ETF Expert Corner

Hear from key industry professionals as they provide their latest perspectives on the everchanging ETF marketplace.

Highlighting the latest and greatest ETFs, ETF360 brings you everything you need to know about newly NYSE-listed exchange traded funds, straight from the issuer.

This interview features Dan Phillips, Director of Asset Allocation Strategy at Northern Trust Asset Management, along with VettaFi Head of Research, Todd Rosenbluth, discussing the FlesShares US Quality Low Volatility Index Fund (QLV).

This interview features Simeon Hyman, Global Investment Strategist and Head of Investment Strategy at ProShares, along with VettaFi Head of Research, Todd Rosenbluth, discussing the ProShares S&P 500 Ex-Financials ETF (SPXN).

This interview features Johan Grahn, Head ETF Market Strategist at Allianz, along with VettaFi Head of Research, Todd Rosenbluth, discussing the AllianzIM U.S. Large Cap Buffer10 May ETF (MAYT) and the AllianzIM U.S. Large Cap Buffer20 May ETF (MAYW).

This interview features Chad Miller, Senior Portfolio Manager at Thrivent Asset Management, along with VettaFi Head of Research, Todd Rosenbluth, discussing the Thrivent Small Mid Cap ESG ETF (TSME).

This interview features Nick Childs, CFA, Portfolio Manager at Janus Henderson Investors, along with VettaFi Head of Research, Todd Rosenbluth, discussing the Janus Henderson JAAA AAA CLO ETF.

This interview features Brian Ellis, Executive Director at Morgan Stanley Investment Management, along with VettaFi Head of Research, Todd Rosenbluth, discussing the Calvert Ultra-Short Investment Grade ETF (CVSB).

This episode features Andrew Mattock, Portfolio Manager at Matthews Asia, along with VettaFi’s Head of Research, Todd Rosenbluth, discussing the Matthews China Active ETF (MCH).

Pimco's Amit Arora, portfolio manager of PRFD, and Philippe Bodereau, Head portfolio manager of PRFD, discuss thE PIMCO Preferred and Capital Securities Active ETF (PRFD) with VettaFi Head of Research, Todd Rosenbluth.

Alexandra Lawson, Fixed Income Portfolio Manager at Goldman Sachs Asset Management discusS the Goldman Sachs Access Fixed Income ETF Suite with VettaFi Head of Research, Todd Rosenbluth.

This interview features Dan Phillips, Director of Asset Allocation Strategy at Northern Trust Asset Management, along with VettaFi Head of Research, Todd Rosenbluth, discussing the FlesShares US Quality Low Volatility Index Fund (QLV).

This interview features Simeon Hyman, Global Investment Strategist and Head of Investment Strategy at ProShares, along with VettaFi Head of Research, Todd Rosenbluth, discussing the ProShares S&P 500 Ex-Financials ETF (SPXN).

This interview features Johan Grahn, Head ETF Market Strategist at Allianz, along with VettaFi Head of Research, Todd Rosenbluth, discussing the AllianzIM U.S. Large Cap Buffer10 May ETF (MAYT) and the AllianzIM U.S. Large Cap Buffer20 May ETF (MAYW).

This interview features Chad Miller, Senior Portfolio Manager at Thrivent Asset Management, along with VettaFi Head of Research, Todd Rosenbluth, discussing the Thrivent Small Mid Cap ESG ETF (TSME).

This interview features Nick Childs, CFA, Portfolio Manager at Janus Henderson Investors, along with VettaFi Head of Research, Todd Rosenbluth, discussing the Janus Henderson JAAA AAA CLO ETF.

This interview features Brian Ellis, Executive Director at Morgan Stanley Investment Management, along with VettaFi Head of Research, Todd Rosenbluth, discussing the Calvert Ultra-Short Investment Grade ETF (CVSB).

This episode features Andrew Mattock, Portfolio Manager at Matthews Asia, along with VettaFi’s Head of Research, Todd Rosenbluth, discussing the Matthews China Active ETF (MCH).

Pimco's Amit Arora, portfolio manager of PRFD, and Philippe Bodereau, Head portfolio manager of PRFD, discuss thE PIMCO Preferred and Capital Securities Active ETF (PRFD) with VettaFi Head of Research, Todd Rosenbluth.

Alexandra Lawson, Fixed Income Portfolio Manager at Goldman Sachs Asset Management discusS the Goldman Sachs Access Fixed Income ETF Suite with VettaFi Head of Research, Todd Rosenbluth.

| Date | Issuer | Speaker | Description | Link |

|---|---|---|---|---|

| 12/14/22 | Quadratic | Nancy Davis, Portfolio Manager, Quadratic | In this episode, Douglas Yones, head of exchange traded products at the New York Stock Exchange, is joined by Nancy Davis, portfolio manager for The Quadratic Interest Rate Volatility and Inflation Hedge ETF (IVOL) and The Quadratic Deflation ETF (BNDD), in discussing how her ETFs, IVOL and BNDD, fit within modern portfolios and how they differ from traditional investment options | |

| 11/9/22 | GraniteShares | William Rhind, Founder and CEO of Granite Shares | In this episode, Douglas Yones, Head of Exchange Traded Products at the New York Stock Exchange, is joined by William Rhind, Founder and CEO of Granite Shares, in discussing the ETF market and how to prepare for the remainder of the year. | |

| 10/28/22 | Cohen and Co | Camille Clemons, Executive Director, Business Development, Cohen & Company | In this episode, Douglas Yones, head of exchange traded products at the New York Stock Exchange, speaks with Camille Clemons, executive director of business development at Cohen & Company, on her entry to the ETF industry, how her team supports new firms entering the marketplace and her approach to supporting career growth across the industry. | |

| 9/28/22 | AllianceBernstein | Noel Archard, global head of ETF and portfolio solution at AllianceBernstein | In this episode, Douglas Yones, head of exchange traded products at the New York Stock Exchange, is joined by Noel Archard, global head of ETF and portfolio solution at AllianceBernstein, diving into the drive behind ETFs as an investment tool and how they fit within the current market environment. | |

| 9/21/22 | JP Morgan | Jed Laskowitz, global head of asset management solutions at J.P. Morgan Asset Management | In this episode, Douglas Yones, head of exchange traded products at the New York Stock Exchange, is joined by Jed Laskowitz, global head of asset management solutions at J.P. Morgan Asset Management, to discuss how ETFs can assist advisors in developing optimal portfolio strategies for the long term, regardless of market conditions. | |

| 8/29/22 | Defiance | Sylvia Jablonski, CEO and CIO of Defiance Investments | In this episode, Douglas Yones, Head of Exchange Traded Products at the New York Stock Exchange, is joined by Sylvia Jablonski, CEO and CIO of Defiance Investments, on how Defiance engages with investors in order to predict market and industry trends, with a focus on future growth, when selecting ETFs. | |

| 8/26/22 | DoubleLine | Jeffrey Sherman, Deputy Chief Investment Officer of DoubleLine | In this episode, Douglas Yones, Head of Exchange Traded Products at the New York Stock Exchange, is joined by Jeffrey Sherman, Deputy Chief Investment Officer of DoubleLine, on how DoubleLine focuses on changing market conditions in order to find opportunities in regardless of the capital market conditions. | |

| 7/28/22 | NightShares | Bruce Lavine, founder and CEO of NightShares | In this episode, Douglas Yones, head of exchange traded products at the New York Stock Exchange, talks to Bruce Lavine, founder and CEO of NightShares, about night trading sessions and their place as a unique option in an investment portfolio. | |

