Data Insights

Market Liquidity Drivers

October 23, 2020

NYSE recently hosted a Virtual Options Update, which included a review of industry liquidity trends. We highlighted some key themes impacting market volume:

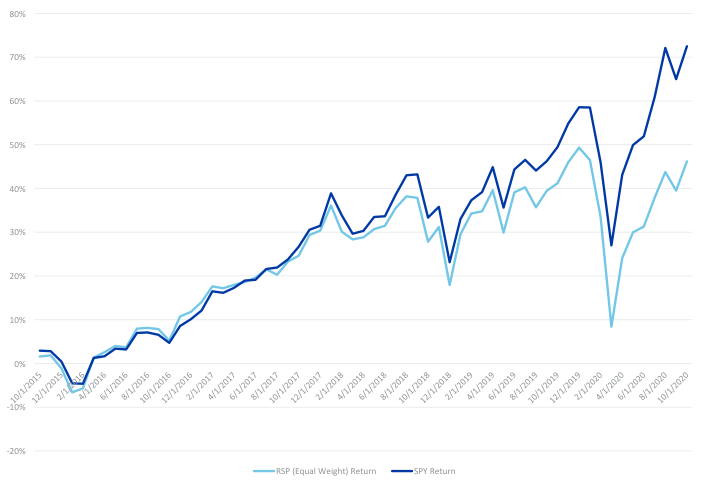

Declining Market Correlations Creating More Varied Risk and Opportunity

- A large divergence has emerged between the (market-cap weighted) S&P 500 and an equal-weighted version of the index

- This means getting efficient exposure to better performing stocks in an index may be even more critical to maximize returns

5 Year Return: SPY vs. RSP (Equal Weight S&P 500)

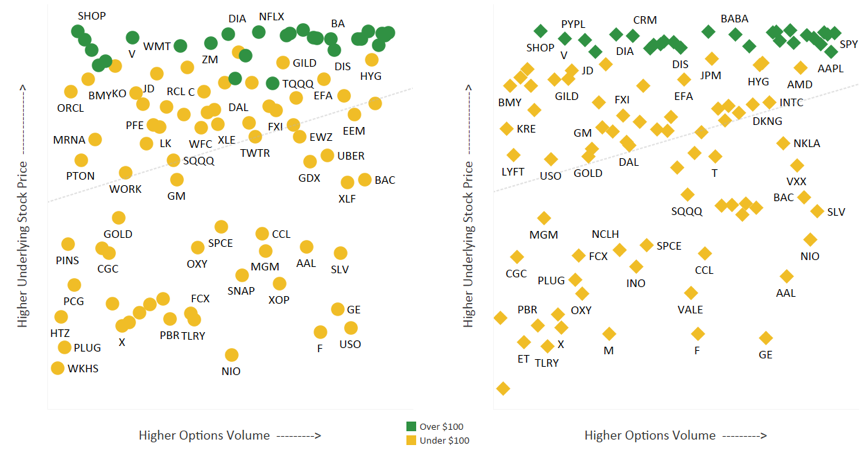

Options Can Help Offer Exposure to High-Priced Stocks

- As market returns have become more varied, efficient exposure to certain stocks has become more impactful to overall portfolio returns

- Options can help address this need and we have seen increasing options popularity for some of the highest-price underlying stocks

March - Options ADV Rank vs. Underlying Price Rank

September - Options ADV Rank vs. Underlying Price Rank

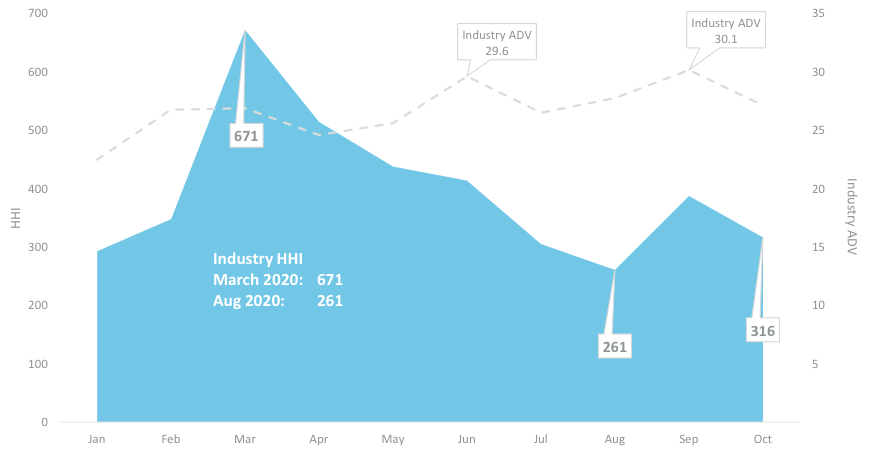

Changes in Market Return Patterns Has Contributed to Less Options Volume Concentration

- We applied the Herfindahl-Hirschmann Index (HHI), a measure of market concentration, to the underlying symbols in the options market

- Volatility and macroeconomic uncertainty in March led to increased concentration, particularly in broad-market ETFs, while the recent divergence of returns has reduced concentration

2020 Options Symbol Concentration: Herfindahl-Hirschman Index (HHI)

For further information on these trends, and to discuss how NYSE Options can help navigate this market environment, contact [email protected].

NYSE Research Insights

Find all of NYSE Research's articles on market quality, market structure, auctions, and options.