NYSE Arca Q1 2021 ETF Quarterly Report

Head of Exchange Traded Products,

Published

Message from Douglas Yones

Vaccine rollouts, warmer weather and longer days indicate spring is finally here and brighter days seem to be in store. More than a year into the pandemic, I continue to be grateful to my team and to the NYSE ETF community for staying nimble, committed and creative while remote, though connected virtually. Collectively, the industry has uncovered great opportunities during a challenging time, and there are strong results to show for it.

2021 is off to a great start for our industry, with 92 new ETF launches and $256 billion in total cash flow. In a notable move, Guinness Atkinson completed the first mutual fund to ETF conversions in Q1, forging another long sought after entryway to the ETF market for many asset managers worldwide.

The actively managed ETF market also continues to attract new issuers and strong inflows, already eclipsing full-year records. The semi-transparent ETF market is growing strong with 28 ETFs with $1.3 billion in assets under management. Regulatory developments like custom basket approval offer further flexibility for these investment vehicles, helping to build interest and opportunity for active managers around the globe.

As this year progresses, we’re closely watching trends like digital assets and ESG, both of which remain poised to be major drivers of investment decisions. Fortunately, we’ll have industry leaders join us to discuss these topics and more during the upcoming NYSE ETF Summit on April 27, so be sure to register and join us live.

For more industry updates and insights, I’m pleased to share our Q1 2021 report below. Please reach out to the NYSE ETF team with your thoughts or to discuss how we can work together in support of your business goals throughout the year ahead.

2021 U.S. Market Statistics

As of March 31, 2021

2,466

ETFs listed in the U.S.

