The global community has seen fundamental economic disruption, resulting in unprecedented market volatility.

The modernized Market-Wide Circuit Breaker (MWCB) triggered on March 9 for the first time, as the S&P 500 Index fell 7% shortly after open in response to COVID-19 fallout. It triggered for a second time on March 12, a third on March 16th and fourth on March 18th. These halts pause trading for 15 minutes so investors can analyze the situation, and re-start trading with an auction to facilitate price discovery.

The unique hybrid model of the NYSE performed as designed. The Designated Market Maker (DMM) is obligated to provide liquidity and facilitate auctions, resulting in reliable auction performance and reduced volatility. With four MWCB triggers and market turbulence, the DMMs were able to offer unmatched stability relative to other global markets. Let's see how.

NYSE Auctions Dramatically Outperformed Following the MWCB

Coming out of a MWCB, trading resumes with a re-opening auction. The NYSE auction’s price discovery process means asset values reflect aggregate supply and demand, and establish a reliable basis to resume trading. The higher volatility means values were changing rapidly, but NYSE auctions produced more reliable prices than market conditions would indicate.

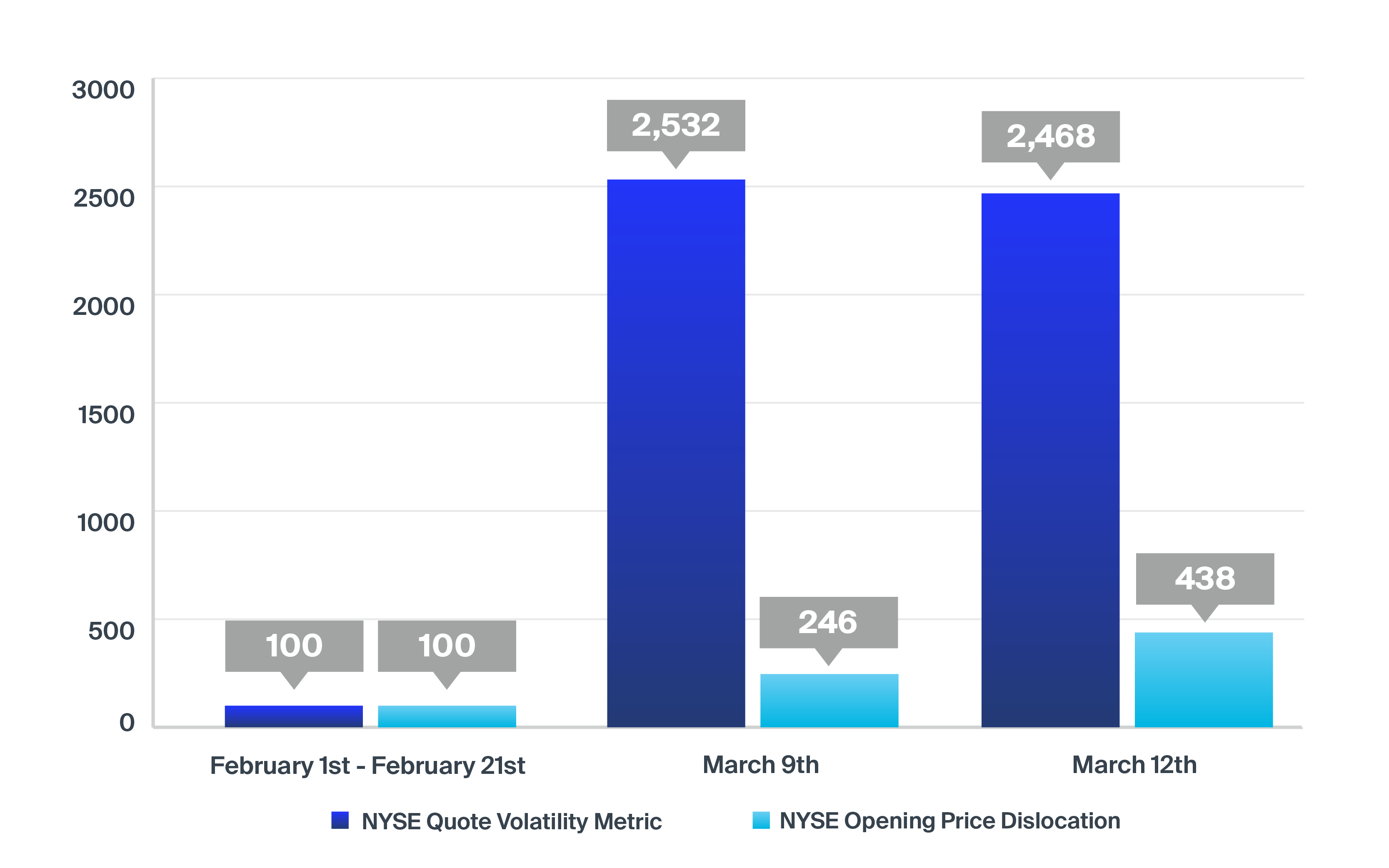

NYSE Opening /Re-Opening Price Dislocation vs Change in Market Volatility Indexed to 100*

In the above, we measured the NYSE opening or re-opening auction price against the subsequent 5 minutes of trading for 3 periods: Feb 1 - Feb 21 (before volatility increased), then March 9 and March 12. We compare this change to that in our proprietary Quote Volatility (QV) metric.