| 7/27/22 | ERShares | Dr. Joel Shulman, founder, CEO and CIO of ERShares | In this episode, Douglas Yones, head of exchange traded products at the New York Stock Exchange, speaks with Dr. Joel Shulman, founder, CEO and CIO of ERShares, on ETF investment options for the modern investor. | |

| 6/29/22 | Simplify | Brian Kelleher, Chief Revenue Officer, Simplify | In this episode, Douglas Yones, head of exchange traded products at the New York Stock Exchange, is joined by Brian Kelleher, chief revenue officer at Simplify Asset Management, to discuss Simplify’s ETF lineup, as well as the support and education available to advisors via their Advisor Hub platform. | |

| 6/22/22 | Janus Henderson | Nick Cherney, John Kerschner, Greg Kuhl, and Tim Gerrard | In this episode, Douglas Yones, head of exchange traded products at the New York Stock Exchange, is joined by the leadership team of Janus Henderson: Nick Cherney, head of exchange traded products; John Kerschner, portfolio manager for the JAAA CLO ETF; Greg Kuhl, portfolio manager for the JRE US Real Estate ETF; and Tim Gerrard, portfolio manager for the Net Zero Transition Resources ETF (JZRO). | |

| 6/13/22 | DWS | Arne Noack, head of systematic investment solutions, Americas at DWS Group | In this episode, Douglas Yones, head of exchange traded products at the New York Stock Exchange, is joined by Arne Noack, head of systematic investment solutions, Americas at DWS Group. Listen in as they discuss today’s market volatility, how to find opportunities for long term portfolios, and how ETFs can offer currency diversification alongside global investment capability. | |

| 5/31/22 | Direxion | David Mazza, Head of Product, Direxion | Direxion's David Mazza discusses capital markets, market trends and investment opportunities based on current and expected market volatility. | |

| 4/25/22 | SSGA | Michael Arone, Chief Investment Strategist and Managing Director, State Street Global Advisors | Michael Arone, Chief Investment Strategist and Managing Director, State Street Global Advisors | |

| 4/25/2022 | SSGA | Michael Arone, Chief Investment Strategist and Managing Director, State Street Global Advisors | State Street Global Advisors' Michael Arone reveals how the pandemic has impacted the way investors and advisors are building their portfolios, and shares his opinions on enhancing your portfolio as new variants emerge. | |

| 4/20/2022 | Franklin Templeton | Dina Ting, Head of Global index Portfolio Management, Franklin Templeton | In this episode, Douglas Yones, head of exchange traded products at the New York Stock Exchange, is joined by Dina Ting, head of global index portfolio management, Franklin Templeton. Dina shares how Franklin Templeton has grown, revealing its increased presence and focus on the ETF market while providing her best practices for advisors looking to invest in ETFs. | |

| 4/20/2022 | Dimensional | Lisa Dallmer, Chief Operating Officer, Dimensional Fund Advisors | In this episode, Lisa Dallmer, Chief Operating Officer, Dimensional Fund Advisors, shares her thoughts on ETFs through the multicultural viewpoint of Dimensional, revealing the role of technology in the expansion of ETFs as an investment class. She also discusses how Dimensional’s unique services across practice management, supports advisors and the growth of their business. | |

| 2/10/22 | PIMCO | David Braun, Head of U.S. Financial Institutions Portfolio Management, PIMCO | PIMCO's David Braun shares how PIMCO provides information to investors and advisors, revealing how the market has evolved amid the recession we experienced during COVID-19. | |

| 2/3/22 | Grayscale | David Lavelle, Global Head of ETFs, Grayscale | David LaValle, the global head of ETFs at Grayscale, shares his knowledge of ETFs, starting from his first experience trading ETFs on the floor of the exchange, to his current role building ETFs for Grayscale Investments. He reveals why Grayscale, the world’s largest asset manager of digital assets, entered the ETF market, how technology and finance are becoming intertwined, and what the future of investments holds for advisors and their clients. | |

| 2/3/22 | Invesco | David Lavelle, Global Head of ETFs, Grayscale | Invesco's David LaValle shares his knowledge of ETFs, starting from his first experience trading ETFs on the floor of the exchange, to his current role building ETFs for Grayscale Investments. He reveals why Grayscale, the world’s largest asset manager of digital assets, entered the ETF market, how technology and finance are becoming intertwined, and what the future of investments holds for advisors and their clients. | |

| 12/9/21 | Invesco | John Feyerer, Head, Innovation & Commercialization, Invesco | Invesco's John Feyerer discusses how ETFs have been adopted by investors, the approach Invesco focuses on when advising clients and what they are looking toward in 2022 | |

| 11/30/21 | KraneShares | Jonathan Krane, CEO, KraneShares | KraneShares CEO Jonathan Krane discusses his predictions for the future of investments in China and reveals the opportunities investors may be missing out on today. | |

| 11/24/21 | Van Eck | Jan Van Eck, CEO, VanEck | Jan van Eck shares his knowledge of global ETFs, his current favorites and the transformation this investing structure has undergone and will continue to undergo as the economy adapts to world events. |

Hear from key industry professionals as they provide their latest perspectives on the everchanging ETF marketplace.

Recently launched ETFs for our May episode are focused artificial intelligence (AI), high income and dividend strategies and the human capital factor.

Recently launched ETFs for our April episode are focused on active management in core large cap equities, aggressive value tactics for equity investors and strategic exposure to commodities.

Recently launched ETFs for our March episode are focused on commodities targeting the energy transition megatrend and actively managed investing strategies for fixed income investors.

Recently launched ETFs for our February program are focused on sustainable investing, commodities that target the clean energy revolution and hedge fund replicators powered by AI/machine learning.

Recently launched ETFs for our January show are focused on investing strategies like volatility and portfolio hedging, ESG investing with AI/ML (artificial intelligence and machine learning) and income strategies from the fast moving renewable energy sector.

Stephanie Stanton examines new ETFs from Angel Oak Capital (CARY), Thor Financial Technologies (THLV) and Zega Financial (TSLY), focusing on investing strategies like volatility hedging, securitized credit in the bond market and alternative income sources from covered call strategies.

Stephanie Stanton examines new ETFs from Bitwise Asset Management (BWEB) and Advocate Capital Management (RRH), covering investing categories like Web3 and investment strategies for hedging against higher interest rates.

Stephanie Stanton examines new ETFs from AllianceBernstein, PGIM and NEOS Investments. The October program's roster of newly launched ETFs covers investing categories like actively managed short-term bonds, floating rate bonds and enhanced yield cash strategies.

Stephanie Stanton talks with Lance McGray, Head of ETFs at Advisors Asset Management, about stubborn inflation and dividend income strategies in the ETF marketplace for combating it. Financial advisors and investors will get insights and ETF strategies for neutralizing higher inflation, rising interest rates and how dividend income could buffer stock market volatility.

Recently launched ETFs for our May episode are focused artificial intelligence (AI), high income and dividend strategies and the human capital factor.

Recently launched ETFs for our April episode are focused on active management in core large cap equities, aggressive value tactics for equity investors and strategic exposure to commodities.

Recently launched ETFs for our March episode are focused on commodities targeting the energy transition megatrend and actively managed investing strategies for fixed income investors.

Recently launched ETFs for our February program are focused on sustainable investing, commodities that target the clean energy revolution and hedge fund replicators powered by AI/machine learning.

Recently launched ETFs for our January show are focused on investing strategies like volatility and portfolio hedging, ESG investing with AI/ML (artificial intelligence and machine learning) and income strategies from the fast moving renewable energy sector.

