| Year | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | YTD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2008 | 0.34 | -1.3 | -0.47 | -0.96 | 5.46 | 2.95 | |||||||

| 2009 | 2.11 | -2.09 | 2.18 | 2.11 | 4.04 | 1.74 | 3.88 | 2.18 | 1.71 | -1.3 | 2.71 | 3.1 | 24.58 |

| 2010 | -2.83 | 1.6 | 4.82 | 0.28 | -4.5 | -2.62 | 1.4 | -2.97 | 5.66 | 4.84 | 0.51 | 3.2 | 9.11 |

| 2011 | 0.99 | 2.12 | -2.22 | 2.37 | 0.41 | -1.05 | -0.23 | 3.17 | -0.36 | 5.23 | 1.61 | 2.16 | 14.92 |

| 2012 | 0.87 | 3.81 | 1.32 | -1.59 | -4.73 | 4.23 | 2.87 | 1.19 | 1.2 | 0.39 | -0.6 | 0.77 | 9.83 |

| 2013 | 5.83 | 3.6 | 4.6 | 6.99 | -1.06 | 0.27 | -0.01 | -2.02 | 2.13 | 2.45 | 0.66 | 1.37 | 27.33 |

| 2014 | -4.69 | 1.44 | 1.75 | 0.73 | 3.25 | 2.39 | -2.21 | 2.73 | -0.65 | 5.83 | 4.88 | 1.3 | 17.57 |

| 2015 | -2.79 | 3.43 | 2.52 | -1.01 | 5.76 | -2.69 | 2.08 | -7.69 | 0.16 | 4.96 | 0.57 | -1.16 | 3.4 |

| 2016 | -2.05 | 1.26 | 2.92 | -1.33 | 3.77 | 2.3 | 1.87 | -1.04 | 1.34 | -1.59 | 1.62 | 0.74 | 10.04 |

| 2017 | 2.01 | 6.82 | 0.78 | 1.47 | 2.54 | 0.19 | 3 | 1.61 | 0.65 | 4.08 | 1.32 | -1.02 | 25.87 |

| 2018 | 3.19 | -2.45 | -0.24 | 0.41 | -0.04 | -3.05 | 2.84 | -0.62 | 0.86 | -2.88 | 0.33 | -2.18 | -3.99 |

| 2019 | 5.39 | 1.77 | 1.4 | -0.07 | -5.07 | 3.47 | 0.36 | -2.47 | 2.58 | -0.18 | 2.27 | -1.73 | 7.52 |

| 2020 | 1.89 | -6.29 | 1.04 | 2.93 | 0.43 | 2.16 | -1.34 | 2.25 | 0.47 | -2.02 | 1.75 | 1.3 | 4.29 |

| 2021 | 0.76 | 0.36 | 5.21 | 1.28 | 3.15 | 1.07 | 0.69 | -0.06 | -5.16 | 1.87 | 1.3 | 5.56 | 16.8 |

| 2022 | -0.49 | -1.23 | 3.13 | 3.34 | 3.08 | -0.1 | 3.11 | 1.18 | -3.51 | 1.27 | 5.86 | -3.71 | 12.09 |

| 2023 | 1.76 | -1.8 | 1.7 | 2.46 | -3.08 | 3.56 | 1.34 | -0.9 | -3.06 | -2.37 | 3.76 | 2.16 | 5.28 |

| 2024 | 4.77 | 1.49 | 3.42 | -4.53 | 2.11 | 0.98 | 1.66 | -0.81 | -1.85 | 0.9 | -4.35 | 0.74 | 4.18 |

| 2025 | 2.19 | 1.35 | -0.69 | -2.78 | 3.11 | -1.18 | -1.17 | 2.7 | 1.74 | -0.63 | 1.47 | 0.45 | 6.59 |

NYSE GEARS® Index

The NYSE® GEARS Index is a growth-oriented index designed to identify the current global equity market environment and reallocate to capture equity performance through changing market conditions while using a proprietary risk management process to reduce volatility.

Index features

Global equity diversification

To help provide broad equity global diversification and the opportunity for greater growth through changing markets, the index leverages a combination of long/short and defensive global equity strategies.

Dynamic market indicator

The Index utilizes a proprietary dynamic market indicator developed by Deutsche Bank* to help forecast the global market outlook and guide the dynamic reallocation process.

