January 18, 2019

With a record year behind us, we wanted to follow up our 2018 Options Market Review with an analysis of the options market in Q1 2019. The market experienced a drop in volatility from the highs of Q4 2018, which also brought a reduction in equity option volumes. Market quality benefited from the low-volatility environment as quoted size and some spreads improved over the quarter and options volumes became significantly less concentrated in the top 50 symbols.

Volatility and Volume

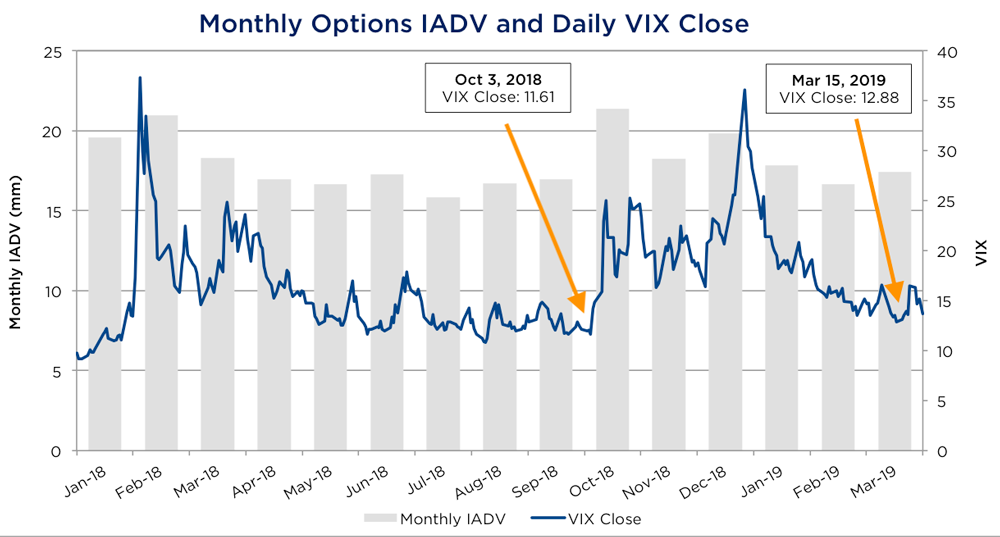

Volatility was driven downward as the VIX closed below 13.00 for the first time in over 5 months on March 15, 2019. Lower volatility depressed options volumes, with Q1 2019 equity option ADV finishing at 17.3mm, down 12.9% from the prior quarter. Despite this reduction in volume, Q1 2019 was the second most-active Q1 of all time, trailing only Q1 2018.

Quoted Spread and Size

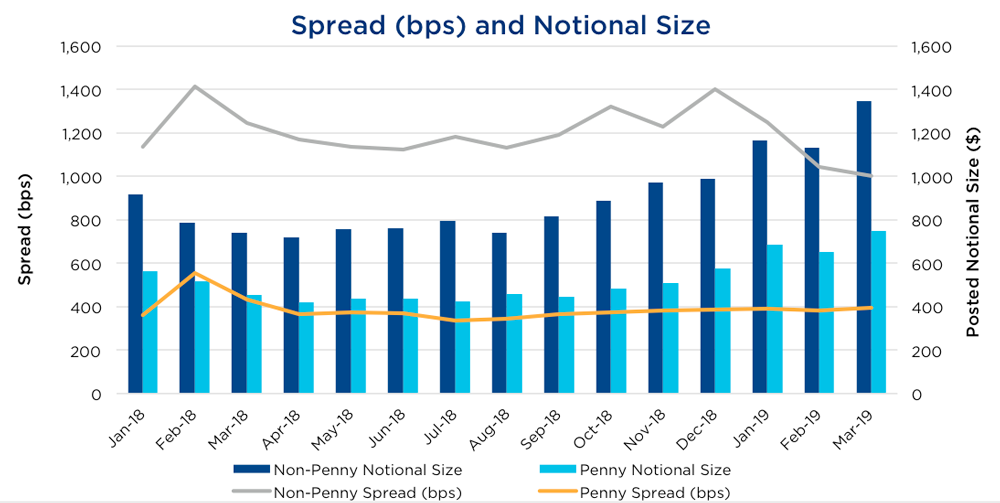

As volatility decreased, posted size increased significantly. Notional size in Penny class symbols increased over 75% and in Non-Penny class symbols increased over 80% from Q3 2018 to the end of Q1 2019. Market-wide quoted bid-ask spreads (measured in basis points) stayed relatively flat as spread widths tightened at the same rate as option values decreased. Quoted spreads in Non-Penny symbols were an exception as they tightened by 28.5%.

Data using methodology described in 2018 Options Market Review and excludes SPY.

Volume Concentration

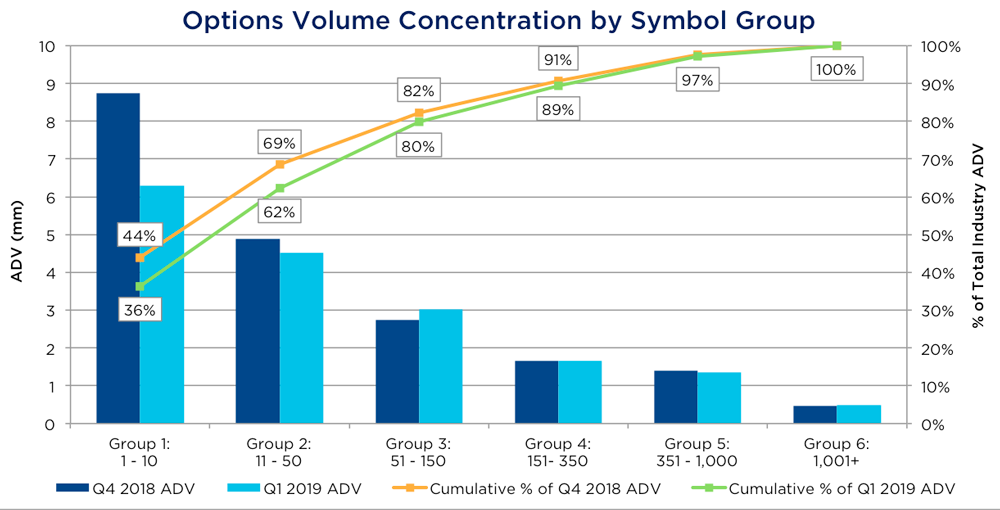

Q1 2019 also saw reduced equity option volume concentration. We found volume less concentrated in the top 50 symbols by ADV, and market volume attributed to the top 10 symbols dropped 8%. Volumes actually increased from the prior quarter in symbols ranked 51 through 350, which broadened market activity into previously less-liquid symbols.

Summary

Options markets currently show an implied probability of VIX being 15 or lower of about 65% 3 months out and 55% 6 months out. The reduced uncertainty yielded an improvement in displayed options market quality with larger posted size and flat or narrower bid-ask spreads. Although volumes have decreased in the most active options, interest in some of the less active symbols increased to this point.

NYSE Research Insights

Find all of NYSE Research's articles on market quality, market structure, auctions, and options.