Stephanie Stanton examines new ETFs from Angel Oak Capital (CARY), Thor Financial Technologies (THLV) and Zega Financial (TSLY), focusing on investing strategies like volatility hedging, securitized credit in the bond market and alternative income sources from covered call strategies.

Stephanie Stanton examines new ETFs from Bitwise Asset Management (BWEB) and Advocate Capital Management (RRH), covering investing categories like Web3 and investment strategies for hedging against higher interest rates.

Stephanie Stanton examines new ETFs from AllianceBernstein, PGIM and NEOS Investments. The October program's roster of newly launched ETFs covers investing categories like actively managed short-term bonds, floating rate bonds and enhanced yield cash strategies.

Stephanie Stanton talks with Lance McGray, Head of ETFs at Advisors Asset Management, about stubborn inflation and dividend income strategies in the ETF marketplace for combating it. Financial advisors and investors will get insights and ETF strategies for neutralizing higher inflation, rising interest rates and how dividend income could buffer stock market volatility.

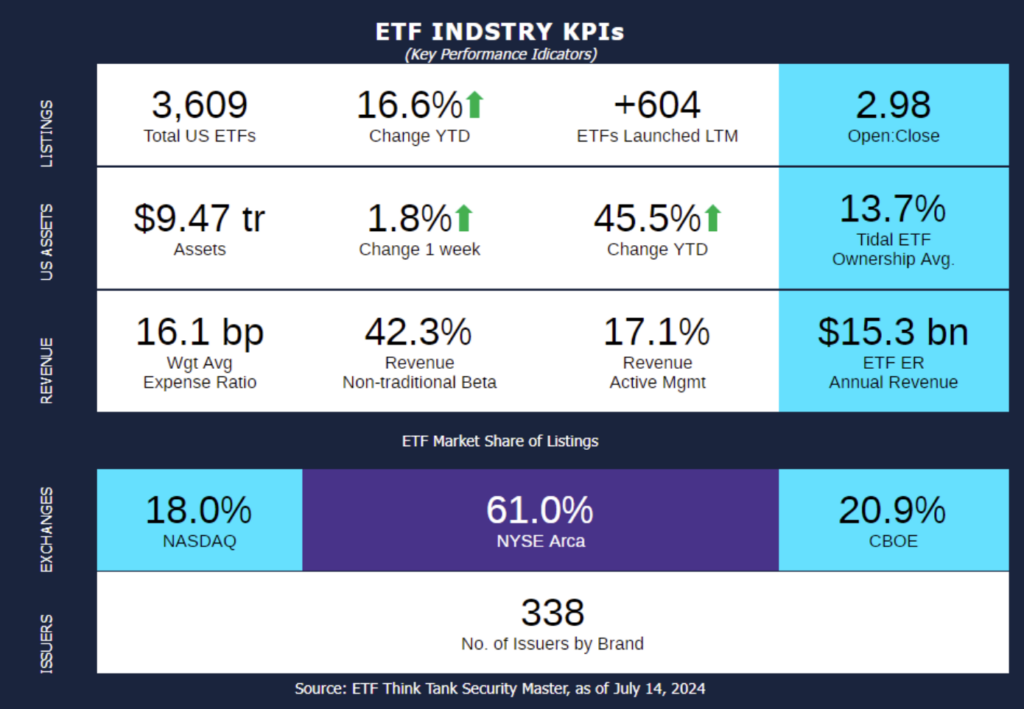

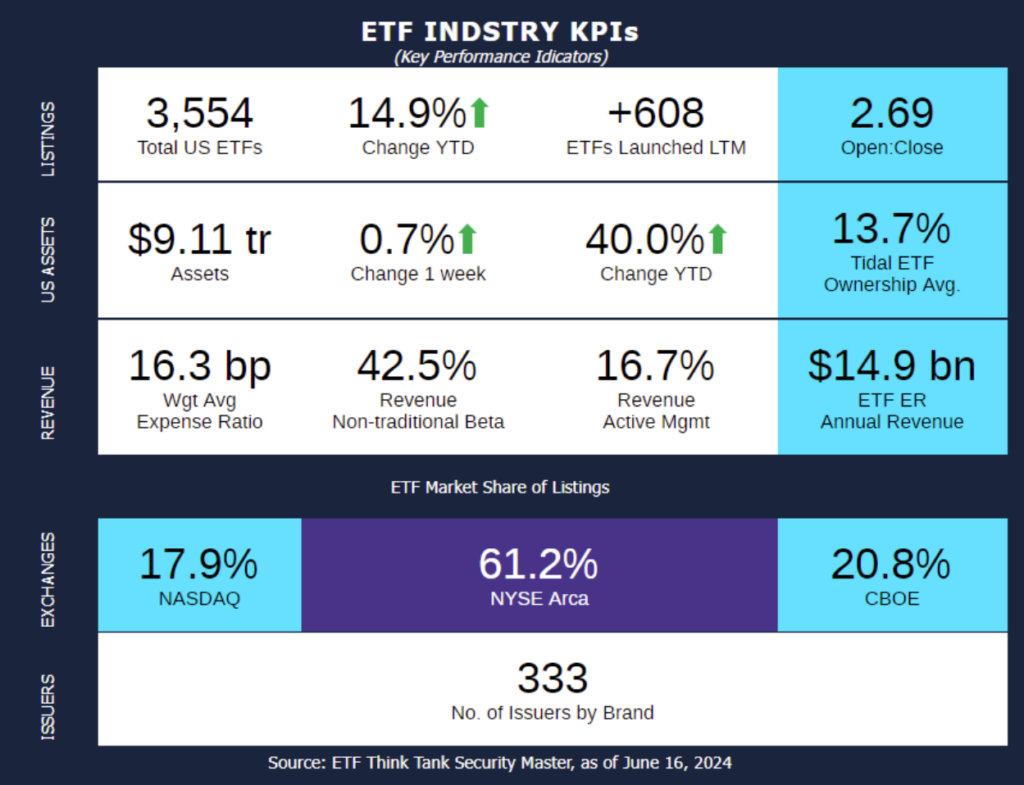

ETF Industry KPI's

by Michael Venuto of ETF Think Tank

Week of July 8, 2024 KPI Summary

- The 1 Year Open-to-Close ratio has risen to 2.98, marking a significant year-over-year increase from 2.02.

- Total US ETFs increased to 3,609, a +12.9% YoY Increase.

- SS&C ALPS Advisors: SS&C ALPS Advisors, a subsidiary 100% owned by SS&C Technologies Holdings, has collaborated with CoreCommodity Management to introduce the ALPS CoreCommodity Natural Resources ETF (CCNR). The Fund utilizes a “pure play” strategy, concentrating on equity securities of upstream commodity producers to gain exposure to natural resources. Assets under management (AUM) for this fund have already exceeded $300 million.

- Cambria: Cambria launched the Cambria Large Cap Shareholder Yield ETF (LYLD), which is the 5th ETF to join their Shareholder Yield suite, that has a combined total of ~$2b AUM. This ETF targets large-cap companies that prioritize high-cash distribution to investors through three methods: dividends, buybacks, and debt reduction, collectively referred to as shareholder yield.

- REX Shares Joins the Leveraged Bitcoin Market: REX Shares launched 2 new enhanced bitcoin strategies: the T-REX 2X Long Bitcoin Daily Target ETF (BTCL) and the T-REX 2X Inverse Bitcoin Daily Target ETF (BTCZ), providing 200% and -200% exposure to Bitcoin’s daily performance. REX Shares will directly compete with ProShares & Volatility Shares who currently offer their own enhanced products revolving around Bitcoin.