$5.92T

Assets in U.S. Markets

$151.47B

Average daily value of U.S. ETF transactions

1.95B

Average daily volume of shares traded

Market Share of Exchange Volume for all U.S. ETFs

Assets Under Management of U.S. ETFs

Narrowest Quoted Spread for all U.S. ETFs

NYSE Updates

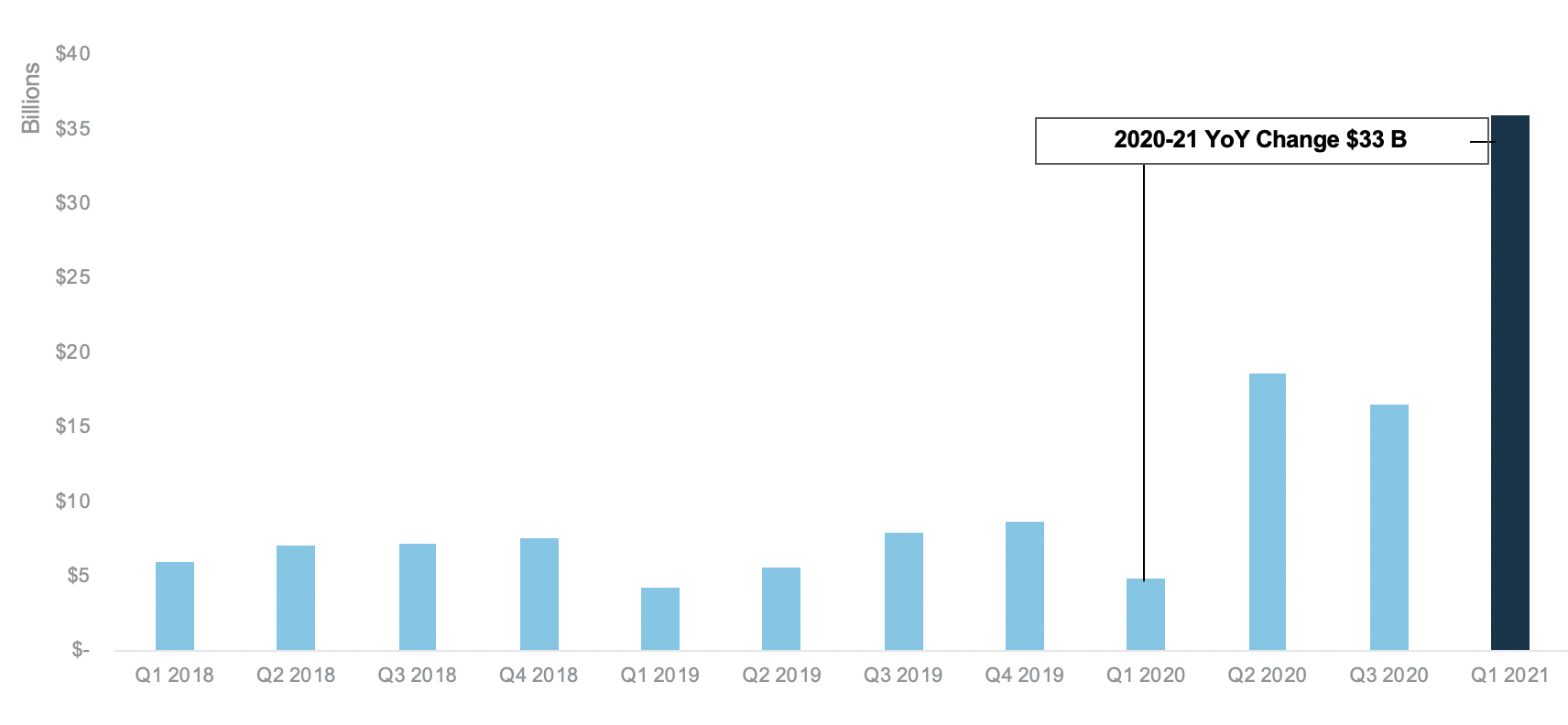

Active ETFs Start Strong

After a momentous year in 2020, the active ETF market accelerated its growth momentum in the first quarter of 2021. By February, cash flows had already surpassed $30 billion. In other words, it took only a handful of weeks in 2021 for the market to eclipse the full-year cash flow totals for every year prior to 2020. The quarter rounded out at $203.5 billion in total active AUM, putting the industry on pace for another banner year. If you are considering joining the active ETF industry, please contact my team to see how we can support your business goals.

Our NYSE Active ETF Newsletter (subscribe here) breaks down the data around growth and distribution of assets across the industry. The active ETF industry cash flow remains diversified across asset classes and issuers. In total, active ETFs brought in $37.6 billion, surpassing the prior Q1 record of $5.9 billion by more than sixfold. All asset classes have experienced an increase in year-over-year growth and nearly 60% of issuers broke their Q1 cash flow records.

Quarterly Active ETF Cash Flow 2018-2021

In another milestone, semi-transparent ETFs collectively closed with over $1 billion in AUM in early January. It took just 286 calendar days since launch for the semi-transparent marketplace to reach this milestone. For perspective, it took 2,371 days for active transparent domestic equity ETFs to reach the same threshold in 2013.

Subscribe and catch up on the NYSE Active ETF Update, our twice-monthly newsletter covering the latest in active ETF developments.

NYSE Arca LMM Program Enhancements

On April 1, the NYSE implemented several new enhancements to the NYSE Arca Lead Market Maker (LMM) program to reflect ETF issuer priorities and market quality enhancements. These new requirements are designed to align LMM performance benchmarks in three key areas in support of ETF growth:

- Tighter spreads. New enhanced spread requirements to ensure your LMM and additional liquidity providers support your ETF’s trading all day, every day.

- Greater depth of book. Depth requirements that will yield higher quality liquidity, with a special focus on low volume ETFs through strong rebate incentives.

- Higher quality auctions. Additional program incentives for LMMs to provide superior opening and closing auctions, allowing for greater price discovery alongside market volatility protections.

For the first time ever, ETF issuers on NYSE Arca will have the benefit of assigning additional market maker firms to their low volume ETFs, supplementing the current liquidity being provided by your Lead Market Maker partner. Contact us to find out more about the program, and for support in assigning additional liquidity providers to your ETFs.

NYSE ETP Notification

Stay up-to-date on the latest ETP launches at the NYSE on our notification page. Click here to subscribe and sign up for additional market and product notices, newsletters and press releases.

First Mutual Fund to ETF Conversions

History was made on March 29 when ADIV and DIVS began trading on NYSE Arca. These two funds, managed by Guinness Atkinson under the SmartETF brand, represent the first-ever mutual funds to directly convert to and trade as ETFs in the U.S. The conversions represent another significant growth opportunity for the ETF market because they are a more seamless, tax-efficient way to place existing strategies in an ETF wrapper. Importantly, active fund managers looking to tap into the flourishing active ETF market now have a direct point of entry. We expect to see a substantial amount of assets follow suit and execute conversions in 2021 and beyond. You can learn more about the process and growth opportunities for conversions at the upcoming NYSE ETF Summit: RSVP here.

Mark Your Calendar: NYSE ETF Summit

The NYSE ETF Summit will take place virtually on Tuesday, April 27. Experts from across the NYSE's ETF community will discuss the latest topics and trends impacting the ETF marketplace, including:

- Embracing virtual marketing: Top strategies for marketing ETFs in a hybrid business model

- Digital assets and cryptocurrencies: Defining the business opportunities

- Solutions for the next wave of ETF growth

- Semi-transparent active ETFs: How they work, and the top business strategies to incorporate post-launch

- Factors in ESG investing: Data and tools for managing responsible strategies

- Mutual fund-to-ETF conversions: Exploring a new path to market entry

Regulatory Updates

SEC Approves Custom Baskets for NYSE Active Proxy Structure ETFs

In February, the SEC approved the NYSE and Natixis Investment Manager’s amended exemptive relief filing to allow for additional basket flexibility – also known as “custom baskets” – for ETFs using the NYSE Active Proxy Structure. The SEC’s approval accommodates construction by asset managers using the NYSE Active Proxy Structure of creation/redemption baskets that differ from the daily tracking basket and proxy portfolio. While traditional transparent ETFs are granted this flexibility through the ETF Rule – this approval marks the first time custom baskets would be available to active, semi-transparent products.

NYSE Insights

Every week, the NYSE talks with industry leaders to share their views on the world of investing. Visit HomeOfETFs.com to watch the latest segments.