Home of ETFs

Where investors come to learn from ETF experts from across the NYSE community.

Discover the ultimate destination for ETF investors

Search, compare, and learn about all things ETF

Brought to you by

ETF Feature

The Exchange

Alexa Gordon, Fixed Income Portfolio Manager, Goldman Sachs Asset Management

Alexa Gordon speaks with Douglas Yones, Head of Exchange Traded Products at the New York Stock Exchange.

ETF Expert Corner

Hear from the ETF experts as they provide their latest perspectives on the evolving ETF marketplace.

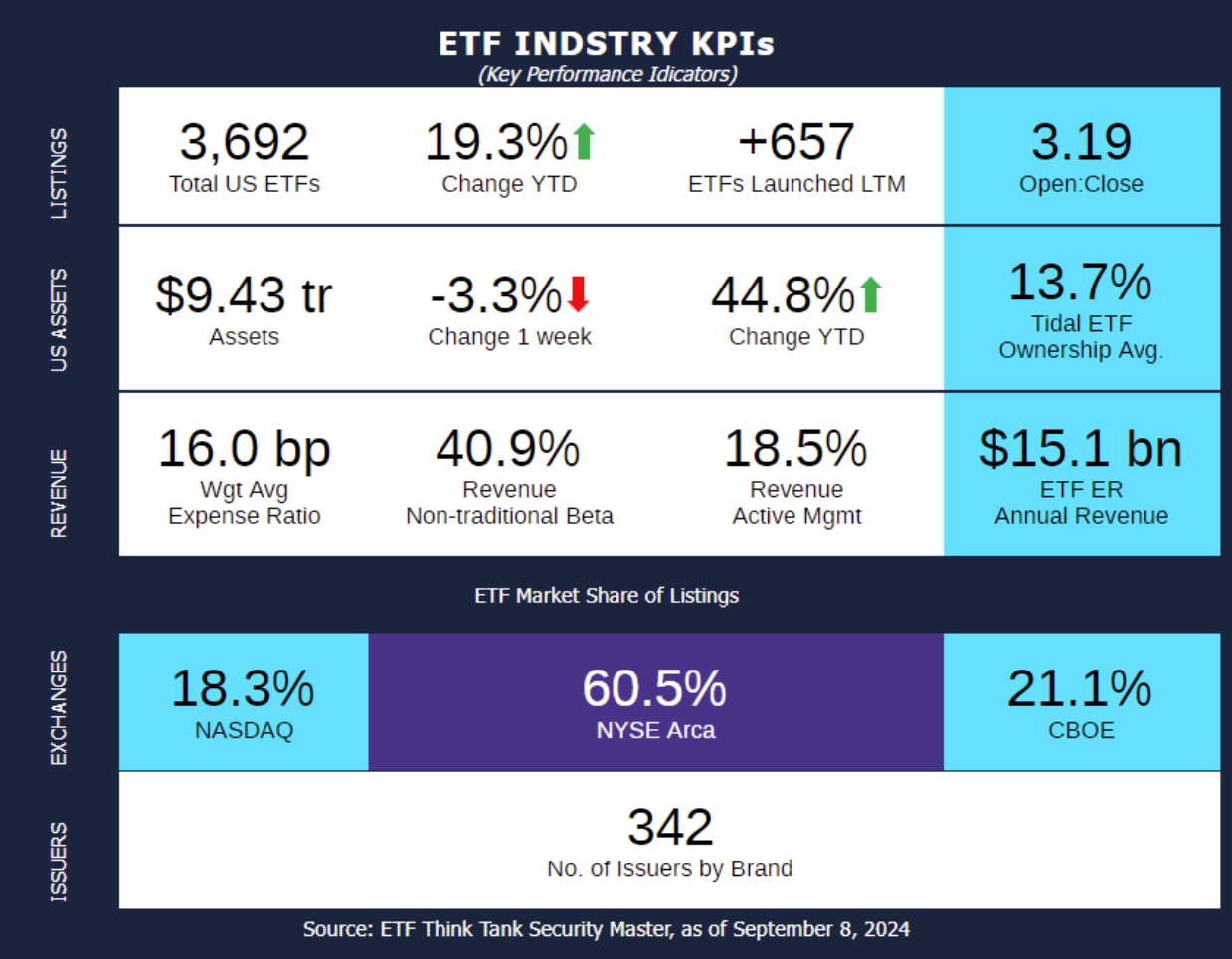

Week of September 2, 2024 KPI Summary

During the first week of September, the ETF industry saw 30 new launches and 7 fund closures.

Last week’s 30 launches were the most in 2024, offsetting a quiet spell two weeks ago.

- The 1 Year ETF Open-to-Close ratio sits at 3.19.

- The total number of US ETFs has risen to 3,692

- Our Toroso ETF Industry Index, which tracks companies generating revenue from the ETF ecosystem, fell 3.54% last week, underperforming the S&P Financial Select Sector Index, which fell by 3.15%.

ETF activity from the past week includes...

The Exchange

Ignacio Canto, President, X-Square Capital

What's the Fund

Vanguard - VTES

Vanguard Portfolio Manager Steve McFee talks to us about Vanguard Short-Term Tax-Exempt Bond ETF (NYSE Arca: VTES).

ETF 360

ProShares - SPXN

Simeon Hyman, Global Investment Strategist and Head of Investment Strategy at ProShares, along with VettaFi Head of Research, Todd Rosenbluth, discusses the ProShares S&P 500 Ex-Financials ETF (SPXN).

First Look ETFs

Kaiju, Sound Income Strategies (Tidal), Harbor Capital

Recently launched ETFs for our May episode are focused artificial intelligence (AI), high income and dividend strategies and the human capital factor.

The Exchange

Ignacio Canto, President, X-Square Capital

What's the Fund

Vanguard - VTES

Vanguard Portfolio Manager Steve McFee talks to us about Vanguard Short-Term Tax-Exempt Bond ETF (NYSE Arca: VTES).

ETF 360

ProShares - SPXN

Simeon Hyman, Global Investment Strategist and Head of Investment Strategy at ProShares, along with VettaFi Head of Research, Todd Rosenbluth, discusses the ProShares S&P 500 Ex-Financials ETF (SPXN).

First Look ETFs

Kaiju, Sound Income Strategies (Tidal), Harbor Capital

Recently launched ETFs for our May episode are focused artificial intelligence (AI), high income and dividend strategies and the human capital factor.

WTF: #WhatsTheFund

Everything you need to know about the latest NYSE-listed ETFs.

The Exchange

Hear from issuers as they take a deep dive into ETFs and industry topics on The Exchange.

Home of ETFs Contributors