- 2 ETF Issuer Debuts:

- Draco Capital Partners, headed by Jack Fu and YouTube co-founder Steve Chen, debuted their inaugural investment offering, the Draco Evolution AI ETF (DRAI). This ETF blends a proprietary artificial intelligence model with macroeconomic quantitative models and aims to allocate investments across diverse asset classes such as commodities, bonds, and equities.

- Ocean Park Asset Management, established in 1987 and overseeing ~$5 billion in AUM, recently introduced their inaugural suite of 4 ETFs. These ETFs utilize decades of strategic research and employ a tactical, rules-based investment methodology across domestic, international and income-based strategies.

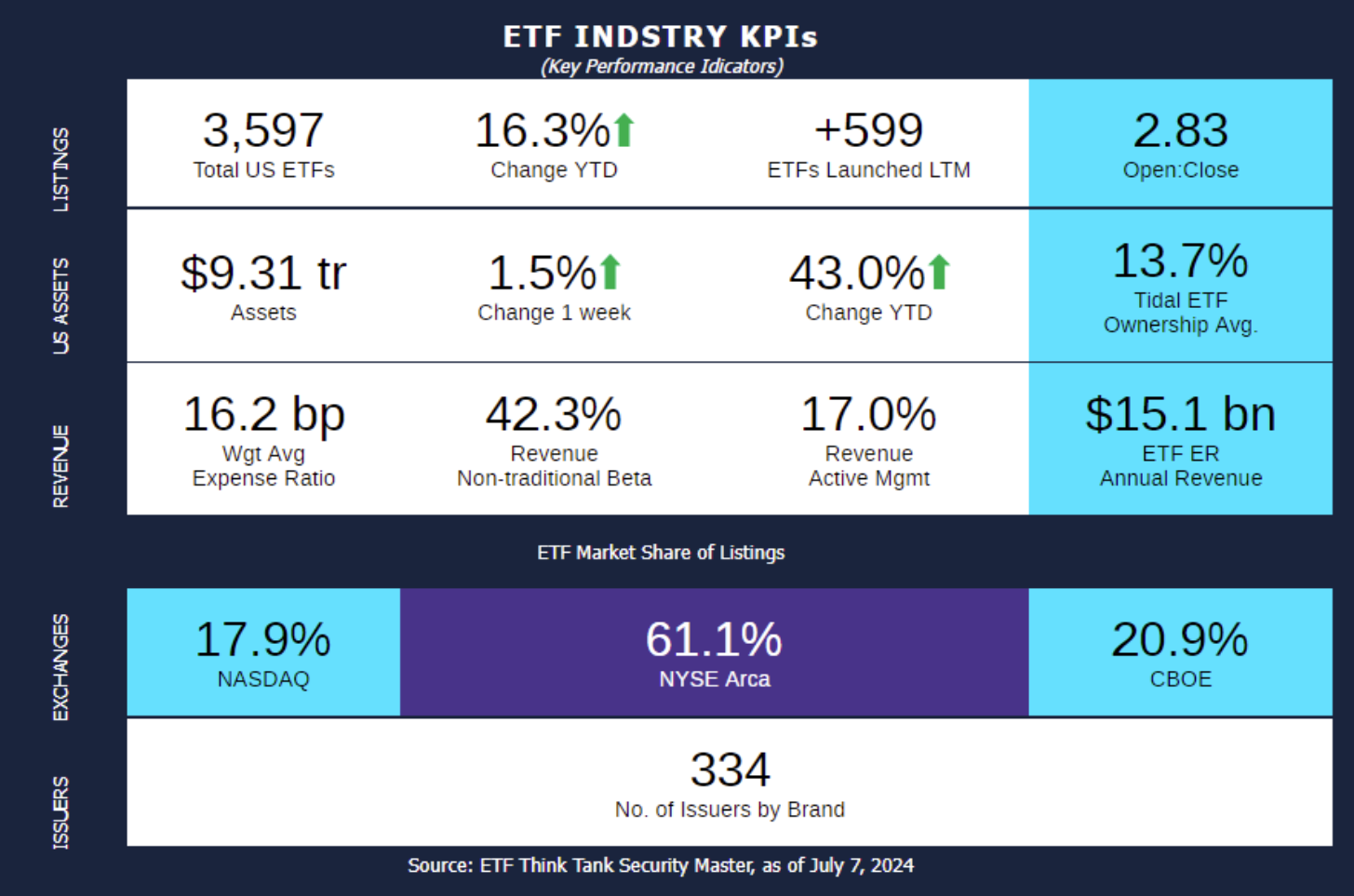

Week of July 1, 2024 KPI Summary

This week, the ETF industry experienced 16 ETF launches and 0 closures.

- 1 Year Open-to-Close ratio is upheld at 2.83.

- Total US ETFs increased to 3,597, a +12.7% YoY Increase.

Our Toroso ETF Industry Index, which tracks companies generating revenue from the ETF ecosystem, rose 0.90% last week, underperforming the S&P Financial Select Sector Index, which rose by 1.00%.

ETF listings in the first week of July highlight the growing prevalence of Buffer ETFs.

- Innovator ETFs: Innovator started the month on a high note, introducing 9 new ETFs on July 1st. Innovator listed 3 new 100% Buffer ETFs and 6 other Buffer and Buffer Income ETFs.

- iShares: iShares debuted its first buffer ETF, the iShares Large Cap Max Buffer Jun ETF (MAXJ), offering 11.14% potential upside exposure to an S&P 500 ETF while protecting 100% against downside performance.

- Calamos Investments: Calamos released the first ETF to provide 100% downside protection to Russell 2000 over a one-year period, (CPRJ).

A buffer ETF is designed for investors to benefit from potential market gains while limiting downside risk within a specified range or “buffer zone”. Buffer ETFs often reset periodically, adjusting their protection levels based on market conditions or predetermined dates.

The “Buffer ETF” sector has expanded significantly since its inception in 2018, now comprising over 250 ETFs with nearly $50 billion in assets.

