Q&A with an ETF expert:

Greg Sutton, Head of Portfolio Trading & ETF Issuer Sales Citadel Securities

August 27, 2020

Greg Sutton

Head of Portfolio Trading & ETF Issuer Sales Citadel Securities

NYSE Arca is the largest global ETF exchange, with the tightest spreads and greatest liquidity for ETF trading. We sat down with one of our Lead Market Maker firms, Citadel Securities, to discuss its entry into the ETF LMM business and how it views the future growth prospects for Active ETFs.

Citadel Securities is a leading market maker to the world’s institutions and largest Designated Market Maker on the New York Stock Exchange. What led to the decision to become a Lead Market Maker (LMM) in ETFs in 2018?

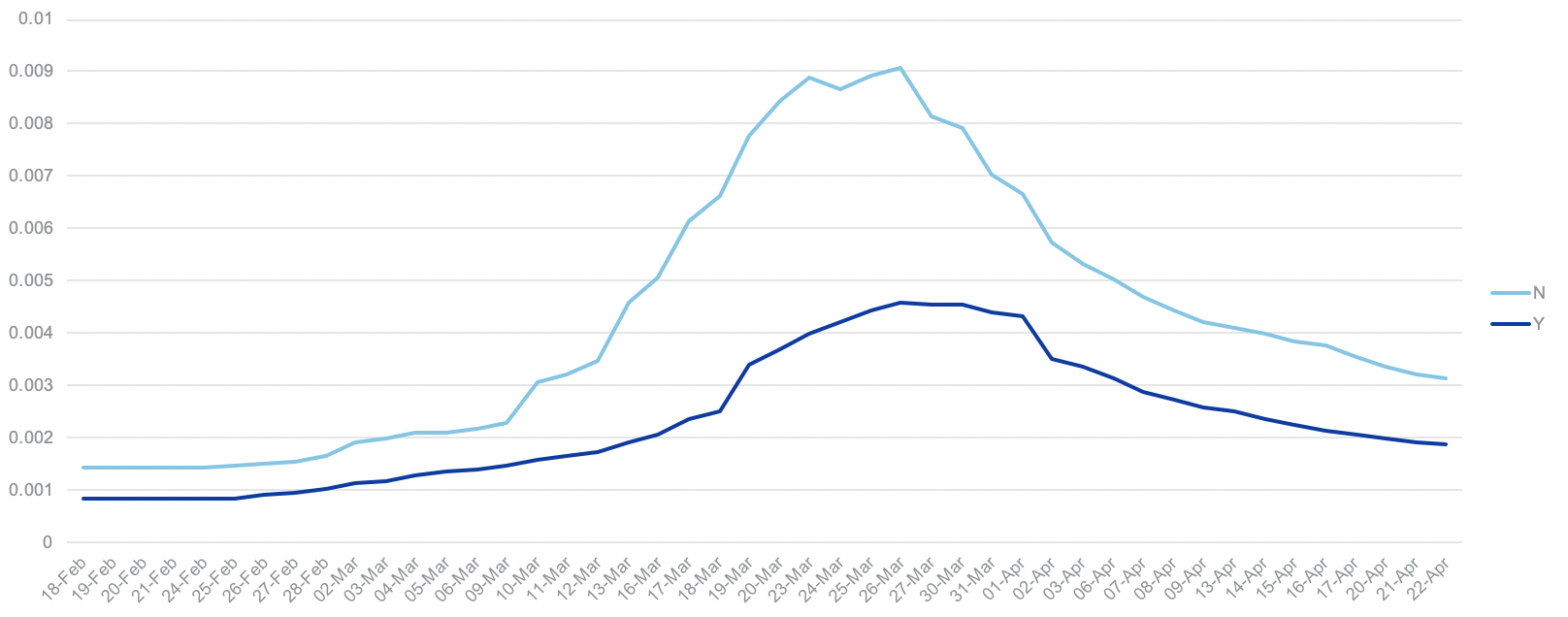

Becoming an LMM was a natural step in the evolution of our ETF business, which has grown significantly over the past five years. Our strategy is to expand into markets and asset classes where our strengths in technology, risk management and precision pricing can make the biggest impact on improving liquidity, and LMM is a great example. Our positive impact in this space was particularly apparent during the unprecedented volatility in March, when spreads on Citadel Securities LMM names were roughly half as wide as spreads on non-Citadel Securities names (chart below). Our ability to provide consistent pricing during this period directly benefited both investors and issuers, which we are incredibly proud of.

As you are assessing LMM opportunities or AP arrangements with new ETF sponsors, what criteria do you most often look to? Do these criteria vary by asset class and/or by management style (active vs. passive)?

We look at a number of criteria when evaluating opportunities but there are certainly a few core focuses, which are consistent across most of the products we trade.

From a trading standpoint, we want to make sure that we can effectively hedge in order to provide a fair price to the end investor. Effective hedging supports tighter and more consistent spreads, which are especially important at launch. Once a product becomes more active, native liquidity will naturally lead to even tighter spreads and we can better position ourselves relative to our normal arb bands.

We also want to gauge the sponsor’s ability to market the product effectively. Have they done their due diligence on the potential product and does it resonate with clients? Understanding the product development strategy and sales plan are important, so an effective ETF Capital Markets team is key.

Citadel Securities is currently acting as an LMM and actively participating in both ActiveShares and the NYSE proxy ETFs, what have your early observations been on the trading and adoption? What hurdles do you see on the horizon for these semi-transparent structures?