Return optimization

The Index uses the dynamic market indicator and proactively rebalances among the long/short and defensive global equity strategies with the aim to optimize returns through changing global markets.

Objective

Designed to capture equity performance through changing global markets while targeting an 8% volatility control level.

Approach

Utilizes a daily dynamic market indicator to evaluate the current global equity market environment and adjusts allocations to global long/short and defensive equity strategies accordingly.

Holdings

Provides exposure to large and mid-cap companies across 23 Developed Markets.

The Index is constructed using two strategies to provide broad global equity exposure: Global Smart Beta and Global Equity Diversifier/Defensive. The allocations are dynamically adjusted to help the Index navigate changes in market conditions with the aim to provide greater growth potential.

The Global Smart Beta Strategy

The DB Global Equity Smart Beta Index leverages liquid large and mid-cap companies across 23 Developed Markets, and strategically weights based on four well-known factors: viz., value/quality , low beta and momentum.

The Global Equity Diversifier/Defensive Strategy

The DB Equity Alpha Basket Index combines two long-short equity tactics to help achieve diversified exposure:

- The Global Equity Diversifier Strategy each month applies a predictive machine learning algorithm to, on average, over 100 different fundamental stock metrics. Weights are then allocated to, on average, 35 of those metrics that are predicted to perform well over the next month.

- The reversion model seeks to identify equities that are not aligned with the expected valuation and that are expected to revert to the expected price over short periods of time.

The Global Equity Defensive Strategy

Provides equal weight exposure to fast acting momentum strategies on the S&P 500® Index and NASDAQ Composite Index that can take long or short positions intraday. This is a reactive model. When the market is trending down intraday, it will “short” the indices via index futures, and when it is trending up intraday it will allocate more to the indices, again via index futures.

The DB Global Equity Smart Beta Index and the DB Equity Alpha Basket Index are administered by Deutsche Bank AG, a pioneer in the Equity Risk Premia space, having been active in equity research since the early 2000s. Investable systematic derivatives and long-short factor indices date back to the early 2000s.

The Global Equity Smart Beta component comprises exposure to the Global Smart Beta Strategy and the Equity Alpha component comprises exposures to the Global Equity Diversifier Strategy and the Equity Defensive Strategy. Deutsche Bank AG* is a pioneer in the Equity Risk Premia space, having been active in equity research since the early 2000s. Investable systematic derivatives and long-short factor indices date back to the early 2000s.