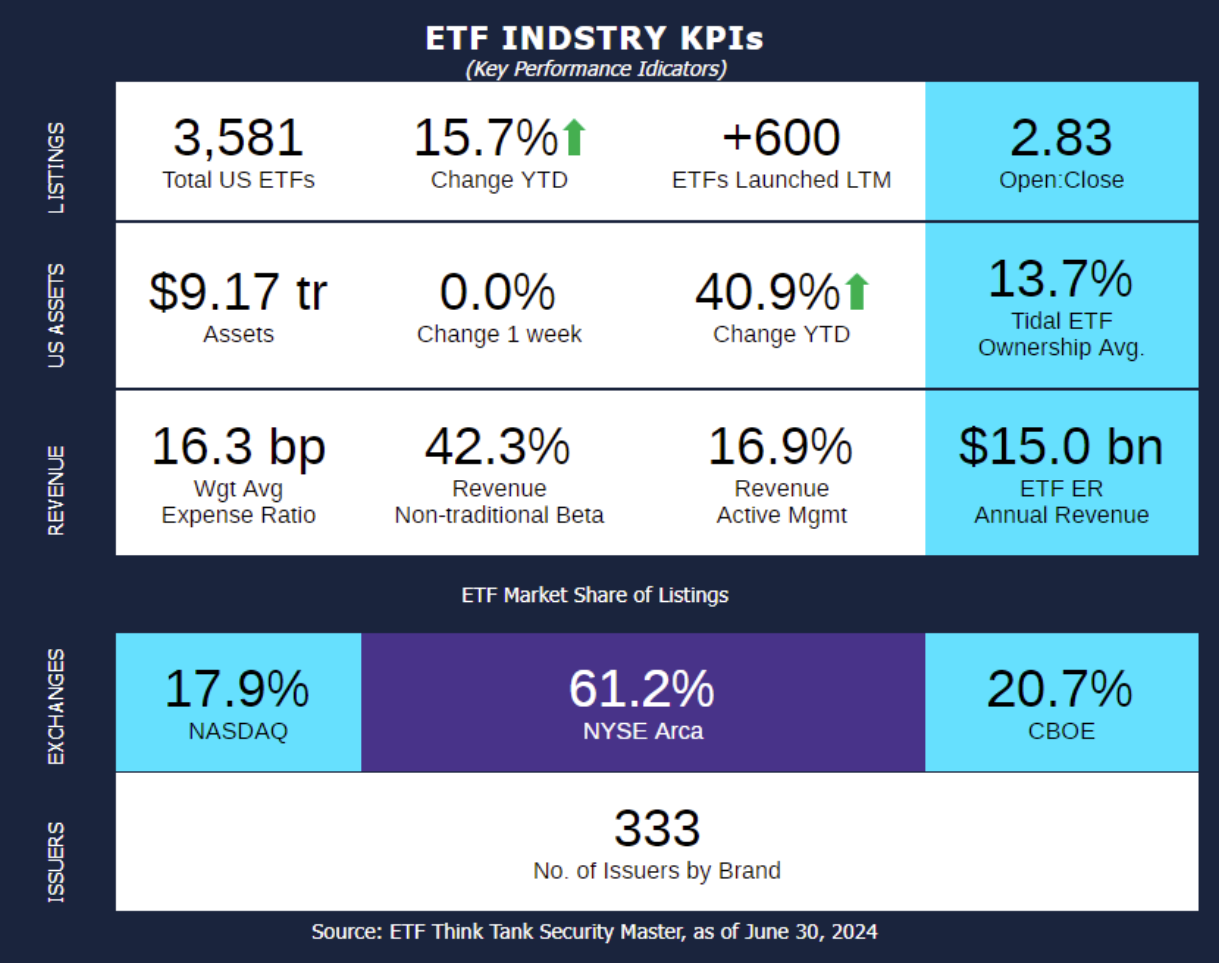

Week of June 24, 2024 KPI Summary

This week, the ETF industry experienced 22 ETF launches and 1 closure, shifting the 1-year Open-to-Close ratio to 2.83 and total US ETFs to 3,581.

Our Toroso ETF Industry Index, which tracks companies generating revenue from the ETF ecosystem, rose 0.33% last week, outperforming the S&P Financial Select Sector Index, which declined by 0.19%.

Notable ETF listings in the last week of June include:

- TCW Flexible Income ETF (FLXR): TCW converted their mutual fund MetWest Flexible Income Fund (MWFEX) to an ETF, bringing over $335m of existing AUM, making this their 2nd biggest ETF.

- First Trust S&P 500 Economic Moat ETF (EMOT): Designed to identify and measure companies with sustainable competitive advantages, this ETF may compete with the popular VanEck Morningstar Wide Moat ETF (MOAT) which currently has ~$14b AUM.

- Capital Group ETFs: Capital Group introduced seven new active, transparent ETFs, including four equity and three fixed income ETFs, listed on the NYSE, bringing their total ETFs to 21 with AUM totaling $30b.

- YieldMax: YieldMax ETFs has expanded its ETF lineup to 27 funds in under 2 years, attracting support from retail investors and reaching $3.8 billion in assets under management (AUM).

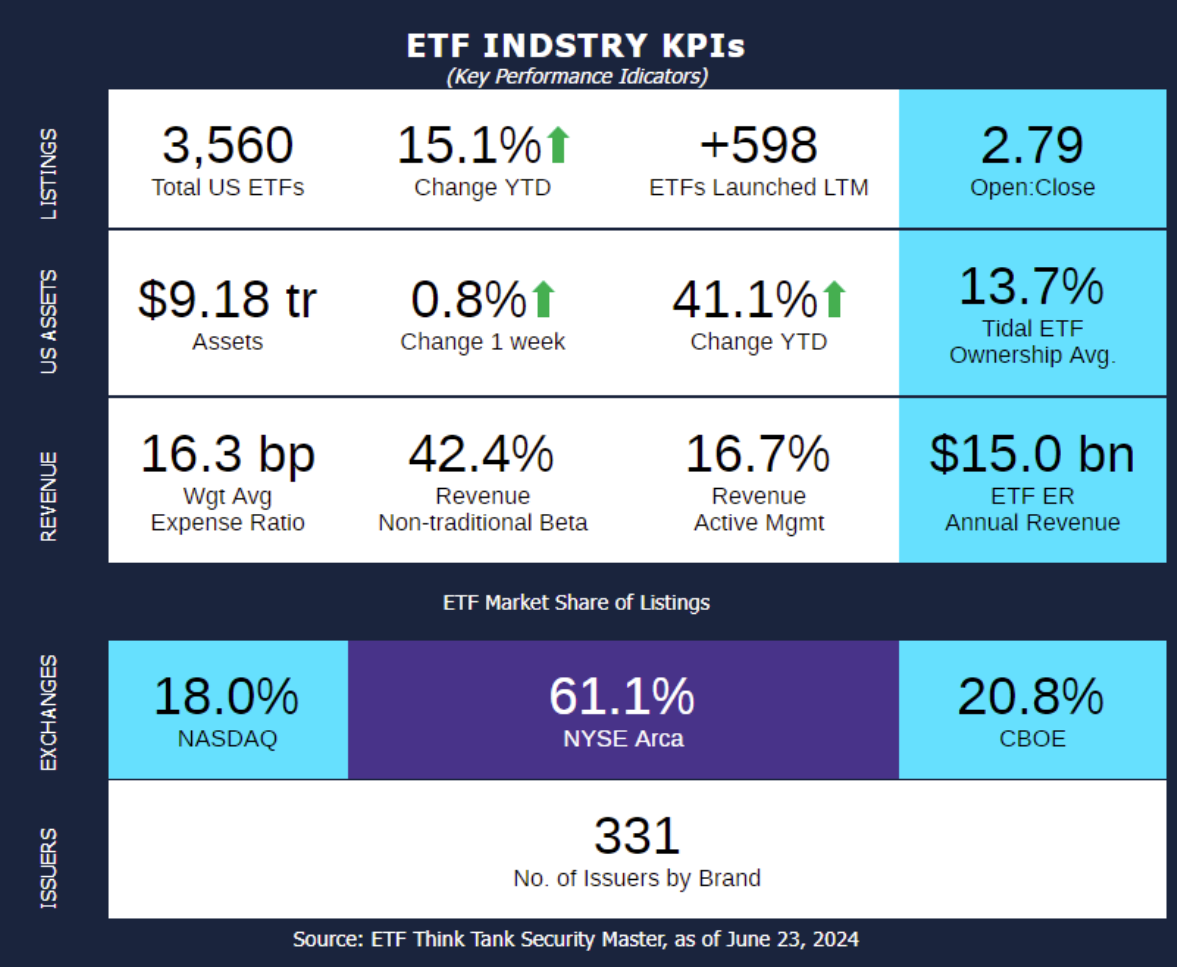

Week of June 17, 2024 KPI Summary

- This week, the industry experienced 5 ETF launches and 0 closures, shifting the 1-year Open-to-Close ratio to 2.79 and total US ETFs to 3,560.

