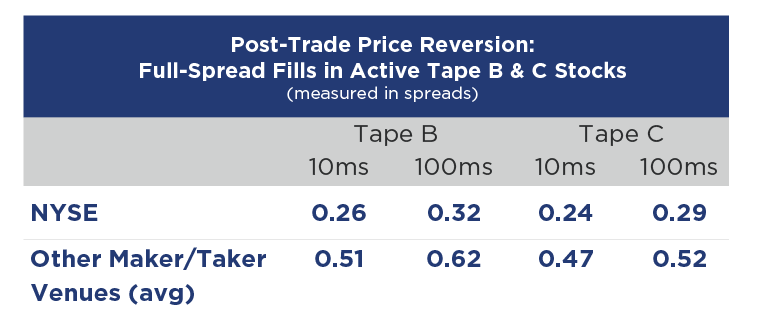

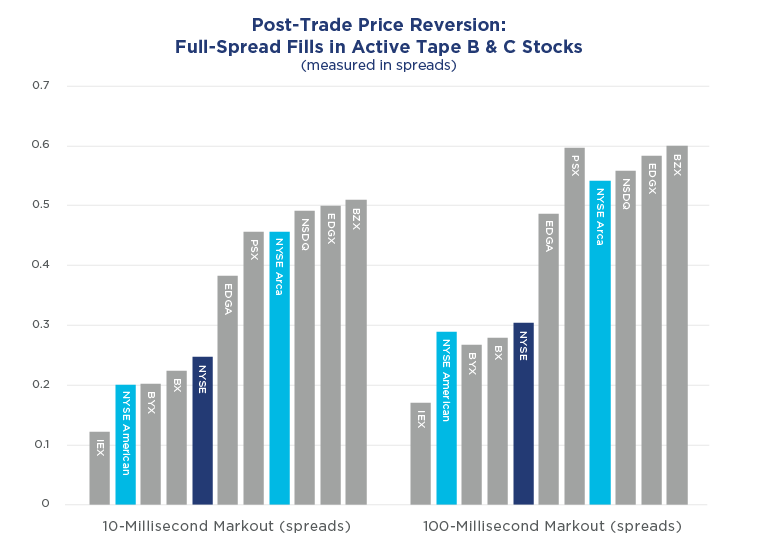

NYSE currently offers two benefits for passively trading Tape B and C securities: 1) a relatively thin limit order book while participants adapt their strategies for the venue, and 2) the parity execution model. Orders entered via a Floor Broker share a portion of incoming order flow, resulting in quicker fills than standard price-time priority venues. This means that orders can get filled quicker and incur less immediate reversion relative to other venues.

The chart below shows short-term price reversion statistics for resting orders filled at the full spread (i.e., buying on the bid or selling on the offer). NYSE outperforms all other maker/taker venues on both Tapes B and C, showing results similar to inverted and flat-fee venues.

Strong Quotes from the Start

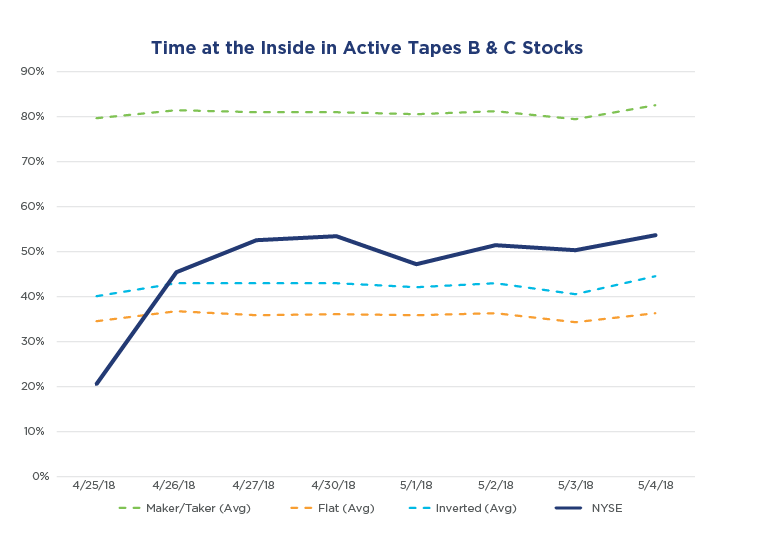

The NYSE market model has also facilitated strong quoting performance in the new symbols right off the bat. The chart below shows NYSE’s time at the inside for the most-active Tape B & C names. The full symbol rollout was complete on April 25; starting the next day NYSE was at the inside in these names more often, on average, than individual taker/maker or flat fee venues.

Next Steps

We expect market quality statistics such as time and size at the inside to continue to improve as more participants adopt the venue into their strategies, which should drive increased market share. We are going to continue to track our performance in active names, particularly those with long queues, where the differentiated NYSE execution model can add value.

Adding Tapes B & C to NYSE is the latest step in the on-going NYSE Pillar migration, to be followed by the launch of NYSE National and the transition of Tape A trading on NYSE.

NYSE Research Insights

Find all of NYSE Research's articles on market quality, market structure, auctions, and options.