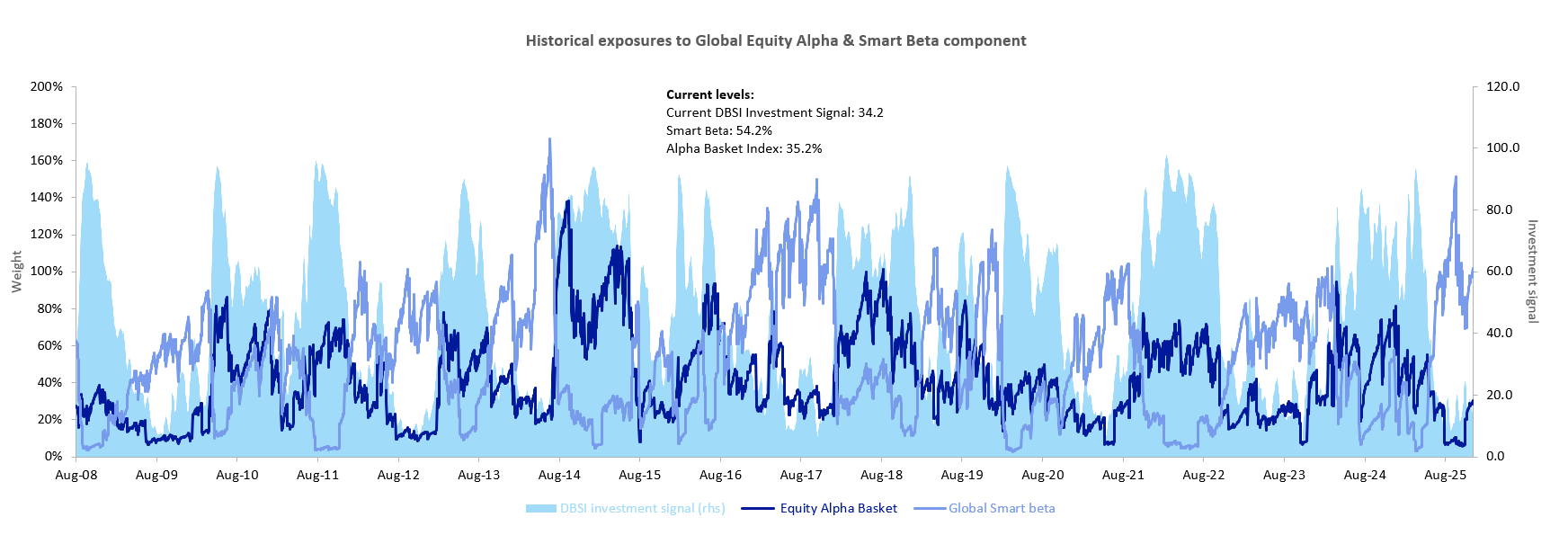

Exposures (Last 10 years) : Historical exposures* to Global Equity Alpha & Smart Beta components

This chart depicts the evolving exposures (over the most immediate 10-year period) to the Global Equity Beta and Alpha components within NYSE GEARS due to the dynamic capital allocation strategy, driven by the twin impacts of the market sentiment indicator and the daily risk management process.

*The NYGEARS Index was launched on [7/29/2025], and any performance or exposure prior to such date is hypothetical and purely for illustrative purposes. Exposures calculated as the product of component allocations as at last rebalance and current exposure within the volatility-targeted NYGEARS Index.

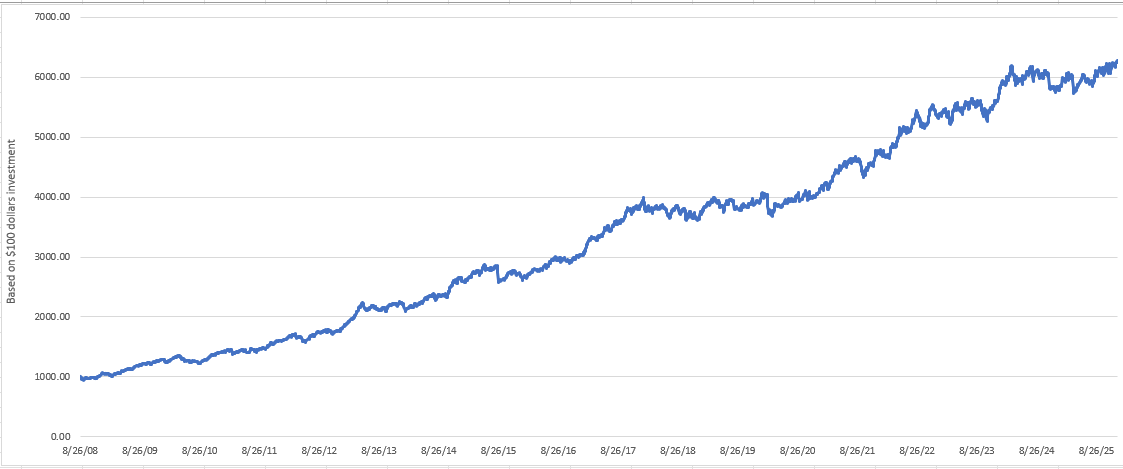

Historical performance

Monthly returns

Annual returns

| Year | 2008* | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Annual return | 2.95 | 24.58 | 9.11 | 14.92 | 9.83 | 27.33 | 17.57 | 3.4 | 10.04 | 28.57 | -3.99 | 7.52 | 4.29 | 16.8 | 12.09 | 5.28 | 4.18 | 6.59 |

The return shown here is the return over the period 8/27/2008-12/31/2008, and is not the annualized return based on that period. Data shown is for historical purposes only, does not represent and actual account, and is not the result of any actual trading. Actual investment outcomes may vary. Historical index performance is no guarantee of any future performance is no guarantee of any future performance.

This is an excess return index which, among other calculation elements that reduce index performance, does not allocate to any interest-bearing cash rate allocations. Because of this, an excess return version of an index will have lower performance than a total return version of the same index would, especially in high interest rate environments.