ICE Global Network

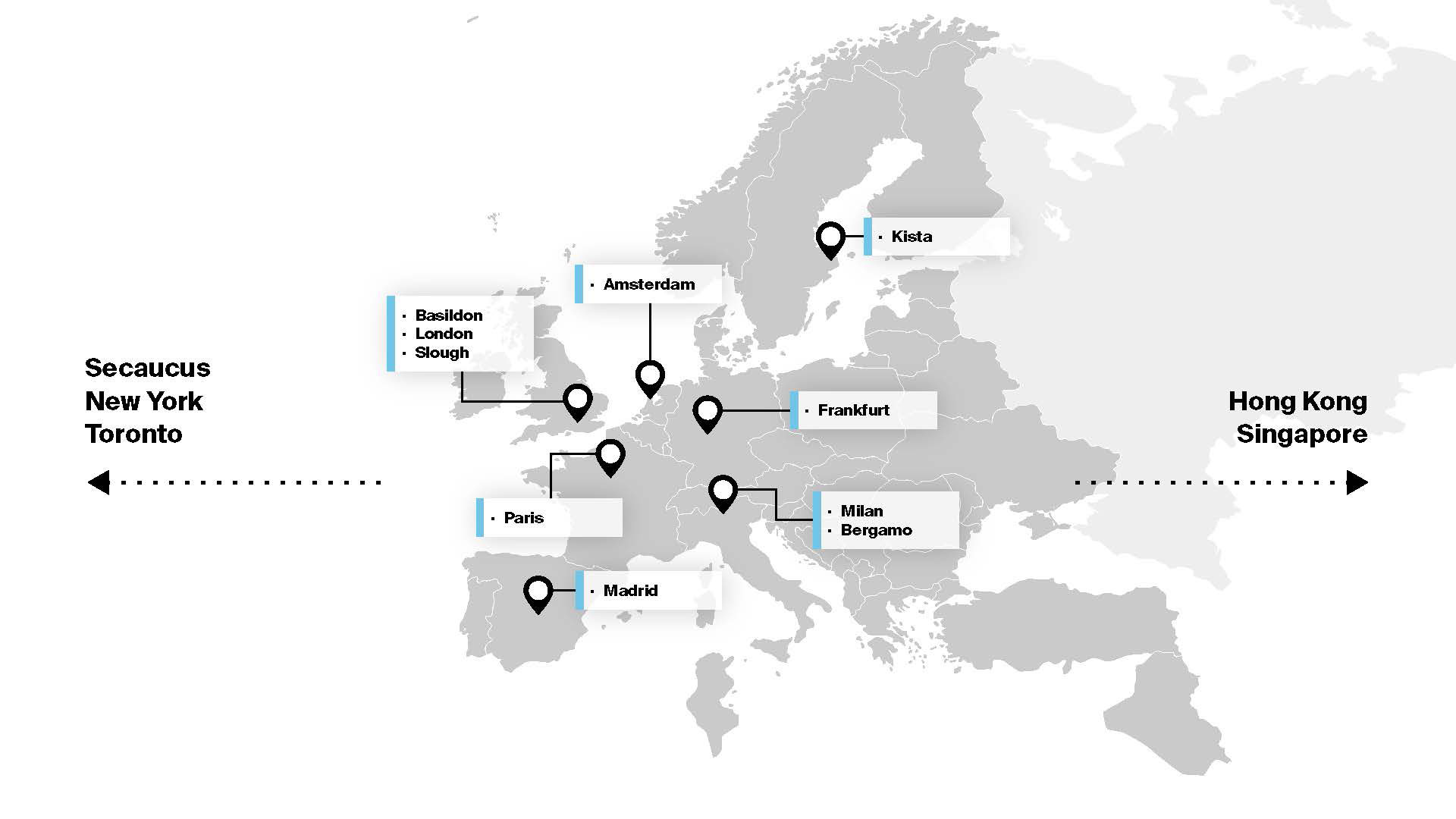

ICE Global Network offers high quality content, delivery and execution services through an ultra-secure, highly resilient network. An important backbone for financial and commodity market information flow, it connects the global market community to the broadest ranges of data sources - including proprietary and third party content - and trading venues in a safe, efficient manner.

ICE Global Network connects market participants to data, trading venues and counterparties across major asset classes.

ICE Global Network Services

Our footprint

Related content

For firms trading European assets, a new wireless option

Our new wireless routes will connect Bergamo in Italy and THN2 in London to Frankfurt and the wider London metro area.

Deploying market infrastructure managed services

Traditionally, trading organisations have procured and managed hardware themselves or through a third-party to support data services in a hosted environment.

Building sustainable, supportable low-latency trading infrastructure

How do IT and trading teams remain cutting edge while adopting a sustainable approach to managing critical trading infrastructure?

High Frequency Trading: direct market access for traders across Asia

Momentum in HFT demands infrastructure support.

For firms trading European assets, a new wireless option

Our new wireless routes will connect Bergamo in Italy and THN2 in London to Frankfurt and the wider London metro area.

Deploying market infrastructure managed services

Traditionally, trading organisations have procured and managed hardware themselves or through a third-party to support data services in a hosted environment.

Building sustainable, supportable low-latency trading infrastructure

How do IT and trading teams remain cutting edge while adopting a sustainable approach to managing critical trading infrastructure?

High Frequency Trading: direct market access for traders across Asia

Momentum in HFT demands infrastructure support.

Growth in key Asian markets

Magnus Cattan, VP of Fixed Income and Data Services in APAC discusses the expansion of ICE Global Network.