Model performance becomes clear. NYSE Auctions dramatically outperformed during the huge jump in market volatility.

Flexibility to Attract Order Flow

The DMMs on the NYSE Floor have an obligation to fulfill all marketable interest in the Auction. If the auction process yields an extreme order imbalance the DMM can, with Exchange approval, allow order entry after 4:00 PM on the opposite side of the imbalance. This flexibility can attract natural order flow to offset extreme imbalances and result in large auctions trading at prices better than those produced by a mechanical auction price boundary.

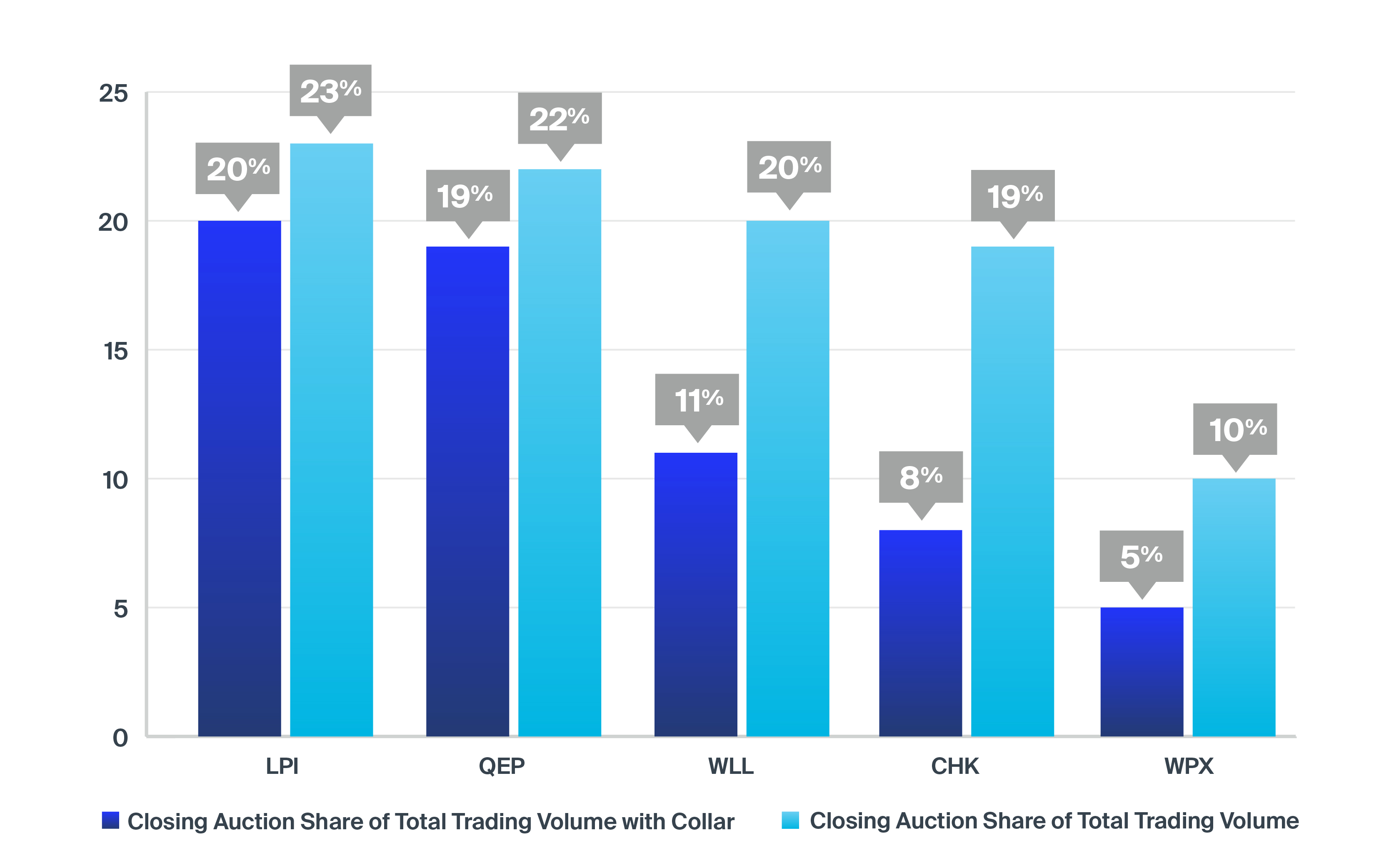

This capability was used for 5 stocks in the Closing Auction on March 13. The average auction in these five symbols accounted for nearly 19% of their total trading that day, more than twice the volume as could have traded in an automated model with less flexibility.

