July 1, 2020

Active management is here to stay. The ETF Rule (SEC Rule 6c-11) approval has spurred this trend - levelling the playing field between ETFs and mutual fund investment strategies. Now, the first semi-transparent active ETF structures, potential for mutual fund-to-ETF conversion and emerging ETF product development, all support the rise of active management.

In the coming months, the New York Stock Exchange ETF team will provide updates, including standard “stat packs” and analysis of active ETF industry developments. Expect each note to be brief, informative and, dare we say, witty.

If you have feedback on this week’s note, topics you’d like covered or would like to contribute, please let us know.

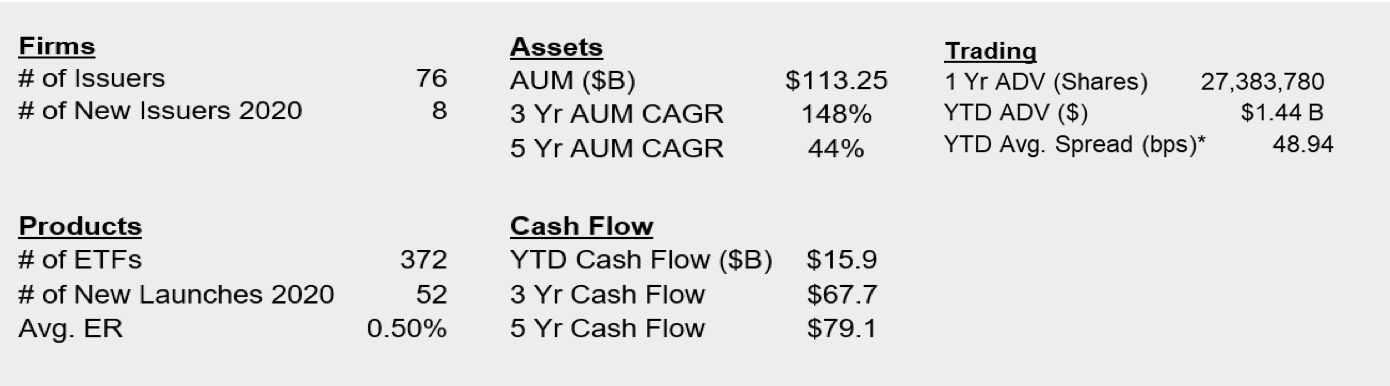

To kick things off, here’s a refresher on today’s active ETF market and how it has grown.

Refresher on the active ETF landscape

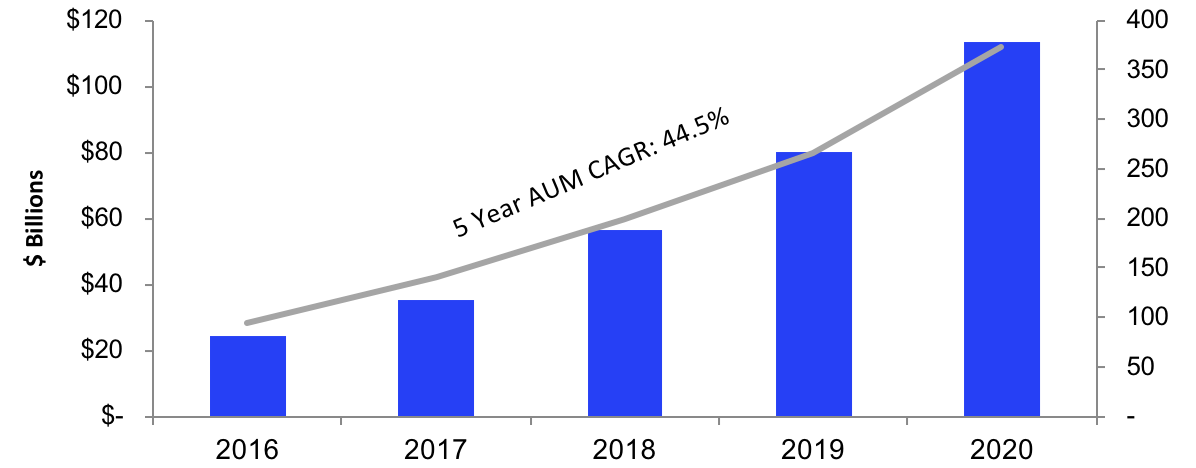

AUM and Product Growth

Source: Factset as of 6/12/2020

The industry has come a long way since Bear Stearns launched the first active fixed income ETF in 2007. Today, the industry has over $110 billion in AUM, 76 sponsors and includes 370+ ETFs across all asset classes.