Trading in these products has been quite orderly so far and we are seeing consistent and gradual growth in demand for them. For the ActiveShares products, the VIIV (Verified Intraday Indicative Value) has been a very helpful reference point for our market making. For the NYSE proxy ETFs, American Century is providing a similar one-second Indicative Optimized Portfolio Value (IOPV) off the actual portfolio that has also been a very helpful reference point.

Potential challenges could include the influence of tracking error on larger positions, which could potentially result in higher risk premiums, as well as limitations in using the VIIV as a reference for non-dollar products.

The active ETF market now offers asset managers a lot of choice when they are considering product design. How has Citadel Securities navigated and prepared for the various structures that are in the market? How are you leveraging the various data attributes that are now required, i.e. VIIV, iNAV, Proxy Overlap, Tracking Error, etc.?

Our experience with the VIIV has been very positive so far and we see it as a reliable source of intraday data for underlying baskets.

Proxy overlap and tracking error are important metrics that we use to estimate variance between the ETF and our hedges and determine the amount of risk premium that we need to incorporate into our pricing.

As a trading firm, what guidance would you provide sponsors as they consider expanding their product offerings to include actively managed ETFs (either fully transparent or semi-transparent)?

It is important to have an effective ETF Capital Markets team that liaises directly with the market making community. Having discussions with market makers to assess potential bid-ask spreads and any challenges to providing liquidity in the product should be a key part of the product development process.

The primary audiences for these (Actively managed) products tend to be retail investors and retail advisors. As the largest retail equity market maker in the U.S. with approximately 40% market share, we feel it’s important to do as much as we can to ensure that these products are traded efficiently, and that client consistently have a positive trading experience.

Update on the newest active ETFs

On August 4, we welcomed the fifth semi-transparent issuer, T. Rowe Price, and their suite of four ETFs to NYSE Arca. Collectively, semi-transparent assets under management have reached nearly $500 million across 12 ETFs.

| Ticker | Name | AUM | Flows | Expense Ratio | Avg. Spread (bps) | ADV (shares) | Structure | LMM |

| FDG | American Century Focused Dynamic Growth ETF | $179,616,360 | $143,574,286 | 0.45% | 17.26 | 41,358 | ActiveShares | Citadel |

| FLV | American Century Focused Large Cap Value ETF | $81,497,208 | $73,580,499 | 0.42% | 17.8 | 21,479 | ActiveShares | Citadel |

| CFCV | ClearBridge Focus Value ETF | $2,824,124 | ($290) | 0.50% | 26.33 | 1,930 | ActiveShares | GTS |

| FBCG | Fidelity Blue Chip Growth ETF | $59,403,680 | $56,106,560 | 0.59% | 21.46 | 103,659 | Fidelity Proxy | GTS |

| FBCV | Fidelity Blue Chip Value ETF | $11,374,385 | $9,314,220 | 0.59% | 25.59 | 30,942 | Fidelity Proxy | GTS |

| FMIL | Fidelity New Millennium ETF | $8,806,085 | $6,657,715 | 0.59% | 23.5 | 20,927 | Fidelity Proxy | GTS |

| ESGA | American Century Sustainable Equity ETF | $81,974,784 | $74,206,204 | 0.39% | 14.14 | 70,605 | NYSE AMS | Citadel |

| MID | American Century Mid Cap Growth Impact ETF | $6,311,055 | $1,985,690 | 0.45% | 14.86 | 5,836 | NYSE AMS | Citadel |

| TCHP | T. Rowe Price Blue Chip Growth ETF | $17,107,200 | N/A** | 0.57% | 12.27 | 13,484 | T Rowe Proxy | Virtu |

| TDVG | T. Rowe Price Dividend Growth ETF | $15,909,200 | N/A** | 0.50% | 5.21 | 3,523 | T Rowe Proxy | RBC |

| TEQI | T. Rowe Price Equity Income ETF | $15,774,750 | N/A** | 0.54% | 12.75 | 2,337 | T Rowe Proxy | Virtu |

| TGRW | T. Rowe Price Growth Stock ETF | $16,188,200 | N/A** | 0.52% | 6.47 | 4,252 | T Rowe Proxy | RBC |

| Total/Average* | $496,787,031 | $365,424,883 | 0.51% | 16.47 | 320,338 |

Source: Factset & NYSE Internal Database and Consolidated Tape Statistics as of 8/21/2020

*Simple average

**Data unavailable at the time of publication

Over the last month, assets have increased by ~$120 million driven by ~$105 million in new cash flow to the proxy structure ETFs from three firms: new entrant T. Rowe Price (~$65 million), Fidelity (~$25 million) and American Century (~$15 million). Spreads remain under the active equity average of 45 bps and have tightened on a simple average basis to 16.5 bps from 20 bps. This tightening has been led by market making activity on T. Rowe’s new products by LMMs RBC and Virtu.

Active ETF Stat Pack

| Firms | |||

| # of Issuers | 78 | ||

| # of New Issuers 2020 | 13 | ||

| Products | Assets | ||

| # of ETFs | 394 | AUM ($B) | $131.95 |

| # of New Launches 2020 | 80 | 3 Yr AUM CAGR | 152% |

| Avg. ER | 0.50% | 5 Yr AUM CAGR | 48% |

| Cash Flow | Trading | ||

| YTD Cash Flow ($B) | $29.2 | YTD ADV (Shares) | 34,243,059 |

| 3 Yr Cash Flow | $89.5 | YTD ADV ($) | $1.39 B |

| 5 Yr Cash Flow | $107.2 | YTD Avg. Spread (bps)* | 44.66 |

Source: Factset & NYSE Internal Database and Consolidated Tape Statistics as of 8/21/2020

*Simple average