- It’s the last week of June, schools are out, and Summer has begun! Many Americans will take a vacation during the summer months, so let’s take a look at the 5 non-leverage Travel and Leisure ETFs.

- The category has $385 Million across the 5 funds, with a large majority ($260 Million) in Invesco’s PEJ which was launched in 2005. The remaining 4 funds (AWAY, BEDZ, CRUZ, JRNY) are all from different Issuers and have been launched in the last 5 years.

- Last year at this time, the category constituted $571 Billion with PEJ managing $400 Million. In June 2022, the category totaled $1.39 Billion.

- Although the category is down 33%, the average revenue is up 1.6% YTD. PEJ leads the pack at 6.7% total revenue YTD.

- The average expense ratio of the category shifted from 67.8 bps to 68.6 bps in one year.

- All 5 of these ETFs are traded on the NYSE.

- As COVID restrictions and fear have all but disappeared in the last two years, the Travel and Leisure ETF category has plummeted 72% in revenues, a surprising dichotomy. Let us know what other sectors have seen this kind of drawback post-COVID.

- The tracked indexes had very similar experiences over the last week. Toroso ETF Industry Index was up 1.56% while the S&P Financial Select Sector Index led at 1.70%.

Week of June 10, 2024 KPI Summary

- This week, the industry experienced 12 ETF launches and 2 closures, shifting the 1-year Open-to-Close ratio to 2.69 and total US ETFs to 3,554.

- Happy Summer everyone! This Thursday, June 20, is the first day of summer. While Winter 2024 was hot with assets (+8.0%), let’s see how Spring 2024 fared (data comparing 3/18/2024 to 6/17/24).

- 5.1% increase in total assets (~$442 Bn) and a 3.2% increase in total US ETFs (+109).

- For comparison, Spring 2023 had 10.0% asset increase and +56 in ETFs.

- The ETF expense ratio 12-month revenue increased from $13.8 Bn to $14.9 Bn.

- Revenue from Active Management increased from 16.1% to 16.7% during the 3-month span.

- Issuers increased +18 (315 to 333). For comparison, Winter 2024 was +11.

- The National Oceanic and Atmospheric Administration released an article last week stating: “The average global May temperature was 2.12 degrees F (1.18 degrees C) above the 20th-century average of 58.6 degrees F (14.8 degrees C), ranking as the warmest May in NOAA’s 175-year global record. May 2024 marked the 12th-consecutive month of record-high temperatures for the planet.”

- While it hasn’t been 12 consecutive months of positive assets in the ETF industry, it has been positive 11 of the last 15 months and, more pertinently, a ‘hot’ Spring after a red hot Winter of growth with 5.1% assets increase and more new ETFs than Spring days!

- The tracked indexes had very different experiences over the Spring. Toroso ETF Industry Index was up 2.31% while the S&P Financial Select Sector Index trailed at -0.04%.

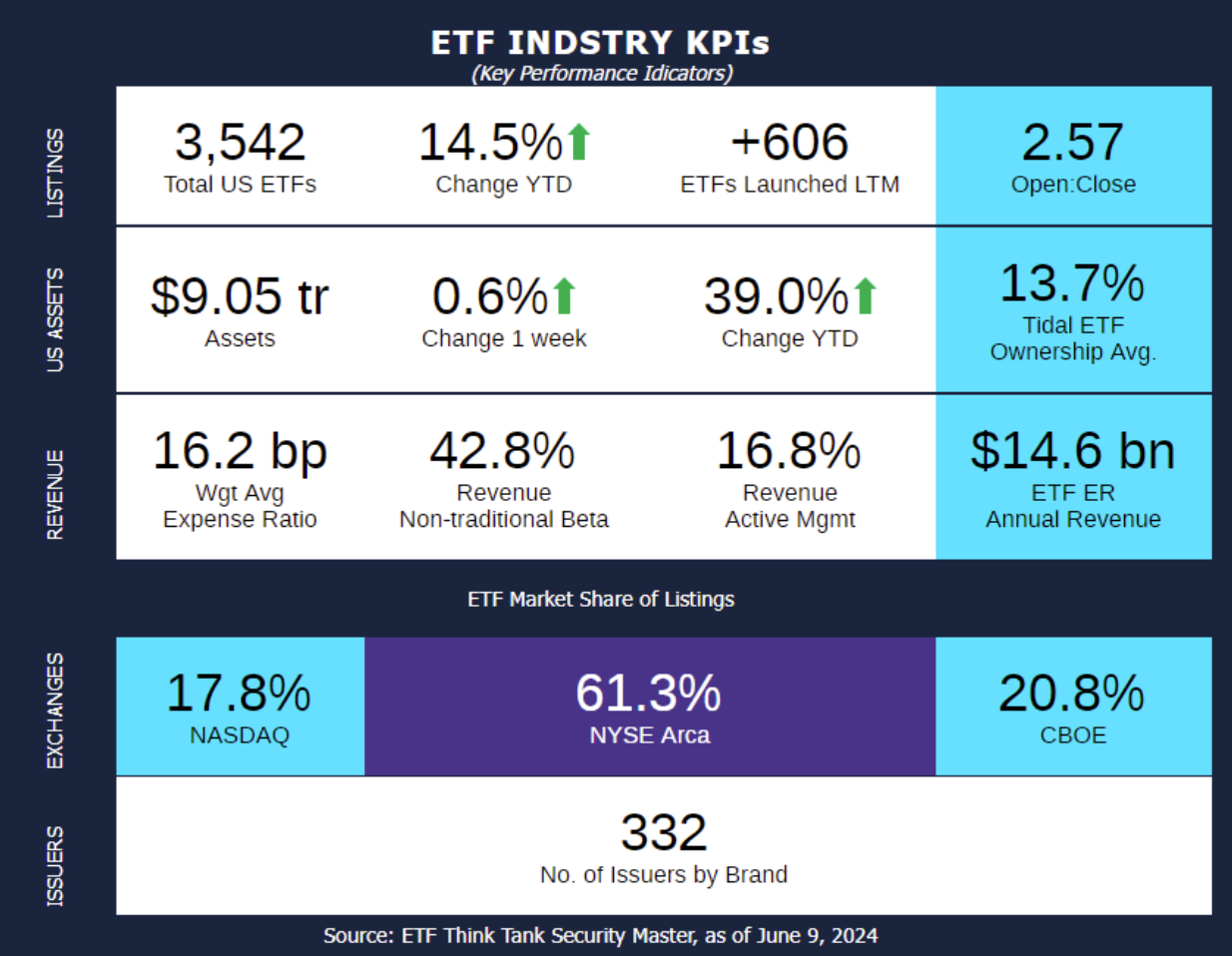

Week of June 3, 2024 KPI Summary

- This week, the industry experienced 15 ETF launches and 2 closures, shifting the 1-year Open-to-Close ratio to 2.57 and total US ETFs to 3,542.

- Here are a few KPI data points that jump out this week:

- In the last 52 weeks, there have been only 17 negative 1-week returns in the ETF industry. Therefore, over two-thirds of our KPI images have noted increases 1-week AUM change.

- All-time highs:

- There have been 606 ETFs Launched in the last 12-months.

- $9.05 Trillion AUM and 3,542 total ETFs are both all-time highs.

- 16.8% revenue from Active ETFs.