Additional Volume from NYSE Closing Auction’s Flexibility

Increased Liquidity Under Stress

Market participants focus on the NYSE auction as a liquidity event. In times of stress, auctions attract even more liquidity than usual, contributing to better price discovery.

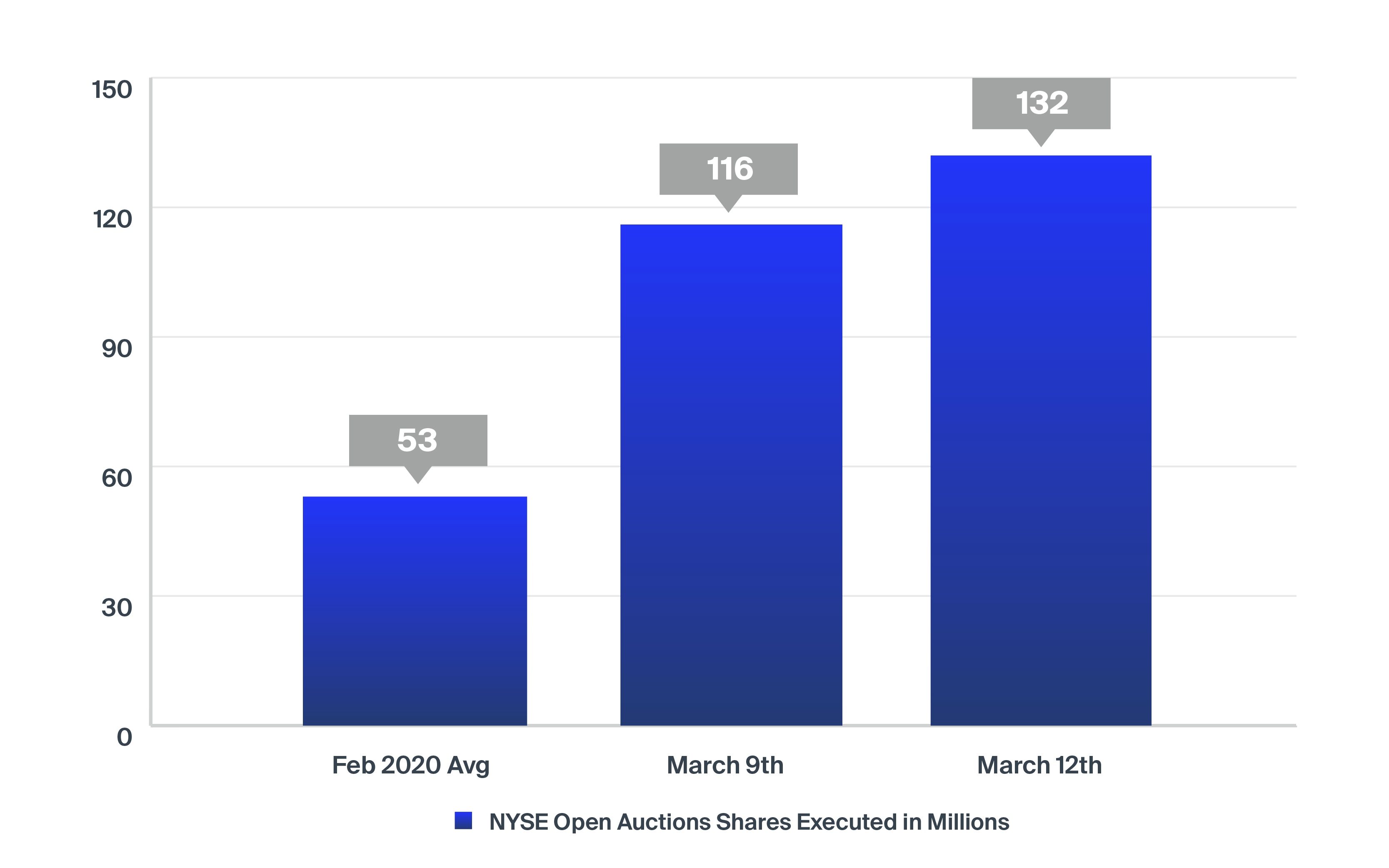

NYSE Opening Auction: Shares Executed (millions)

The DMM has responsibility for running the auction and participating when necessary. On March 9 and 12, DMMs participated in 25% more auctions than usual, helping to stabilize prices and satisfy liquidity demand.