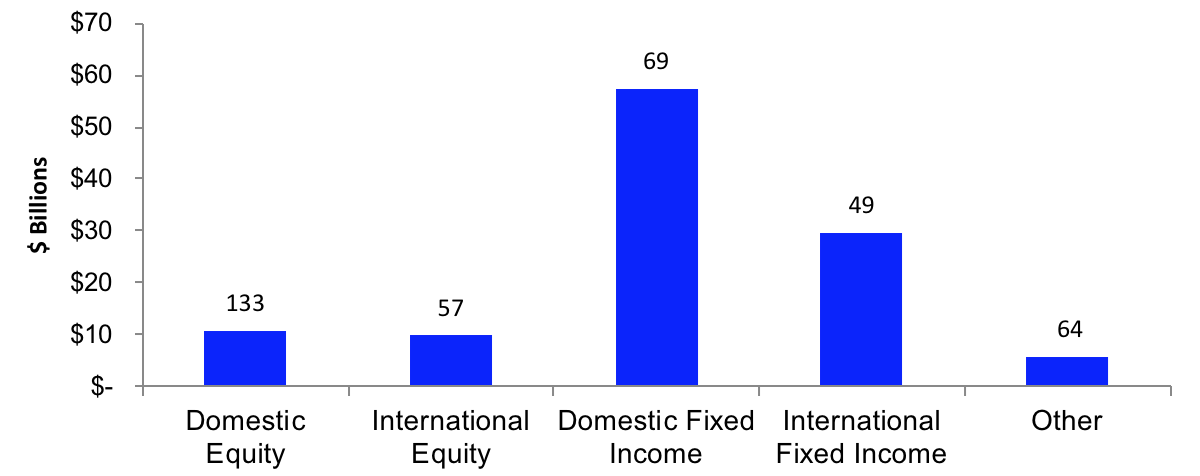

Active ETF AUM & Product Count by Asset Class

Source: Factset as of 6/12/2020

Today, industry assets are largely concentrated in fixed income strategies from First Trust, PIMCO, JP Morgan and iShares. Product development has been focused on equity strategies, while new product launches have outpaced their fixed income counterparts by nearly four to one over the last 18 months. Further, assets are far less concentrated in active strategies versus the broader ETF industry, with the top five issuers accounting for ~68% of assets compared with ~88% for the industry at large.

Top 5 Active ETF Issuers by AUM

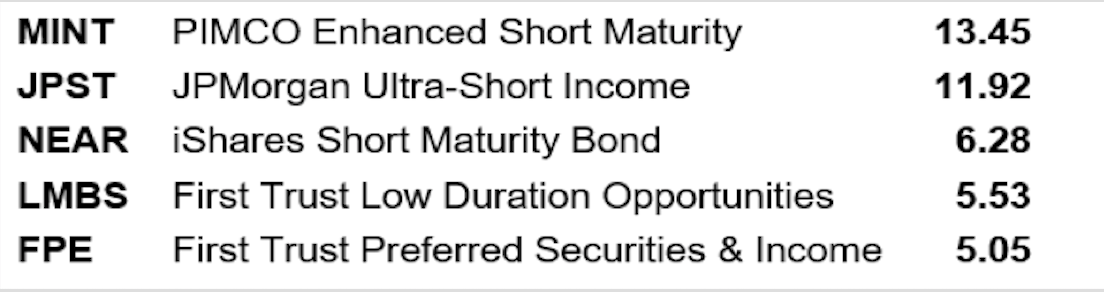

Top 5 Active ETFs by AUM ($B)

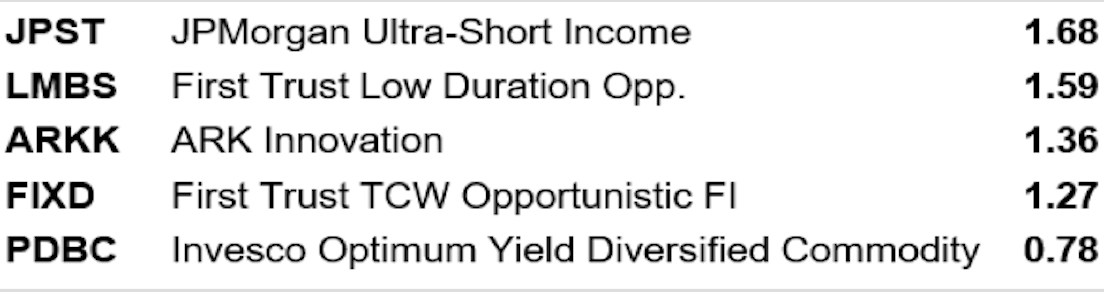

Top 5 Active ETFs by YTD Cash Flow ($B)

Active ETF Stat Pack

Top 5 Active ETF Issuers by AUM

Source: FactSet & NYSE Internal Database and Consolidated Tape Statistics as of 6/12/2020

*Simple average

In our next issue

An analysis of the NYSE Semi-Transparent Solution:

Building a Proxy with a Low Portfolio Overlap