- As of 2 years ago, this number was 11.2% and June 2023 it was 13.2%. By the end of 2025, Active ETFs will likely represent ~20% of revenue, taking market share disproportionately from the Traditional ETF category.

- The current open-to-close ratio is 2.57 – we haven’t seen one that high since February 19, 2023. The lowest point during this 16-month period was 1.81 in September 2023.

- The tracked indexes had similar experiences this week. The Toroso ETF Industry Index was down -0.90% while the S&P Financial Select Sector Index led at -0.40%.

Interviews with key industry professionals who highlight funds listed on the NYSE and trends that are transforming the ETF landscape.

Chad Miller, Senior Portfolio Manager at Thrivent, discusses the benefits of actively managed, semi-transparent ETFs and Thrivent's Small-Mid Cap ESG ETF. Gain insights into their unique process that capitalizes on stakeholder value and commitment to sustainability.

Joel Hirsh, CFA, Co-CIO, Kovitz Investment Group Partners discusses the Kovitz Core Equity ETF (EQTY), built to be the core compounding vehicle in a portfolio, and how the fund’s focus on fundamentals might actually benefit from a higher rate environment.

Chris Dahlin, Factor & Core Equity Strategist for Invesco discusses the Invesco S&P 500® Equal Weight ETF (RSP), the first Smart Beta ETF ever launched - on it’s 20th anniversary - including the thought process behind the fund’s origination, why it’s had staying power, and how it is still helping investors.

Sandra Testani, CFA, CAIA, Vice President, ETF Product and Strategy for American Century Investments discusses the newly launched Multisector Floating Income ETF (ticker: FUSI), which seeks to complement an investor's core bond holdings with current income, broad diversification, and the potential to mitigate the impact of rising rates.

Jay Pestrichelli, CEO of ZEGA Financial, discusses the launch of their two single-stock, option income strategy ETFs, TSLY and OARK. And Goldman Sachs Asset Management Portfolio Manager, Alexa Gordon, introduces the newly launched, tax free income strategy, GS Community Municipal Bond ETF (GMUN).

Philippe Bodereau, Portfolio Manager & Head of Credit Research Europe for PIMCO discusses the advantages of preferred securities and PIMCO’s ETF (PRFD). Douglas Yones, ChFC, Head of Exchange Traded Products at The New York Stock Exchange discusses ETF trends to look out for in 2023 and the advantages of bringing ETF trading back to the most famous trading floor in the world.

James Seyffart, CFA, CAIA, ETF Research Analyst for Bloomberg Intelligence shares a recap of ETF trends in 2022 and what to expect in 2023, followed by Ed Coyne, Senior Managing Director of Global Sales for Sprott doing the same for precious metals related to the energy transition.

Tim Coyne, Global Head of Exchange Traded Funds at T. Rowe Price, and Bill Sokol, VP, Director of Product Management at VanEck, take a closer look at the use case for CLOs and high-yield bonds.

Nick Elward, ETF head of strategy at Natixis, shares the top concerns he is hearing from investors and why concentrated equity strategies are in such high demand. Nick Cherney, Head of Exchange Traded Products at Janus Henderson Investors, also discusses CLOs and other assets in demand for fighting inflation.

Chad Miller, Senior Portfolio Manager at Thrivent, discusses the benefits of actively managed, semi-transparent ETFs and Thrivent's Small-Mid Cap ESG ETF. Gain insights into their unique process that capitalizes on stakeholder value and commitment to sustainability.

Joel Hirsh, CFA, Co-CIO, Kovitz Investment Group Partners discusses the Kovitz Core Equity ETF (EQTY), built to be the core compounding vehicle in a portfolio, and how the fund’s focus on fundamentals might actually benefit from a higher rate environment.

Chris Dahlin, Factor & Core Equity Strategist for Invesco discusses the Invesco S&P 500® Equal Weight ETF (RSP), the first Smart Beta ETF ever launched - on it’s 20th anniversary - including the thought process behind the fund’s origination, why it’s had staying power, and how it is still helping investors.

Sandra Testani, CFA, CAIA, Vice President, ETF Product and Strategy for American Century Investments discusses the newly launched Multisector Floating Income ETF (ticker: FUSI), which seeks to complement an investor's core bond holdings with current income, broad diversification, and the potential to mitigate the impact of rising rates.

Jay Pestrichelli, CEO of ZEGA Financial, discusses the launch of their two single-stock, option income strategy ETFs, TSLY and OARK. And Goldman Sachs Asset Management Portfolio Manager, Alexa Gordon, introduces the newly launched, tax free income strategy, GS Community Municipal Bond ETF (GMUN).

Philippe Bodereau, Portfolio Manager & Head of Credit Research Europe for PIMCO discusses the advantages of preferred securities and PIMCO’s ETF (PRFD). Douglas Yones, ChFC, Head of Exchange Traded Products at The New York Stock Exchange discusses ETF trends to look out for in 2023 and the advantages of bringing ETF trading back to the most famous trading floor in the world.

James Seyffart, CFA, CAIA, ETF Research Analyst for Bloomberg Intelligence shares a recap of ETF trends in 2022 and what to expect in 2023, followed by Ed Coyne, Senior Managing Director of Global Sales for Sprott doing the same for precious metals related to the energy transition.

Tim Coyne, Global Head of Exchange Traded Funds at T. Rowe Price, and Bill Sokol, VP, Director of Product Management at VanEck, take a closer look at the use case for CLOs and high-yield bonds.

Nick Elward, ETF head of strategy at Natixis, shares the top concerns he is hearing from investors and why concentrated equity strategies are in such high demand. Nick Cherney, Head of Exchange Traded Products at Janus Henderson Investors, also discusses CLOs and other assets in demand for fighting inflation.

Hear from issuers as they take a deep dive into ETFs and industry topics on The Exchange.

Everything you need to know about the latest NYSE-listed ETFs.

Douglas Heske, CEO of Newday talks with Vincent Molinari on this episode of ETF Rundown. Douglas shares about the Newday Ocean Health ETF AHOY, how Newday goes beyond investments, their investing mechanism, and the other ETFs they hold.

Simeon Hyman, Head of Investment Strategy Group and Global Investment Strategist of ProShares, talks with Vice Molinari on this ETF Rundown episode about BITI – Bitcoin Short Strategy ETF, BITO – Bitcoin Strategy ETF, and how investors can utilize both of this ETFs Strategies.

Rohan Reddy, Director of Research of Global X joins Vince Molinari on the ETF Rundown to give us an insightful breakdown of Beyond Ordinary ETFs from Global X, how they democratize complex ETF strategies, and why retail investors are doubling down on ETFs.

In this episode of ETF Rundown with Vince Molinari, we talk with Jerry Hicks, CEO of Optica Capital. Jerry discusses CRIT, the importance of rare earth and critical minerals for National Security, and the importance of lithium and gigafactories for the EV revolution.

Are you looking for a way to protect your investments? Axel Merk, President and CIO of Merk Investments, joins us on the ETF Rundown to discuss how the STGF – the Merk Stagflation ETF – can help investors during an occurrence of stagflation. You’ll want to hear what Axel says about this unique ETF that invests in real estate, oil, gold, and inflation-protected securities. He explains how it works and why it could be a valuable tool for your portfolio. Learn more now and see if this ETF is right for you!

We are joined by Yung Lim, CEO of FolioBeyond. He begins by discussing the current state of the economy and the recent rise in interest rates. He goes on to introduce RISR (FolioBeyond Rising Rates ETF), explaining how it can offer protection for rising interest rates while still generating current income from more stable ones. He also discusses how the fund can help to offset the effects of the Federal Reserve’s balance-sheet shrinkage, and how it differs from other similar strategies. Ultimately, he provides a comprehensive overview of how this ETF can be used to provide protection in a rising interest rate environment.