Lower Volatility

In addition to running the auctions, DMM provide liquidity and price stability throughout the trading day. This helps to reduce volatility for NYSE stocks.

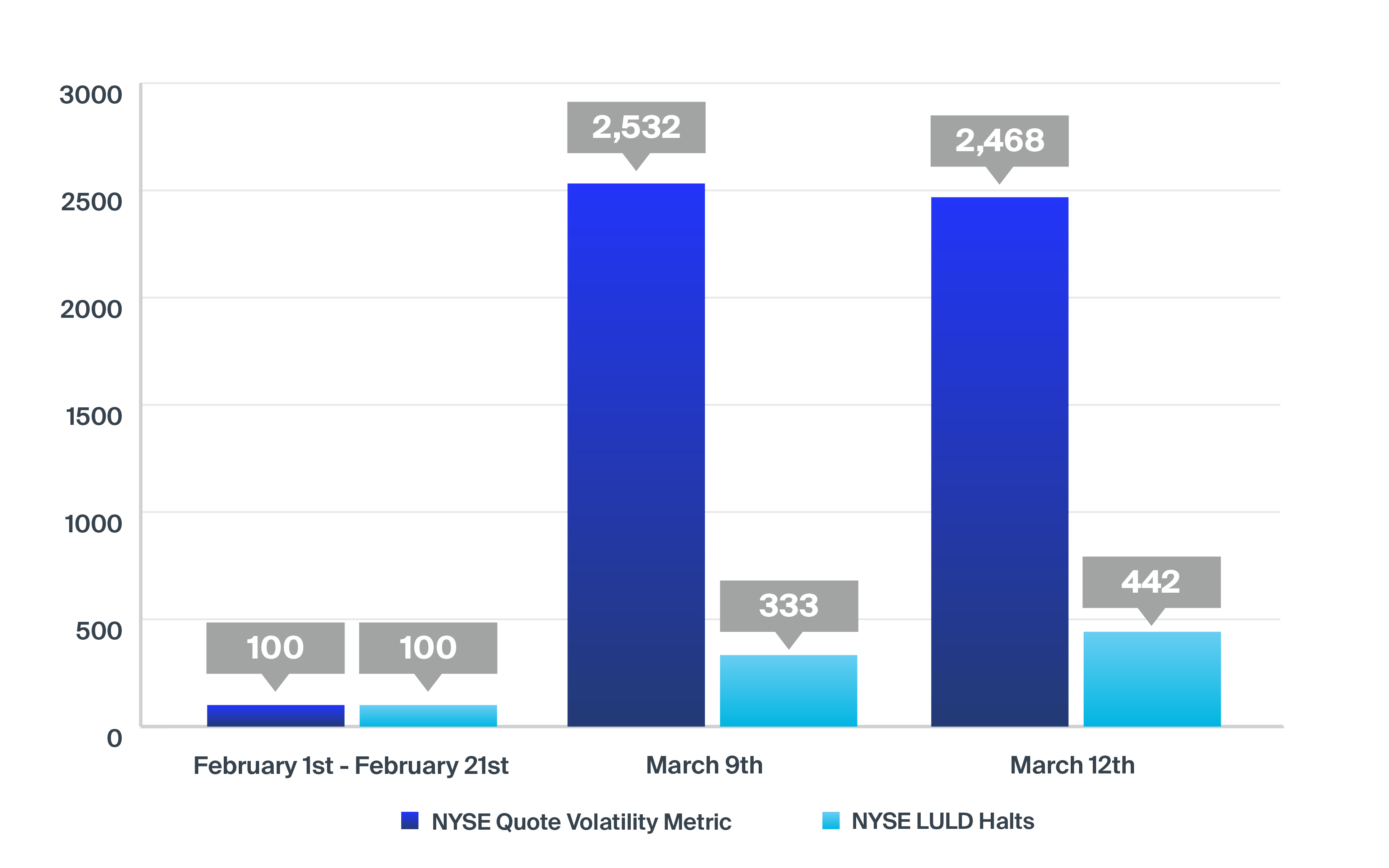

NYSE LULD Events vs. Change in Market Volatility Indexed to 100*

Individual stocks have Limit Up/Limit Down (LULD) protections which halt a single stock if prices exceed an upper or lower bound. Increased volatility results in more LULD halts, but the NYSE market model produces fewer extreme volatility events than market volatility would suggest.

Conclusion

Volatile times like these demonstrate the value of the high-touch market model at the NYSE . Combining technology with human judgment and measured action exercised by the DMMs provide incomparable stability during rapid market fluctuations enabling smoother trading for NYSE-listed securities.

*Data as of March 16, 2020