Vince Molinari is joined by Michael Winter, Founder, CEO, and CIO of Leatherback Asset Management. They discuss the Leatherback Long/Short Alternative Yield ETF (LBAY), which aims to provide a liquid alternative ETF. Michael explains that the algorithm driving the LBAY strategy is active management, and how the strategy has proven to be a viable workaround for rising interest rates. Whether you’re an ETF investor or just curious about ETFs, this episode provides a great introduction to the world of alternative yield strategies.

Advocate Capital Management’s Founder and CEO, Scott Peng join us today on the ETF Rundown with Vince Molinari straight from the NYSE to share how his company provides portfolio protection strategies for various formats even encapsulating ETFs. He also explains how RRH (Advocate Rising Rate Hedge ETF) is a multi-strategy, multi-asset portfolio-based protection that can help anyone secure their assets.

Vegtech Invest Co-Founder & CEO Elysabeth Alfano explains the Vegtech Plant-Based Innovation and Climate ETF at the NYSE ETF Rundown with Vince Molinari. She zooms in on how her plant-based initiative is targeting Animal Agriculture as an environmental pain point.

Douglas Heske, CEO of Newday talks with Vincent Molinari on this episode of ETF Rundown. Douglas shares about the Newday Ocean Health ETF AHOY, how Newday goes beyond investments, their investing mechanism, and the other ETFs they hold.

Simeon Hyman, Head of Investment Strategy Group and Global Investment Strategist of ProShares, talks with Vice Molinari on this ETF Rundown episode about BITI – Bitcoin Short Strategy ETF, BITO – Bitcoin Strategy ETF, and how investors can utilize both of this ETFs Strategies.

Rohan Reddy, Director of Research of Global X joins Vince Molinari on the ETF Rundown to give us an insightful breakdown of Beyond Ordinary ETFs from Global X, how they democratize complex ETF strategies, and why retail investors are doubling down on ETFs.

In this episode of ETF Rundown with Vince Molinari, we talk with Jerry Hicks, CEO of Optica Capital. Jerry discusses CRIT, the importance of rare earth and critical minerals for National Security, and the importance of lithium and gigafactories for the EV revolution.

Are you looking for a way to protect your investments? Axel Merk, President and CIO of Merk Investments, joins us on the ETF Rundown to discuss how the STGF – the Merk Stagflation ETF – can help investors during an occurrence of stagflation. You’ll want to hear what Axel says about this unique ETF that invests in real estate, oil, gold, and inflation-protected securities. He explains how it works and why it could be a valuable tool for your portfolio. Learn more now and see if this ETF is right for you!

We are joined by Yung Lim, CEO of FolioBeyond. He begins by discussing the current state of the economy and the recent rise in interest rates. He goes on to introduce RISR (FolioBeyond Rising Rates ETF), explaining how it can offer protection for rising interest rates while still generating current income from more stable ones. He also discusses how the fund can help to offset the effects of the Federal Reserve’s balance-sheet shrinkage, and how it differs from other similar strategies. Ultimately, he provides a comprehensive overview of how this ETF can be used to provide protection in a rising interest rate environment.

Vince Molinari is joined by Michael Winter, Founder, CEO, and CIO of Leatherback Asset Management. They discuss the Leatherback Long/Short Alternative Yield ETF (LBAY), which aims to provide a liquid alternative ETF. Michael explains that the algorithm driving the LBAY strategy is active management, and how the strategy has proven to be a viable workaround for rising interest rates. Whether you’re an ETF investor or just curious about ETFs, this episode provides a great introduction to the world of alternative yield strategies.

Advocate Capital Management’s Founder and CEO, Scott Peng join us today on the ETF Rundown with Vince Molinari straight from the NYSE to share how his company provides portfolio protection strategies for various formats even encapsulating ETFs. He also explains how RRH (Advocate Rising Rate Hedge ETF) is a multi-strategy, multi-asset portfolio-based protection that can help anyone secure their assets.

Vegtech Invest Co-Founder & CEO Elysabeth Alfano explains the Vegtech Plant-Based Innovation and Climate ETF at the NYSE ETF Rundown with Vince Molinari. She zooms in on how her plant-based initiative is targeting Animal Agriculture as an environmental pain point.

NYSE's Judy Shaw sits down with Index IQ's Ian Forrest for ETF Leaders, powered by the New York Stock Exchange, at Exchange: An ETF Experience 2022.

NYSE's Judy Shaw sits down with Fidelity's Greg Friedman for ETF Leaders, powered by the New York Stock Exchange, at Exchange: An ETF Experience 2022.

NYSE's Judy Shaw sits down with State Street's Matt Bartolini for ETF Leaders, powered by the New York Stock Exchange, at Exchange: An ETF Experience 2022.

NYSE's Judy Shaw sits down with Bondbloxx's Joanna Gallegos for ETF Leaders, powered by the New York Stock Exchange, at Exchange: An ETF Experience 2022.

NYSE's Judy Shaw sits down with US Bank's Michael Barolsky for ETF Leaders, powered by the New York Stock Exchange, at Exchange: An ETF Experience 2022.

NYSE's Judy Shaw sits down with Innovator's Graham Day for ETF Leaders, powered by the New York Stock Exchange, at Exchange: An ETF Experience 2022.

NYSE's Judy Shaw sits down with Innovator's Graham Day for ETF Leaders, powered by the New York Stock Exchange, at Exchange: An ETF Experience 2022.

NYSE's Judy Shaw sits down with DoubleLine's Jeffrey Sherman for ETF Leaders, powered by the New York Stock Exchange, at Exchange: An ETF Experience 2022.

NYSE's Judy Shaw sits down with TrueMark's Mike Loukas for ETF Leaders, powered by the New York Stock Exchange, at Exchange: An ETF Experience 2022.

NYSE's Judy Shaw sits down with Index IQ's Ian Forrest for ETF Leaders, powered by the New York Stock Exchange, at Exchange: An ETF Experience 2022.

NYSE's Judy Shaw sits down with Fidelity's Greg Friedman for ETF Leaders, powered by the New York Stock Exchange, at Exchange: An ETF Experience 2022.

NYSE's Judy Shaw sits down with State Street's Matt Bartolini for ETF Leaders, powered by the New York Stock Exchange, at Exchange: An ETF Experience 2022.

NYSE's Judy Shaw sits down with Bondbloxx's Joanna Gallegos for ETF Leaders, powered by the New York Stock Exchange, at Exchange: An ETF Experience 2022.

NYSE's Judy Shaw sits down with US Bank's Michael Barolsky for ETF Leaders, powered by the New York Stock Exchange, at Exchange: An ETF Experience 2022.

NYSE's Judy Shaw sits down with Innovator's Graham Day for ETF Leaders, powered by the New York Stock Exchange, at Exchange: An ETF Experience 2022.

NYSE's Judy Shaw sits down with Innovator's Graham Day for ETF Leaders, powered by the New York Stock Exchange, at Exchange: An ETF Experience 2022.

NYSE's Judy Shaw sits down with DoubleLine's Jeffrey Sherman for ETF Leaders, powered by the New York Stock Exchange, at Exchange: An ETF Experience 2022.

NYSE's Judy Shaw sits down with TrueMark's Mike Loukas for ETF Leaders, powered by the New York Stock Exchange, at Exchange: An ETF Experience 2022.